The CDS trade

Credit default swaps (CDS) are derivative instruments which enable investors to hedge the credit spread component of a corporate bond. Buying a single CDS, or CDS basket, is seen as buying protection against credit spreads widening. With increased liquidity, they also allow for expressing speculative views on the direction of credit spreads and achieving leveraged exposure to corporate credit, in investment grade, high yield and emerging market credit sectors. With being overweight credit a consensus view, using CDS to gain leveraged exposure has become a popular trade. Credit fundamentals are positive: ongoing growth, stable rates and strong corporate earnings. Momentum is positive, with credit spreads generally moving tighter in 2025. We remain positive on the asset class. However, spreads are at their narrowest for some time and speculative short CDS positions are considerable. Any macroeconomic shock could presage a rapid unwind and a reversal in spreads. Credit is attractive but negative returns are a clear risk given current market levels and positions.

The Fed’s dilemma

Following the Federal Reserve’s (Fed) decision to keep rates unchanged in July, the market is anticipating another 35 basis points (bp) of cuts by year end – in contrast with more than 100bp when the Liberation Day tariffs were announced. At the same time, the consensus still expects the US economy to slow from 2.8% in 2024 to around 1.5% in 2025, while inflation should accelerate to 3.0% and 3.1% in the third and fourth quarter of this year. The Fed is clearly facing a dilemma: cut rates as the economy is expected to slow or hike rates/keep them unchanged as the risk of faster inflation materialises. It has clearly identified and adopted the optimum policy stance to tackle this dilemma. A strictly data-dependent, neutral-guidance approach is best suited to deal with binary uncertainty about the future state of the economy, as it minimises the potential negative impact in the worst-case macroeconomic scenario.

Anti-involution evolution

As China’s deflationary backdrop persisted into its 33rd month in June, policymakers acknowledged the underlying problem, driven by a growth model tilted toward investment and supply. Anti-involution actions – i.e. a pushback against intense and non-productive competition – have been mobilised by authorities across e-commerce, the auto sector, solar panels, electric vehicle batteries, and select upstream commodity sectors. The intention is to reduce capacity and/or promote investment favouring efficiency over output. That has driven renewed interest in policy-induced investment opportunities, with earnings multiples expanding in targeted sectors, albeit without indications of earnings recovery. Sustained earnings recovery requires deeper reforms to China’s growth model – the internal demand shortage is a key challenge and remains an economic barrier. Excess capacity in the non-metallic minerals industry is largely a result of the property downturn. Past episodes of supply-side reforms were focused on aggressive capacity cuts – a path more challenging to take now, with much of the overcapacity sitting with private industries.

Also read: Insurers Revise Portfolios as Geopolitics and Private Credit Dominate Investments

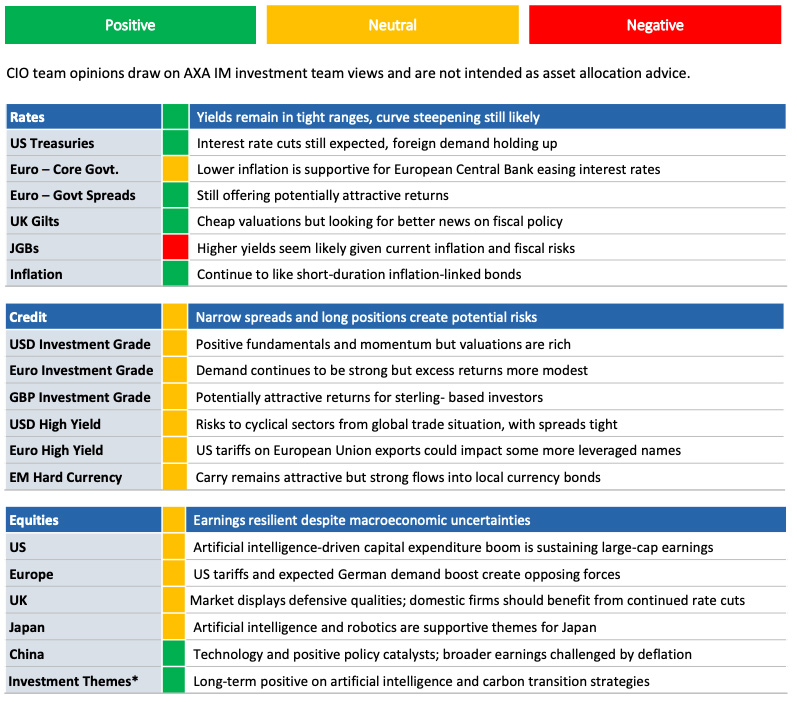

Asset Class Summary Views

Views expressed reflect CIO team expectations on asset class returns and risks. Traffic lights indicate expected return over a three-to-six-month period relative to long-term observed trends.

*AXA Investment Managers has identified several themes, supported by megatrends, that companies are tapping into which we believe are best placed to navigate the evolving global economy: Automation & Digitalisation, Consumer Trends & Longevity, the Energy Transition as well as Biodiversity & Natural Capital

Data source: Bloomberg