There has been no official US economic data this month. The markets have enough to go on to assume a benign macroeconomic backdrop. Equities are quietly digesting what appears to be a solid third quarter earnings season, while bonds are telling us that lower rates and decent growth trumps fiscal concerns for now. We await US technology companies’ earnings numbers but if the bond market mantra has always been “don’t fight the Federal Reserve (Fed)”, in equities it has become “don’t fight artificial intelligence (AI)”.

- Key macro themes – No US data but a benign slowdown remains the narrative

- Key market themes – Are equities set to rally into the holiday season?

No news is good news

Despite the absence of official US government data due to the federal shutdown, markets have continued to perform in a very benign way so far in October. Major US equity markets have taken a breather as earnings reports continue to come out. It’s likely the season will be sufficiently strong to support the belief that current valuations are sustainable, allowing for a potential move higher in stock markets in November, typically a strong month for S&P 500 performance. Equity markets elsewhere have performed well, with markets like Korea, Taiwan, Japan and India confirming that technology is a driver in more than just the US.

The power of rising wealth…

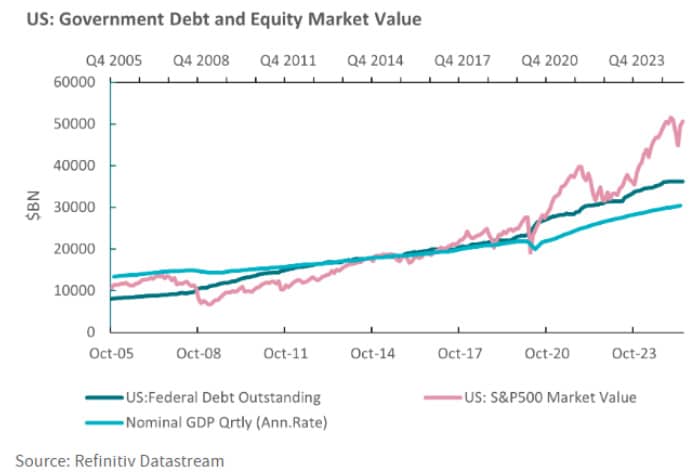

Rising equity markets mean rising wealth and support for economic growth. For now, this is outweighing concerns about public debt, especially in the US where equity market capitalisation as a percentage of GDP (around 165%) is much higher than public debt is as a percentage of GDP (125%) – see chart above. The equity buffer is lower in Europe, but strong equity performance is still positive for growth because it is based on companies delivering on real growth in revenues, which in turn is boosting investment spending with all the benefits that has for future activity and employment. Investors worry about how some governments will manage their public debt profiles, but growth is a necessary bulwark against debt unsustainability. So, for the sake of long-term premiums in fixed income markets, let’s hope the virtuous equity and economic growth circle can remain intact

…and lower rates

Longer-duration bonds have outperformed core equities in the US and in Europe this month. The benchmark 10-year Treasury yield fell below 4% and expectations of additional easing by the Fed are well priced in. Without the economic snapshots provided by the usual monthly data, the narrative is that the Fed will ease because of softer labour market trends, and this will help cushion the economy, while high levels of capital spending on AI will raise expectations about future productivity growth. Even credit spreads have stabilised, after having jumped when US President Donald Trump threatened more tariffs on China. Market expectations are strongly biased towards a Fed rate cut on 29 October with another one coming before the end-of-year. The bull market continues. Fears of inflation have receded.

The near-term risk is that assumptions of where the economy is could drift away from the picture which is painted when official data releases resume. I doubt this is a big risk given the wealth of private sector data, ongoing data releases from other countries that are generally market-friendly , and the information provided by corporate earnings updates .

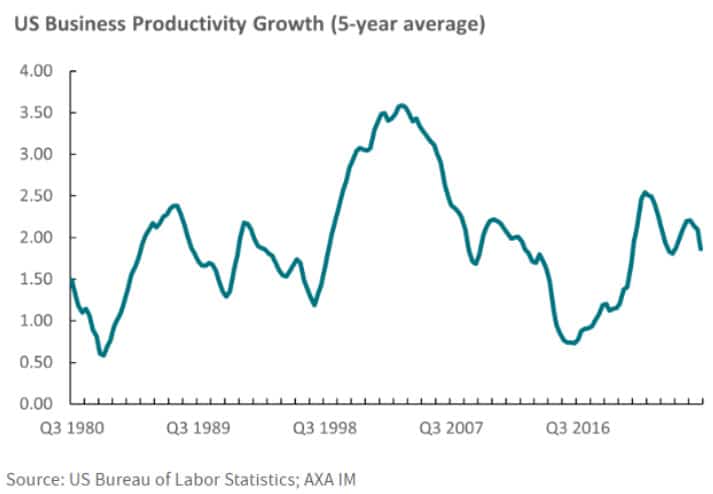

The bet on being more productive

Core to the AI transition of economic life is the belief that it will boost productivity, by being a lot better at a lot of jobs, that humans do today – so those in work will be more productive. Output per hour worked is the key measure of productivity. AI promises the same amount of output can be produced with fewer hours (people) worked, or that more output can be produced with the same hours worked. It is a slow-moving measure and there is some scepticism around technology developments and productivity – as economist Robert Solow said: “You can see the computer age everywhere but in the productivity statistics.” However, US data shows labour productivity did increase in the years after the digital revolution got going in the mid-1990s (the five-year average annual business productivity rate reached 3.5% at the beginning of the 2000s, see chart below). Increased digitalisation, automation, data storage and communication all contributed to the surge in productivity and another surge is expected by AI enthusiasts. If they are right, then the cycle can be extended, and we should start to see the benefits across the economy. AI can certainly play a key role in meeting the long-term challenges of fiscal stability (improved performance in the public sector), dealing with labour shortages in ageing societies, providing better and cheaper health provision, and optimising green energy and climate change adaption. But the effects take time because companies and individuals must learn how to use new technology and pay for it.

The future – greener, more efficient?

AI and the green transition are the most important economic trends of this epoch, and electricity generation is powering the growth of new technologies. Both can provide fundamental improvements to the human condition. More and more investment capital is being directed to these sectors because investors can see the long-term return from being invested in transformational businesses. The economies that embrace electrification, renewable power generation, and support the development of AI for productive purposes will be those that grow the most and will be most capable of providing the public services that many of the advanced economies today are struggling with. Finally, when we think about what blockchain technologies can bring to improve the financial sector’s efficiency, including the greater mobilisation of savings for productive purposes, one can get quite excited about an electric future.

Performance data/data sources: LSEG Workspace DataStream, ICE Data Services, Bloomberg, AXA IM, as of 23 October 2025, unless otherwise stated). Past performance should not be seen as a guide to future returns.