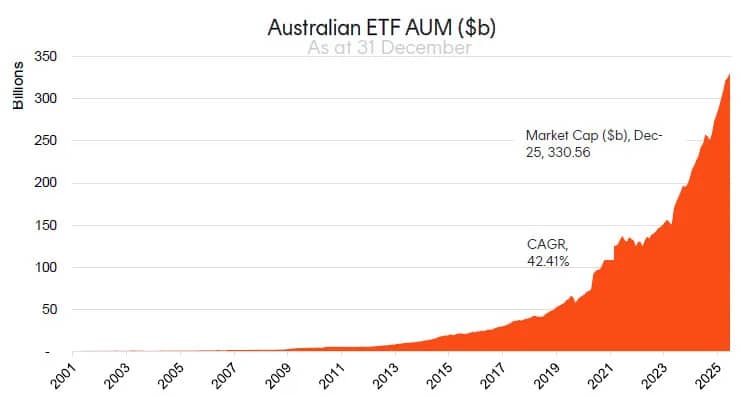

The Australian ETF industry closed 2025 at an all‑time high, smashing records across funds under management, inflows, trading activity and product development. According to Betashares, total industry market capitalisation reached $330.6 billion, representing 34.2% growth year‑on‑year. The sector added $84.3 billion in FUM over the year — the largest annual increase in its history.

Investor demand was equally strong, with $53 billion in net new money flowing into ETFs, far surpassing the previous annual record of $30 billion set in 2024. The 2024 total was overtaken as early as August. Trading activity reached unprecedented levels, with $196 billion in ETF value traded on the ASX across the year, a 39% rise on 2024’s $141 billion.

Despite more issuers entering the Australian market, inflows remained highly concentrated. Vanguard, Betashares and iShares were again the dominant players, collectively attracting more than 70% of all industry flows, equal to roughly $37.5 billion.

The year also saw the most active period on record for product innovation, with 71 new ETFs launched and 15 closed, resulting in a net increase of 56 funds. Investor preferences clearly tilted toward passive strategies, which attracted $38.9 billion. Smart beta ETFs received $8.2 billion, while active ETFs collected $6.3 billion despite numerous new entrants.

Also read: Coolabah Capital Launches Global Carbon Leaders Complex ETF

All major asset classes posted record inflows in 2025. International equities led with $20.9 billion, up from $15.1 billion the previous year. Australian equities followed with $13.2 billion (compared with $7.1 billion in 2024), while fixed income ETFs drew $11.6 billion, nearly doubling the prior year’s result.

In last year’s outlook, analysts predicted the ETF industry would exceed $300 billion by the end of 2025 — a milestone surpassed comfortably. Looking ahead, forecasts now suggest total FUM will move beyond $400 billion in 2026, with monthly inflows expected to hold above $5 billion. The industry is projected to reach $500 billion by 2028, although current momentum indicates this could happen as early as 2027.

Source: Betashares