From Insight Investment’s Cathy Braganza, Senior Portfolio Manager

High yield may offer best value to those invested for the long term, rather than range trading. Investors looking to enter the market at attractive levels should, in our view, consider long term allocations.

- Range trading the high yield market may, in our view, deliver ‘index-minus’ returns over the long-term.

- Tariff-related volatility may however offer compelling entry points for long-term allocations.

- In our view, yields and spreads may offer what investors fundamental require: compelling compensation for default risks.

‘Buying Low and Selling High’ May Not Work in High Yield

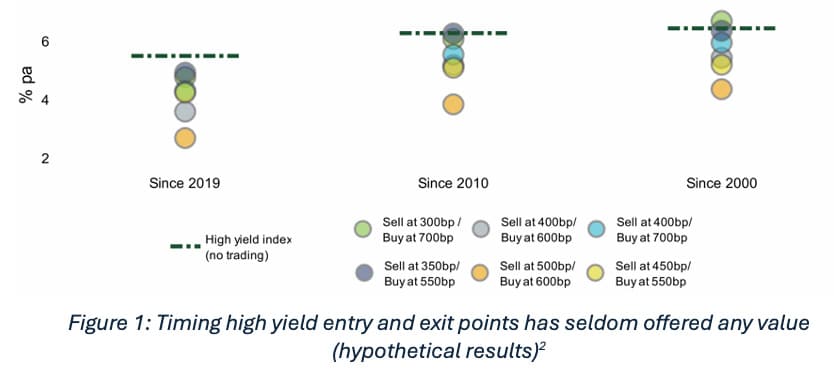

We back-tested several hypothetical US high yield range trading strategies – all designed to ‘buy low and sell high’. Each buys the index1 when spreads widen to a historically high trigger level and sells into cash when spreads tighten to a lower trigger level.

We found multiple variations consistently underperformed a simpler strategy of holding the index over the long term (Figure 1).

The one strategy that did (just) outperform since 2000 is captured by the light green bubble. It buys when spreads hit 700bp and sells at 300bp. It benefited from being invested in cash instead of the high yield market during the post pandemic rate hikes.

The 350bp / 550bp strategy (dark grey), chosen for its proximity to the median average spread of c.450bp, was also close to the index, but likely underperformed significantly when considering transaction costs (which are ignored here), particularly given its relatively narrow trading band.

Other strategies consistently underperformed.

How Can ‘Buying Low and Selling High’ Not Guarantee the Best Returns?

A trading strategy may deliver capital gains over time, but credit asset returns have historically been driven by income. Since 2000, the high yield index had returned 6.6% pa in total, with +7.6% coming from income and -1.0% from price moves3.

You need to be invested to harvest income.

To us, the takeaway is clear: in our view time in the market beats timing the market.

Also read: How Should Credit Investors Navigate Such An Uncertain Backdrop?

It Could Nonetheless be a Compelling Entry Point for a Long-Term Allocation

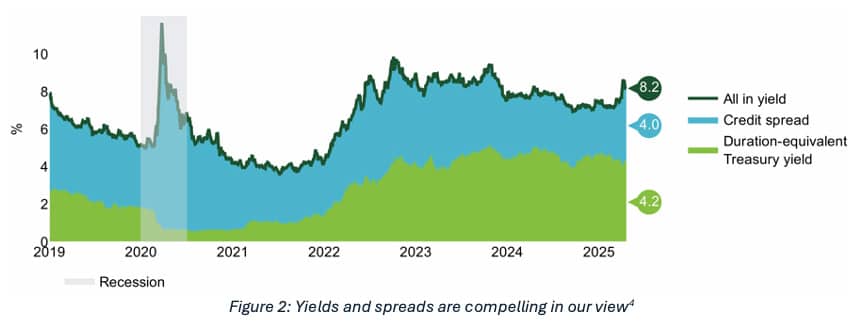

High yield all-in yields are currently trading at their highest levels since June 2023 (Figure 2), with a potentially compelling balance of ‘risk free’ yields and spreads and yields, potentially offering a mutual stability buffer.

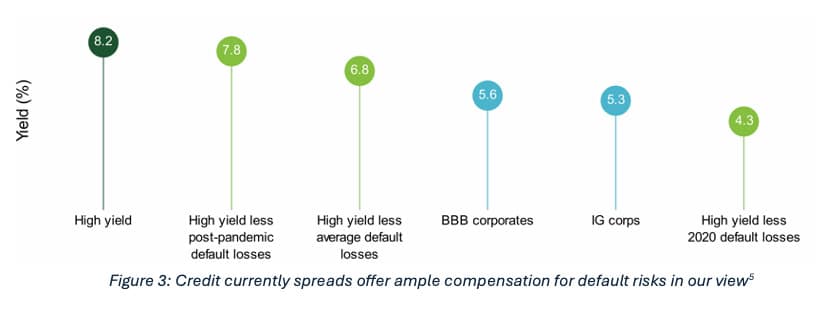

Tariff-related disruption may nonetheless threaten a rise in defaults.

However, if we project default scenarios (accounting for historical 47% average recovery rates4) into the next 12 months, we find that default losses may have to be in line with deep recessions or disruptions (such as the pandemic), before the realised yield even falls below investment grade levels (Figure 3).

Market pricing may also offer some cushion. CCCs have been pricing in increased stress relative to the default rate in recent years, implying the market is already priced for rising defaults (Figure 4).

It May be a Compelling Time for a Long-Term High Yield Allocation

We believe that high yield may be the risk asset of choice for the current environment. In our view investors should focus on the potential for sustainable long-term income in the asset class because we believe time in the market beats timing the market.

[1] Bloomberg US Corporate High Yield Index

[2] Bloomberg US Corporate High Yield Index, ICE BofA US 3-Month Treasury Bill Index, Insight calculations, April 18, 2025. The quoted benchmarks do not reflect deductions for fees, expenses or taxes. The benchmarks are unmanaged and do not reflect actual trading. There could be material factors relevant to any such comparison such as differences in the volatility, and regulatory and legal restrictions between the indexes shown and the strategy. Investors cannot invest directly in any index. WHERE MODEL OR SIMULATED RESULTS ARE PRESENTED, THEY HAVE MANY INHERENT LIMITATIONS. MODEL INFORMATION DOES NOT REPRESENT ACTUAL TRADING AND MAY NOT REFLECT THE IMPACT THAT MATERIAL ECONOMIC AND MARKET FACTORS MIGHT HAVE HAD ON INSIGHT’S DECISION-MAKING.

[3] Bloomberg Corporate High Yield Index, Insight, April 18, 2025. Past performance is not indicative of future results. Investment in any strategy involves a risk of loss which may partly be due to exchange rate fluctuations.

[4] Bloomberg US Corporate High Yield Index, Insight calculations, April 18, 2025.

[5] Bloomberg US Corporate Investment Grade Index, Bloomberg US Corporate BBB Index, Bloomberg Corporate High Yield Index, Insight calculations, April 18, 2025. Past performance is not indicative of future results. Investment in any strategy involves a risk of loss which may partly be due to exchange rate fluctuations.

[6] Bloomberg, Insight, April 18, 2025