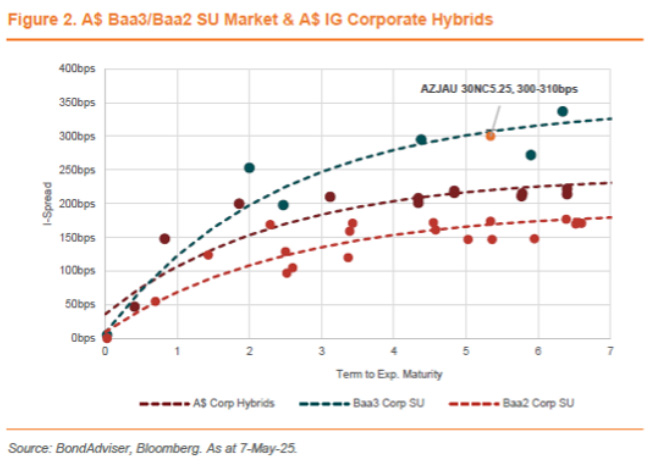

Aurizon Holdings (Issuer rating: BBB+/Baa1/NR) announced an indication of interest in a 30nc5.25 floating rate and/or Fixed-to-Floating subordinated note. Initial price guidance was set at + 300 – 310bps (area) over 3mBBSW, paying an indicative first coupon of ~ 6.5% to 6.6%. The bond is expected to have an investment-grade issue rating of Baa2/BBB-.

Income Asset Management was accepting bids in 50k minimums, and 10k increments thereafter, and charges a facilitation on top of the issue capital price.

Aurizon Holdings (ASX: AZJ) is Australia’s largest rail freight operator, with four key business segments across network, coal, bulk and containerised freight. The coal, bulk and freight units are part of the operations subsidiary, whilst the network unit is under its own subsidiary. The network subsidiary contributed 61% of EBITDA in FY24, with the subsidiary acting as guarantor for the proposed notes. AZJ’s Queensland network infrastructure supports 90% of Australia’s metallurgical coal volume exports, with Australia’s largest fleet of locomotives and wagons.

Aurizon reported 1H2025 revenue of $2,023 mn (3% YoY) and underlying EBITDA of $813 mn (-4% YoY). The Group’s FY25 group EBITDA guidance remains on the lower end of the AU$1.66-1.74bn range, with network volumes in the 10-months to 30 April 2025 9.9mt lower. The company reported a gearing ratio of 54.2% (up 2%) in 1H2025 with a net debt-to-EBITDA ratio of 3.2x from 3.0x compared to FY24.