By Clive Maguchu, senior strategist, and Marie Tsang, fixed income strategist, State Street Investment Management.

In 2025, global markets are navigating a landscape defined by persistent geopolitical tensions, rising trade barriers, and ongoing policy uncertainty. Against this backdrop, Australian investment grade bonds are a clear stand out —offering investors a rare combination of dependable income and portfolio stability. With yields still at multi-year highs and credit fundamentals remaining strong, Australian bond ETFs are increasingly seen as a prudent allocation for those seeking income and/or portfolio resilience.

Favourable Environment for Australian Bonds

The Australian bond market may be smaller and less diversified than some other developed fixed income markets. However, this belies the fact that Australia is a mature and growing market, supported by strong demand from superannuation funds and institutional investors. Meanwhile, our developed market counterparts that are larger and more liquid, especially the US and Eurozone, have a greater variety of instruments available. This additional variety has come with more volatility, as demonstrated over the last few years with more susceptibility to global capital flows and geopolitical shocks.

For local investors, currency hedging is another complication for international bonds, while this is not an issue for domestic bonds. Additionally, Australian bonds are more reflective of local macroeconomic conditions, including the rate of inflation and economic growth, as well as domestic interest rates.

Rates Backdrop

Australian government bonds continue to be a cornerstone of the domestic bond market. The Reserve Bank of Australia (RBA) has begun a cautious rate cutting cycle in 2025, following a hawkish stance and rate hikes in previous years. Inflation has now moderated within the 2–3% target band and is showing signs of stabilising at current levels. This benign inflation outlook paved the way for the RBA’s cautious approach, and combined with relative fiscal prudence, supports a stable environment for Australian rates.

Also read: Japan Versus the World. Why Bond Markets Have Never Been More Exciting

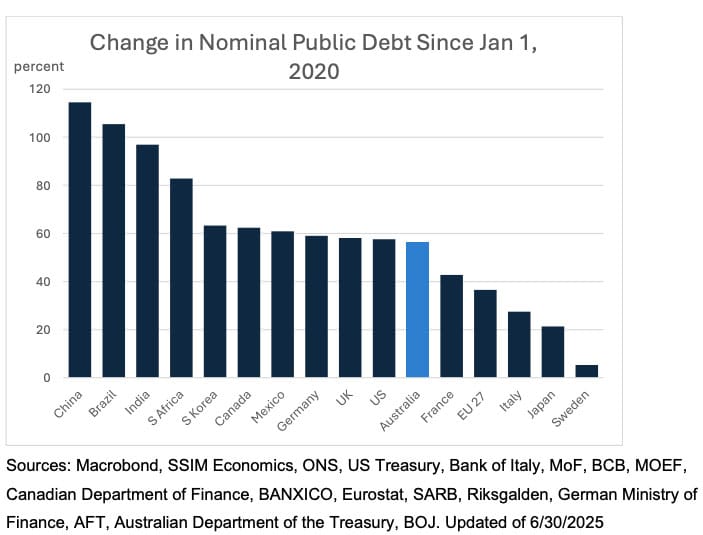

Information Classification: General Globally, fiscal dominance is reshaping market dynamics. Central banks, including the US Federal Reserve, are taking a more reactive stance, while government policies on spending, trade, and regulation are becoming primary market drivers. This has led to more volatility emanating from fixed income markets as investors reassess the sustainability of ever-increasing government debt burdens. This shift in the global landscape enhances the appeal of Australian bonds against more traditional international bond exposures as a defensive asset class.

Credit Backdrop

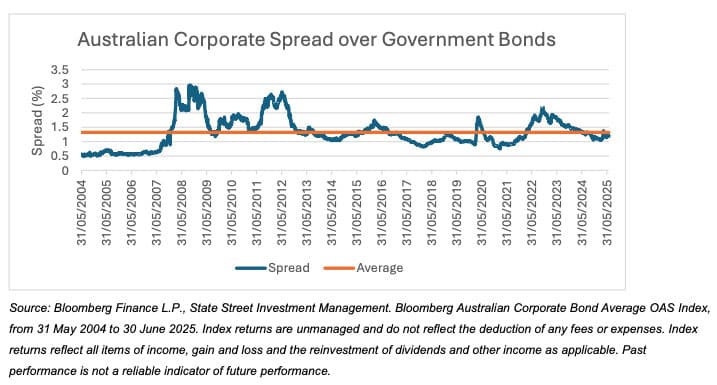

Unlike the concerns around sovereign debt levels, corporate issuers have been more cognisant around maintaining sustainable debt levels. Investment grade corporate bond issuers demonstrate solid fundamentals – good profitability and low debt levels. This combination leads to more moderate credit risk relative to history. Spreads (the compensation to investors for taking credit risk) are narrower than historical averages, but we are comfortable with the current levels because underlying fundamentals are favourable.

Meanwhile, more Australian corporates are issuing debt domestically rather than offshore, supported by a maturing market infrastructure and growing investor base. Overall, these factors lead to an attractive yield which is commensurate with the level of risk we see currently.

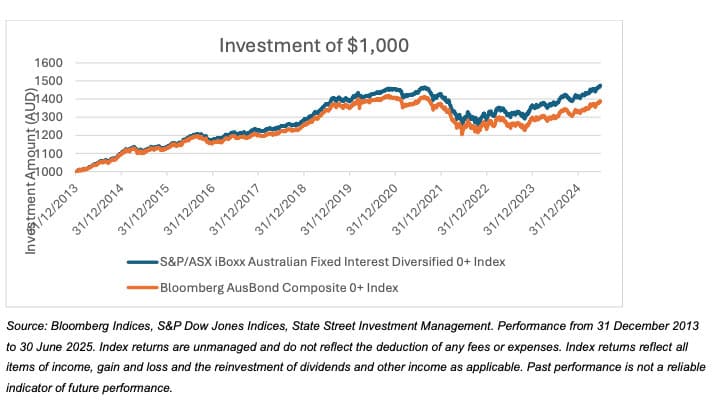

The Benefits of a Non-Market Value Weighted Approach

In traditional market value weighted Australian bond index exposures, less than 10% of the allocation comprises corporate bonds.1 We feel this leaves investor portfolios under-exposed to the opportunity set that corporate bonds present. A non-market value weighted approach to index construction can give portfolios more balance between the rates and credit components of the Australian fixed income market. In addition to balancing the key drivers of a bond portfolio, credit also provides investors with incremental yield (also known as carry). On average, the incremental yield earned by corporate bonds compared with government bonds has been 1.3%.2 The additional expected return is commensurate with risk, as investors are exposed to additional risk of distress or default of the corporate issue.

The Benefits of a Low-Cost ETF Wrapper

Management fees and other costs represent an erosion of returns from an investor’s perspective. A low-cost exposure means that investors can keep more of their returns over time. Meanwhile, the ETF wrapper provides investors with intraday trading access on exchange. ETFs also tend to offer more transparency on underlying holdings and characteristics (with most available daily) when compared with managed funds.

Potential Risks

Investors should be aware of some of the risks of investing in core Australian bonds, including:

• Interest rate risk: Unexpected inflation or other shocks could cause bond values to decline because of increases in market interest rates, while falling interest rates can lower the fund’s income and yield.

• Credit risk: Non-government issuers have different levels of credit worthiness and may be upgraded or downgraded as their circumstances change. These events can impact the fund’s income and yield.

Conclusion

Australian investment grade bonds offer a timely opportunity in 2025 for income, capital preservation, and portfolio diversification. Government bonds provide safety and liquidity, while high-quality corporate bonds offer attractive yields. With a prudent, well-diversified strategy, investors can harness the evolving fixed-income opportunities to meet their financial goals.

1. Source: Bloomberg Indices, Bloomberg AusBond Composite 0+ Index, corporate sector allocation, 30 June 2025.

2. Source: Bloomberg Indices, daily Bloomberg Australian Corporate Average OAS Index, averaged over the period from 31 May 2004 to 30 June 2025.