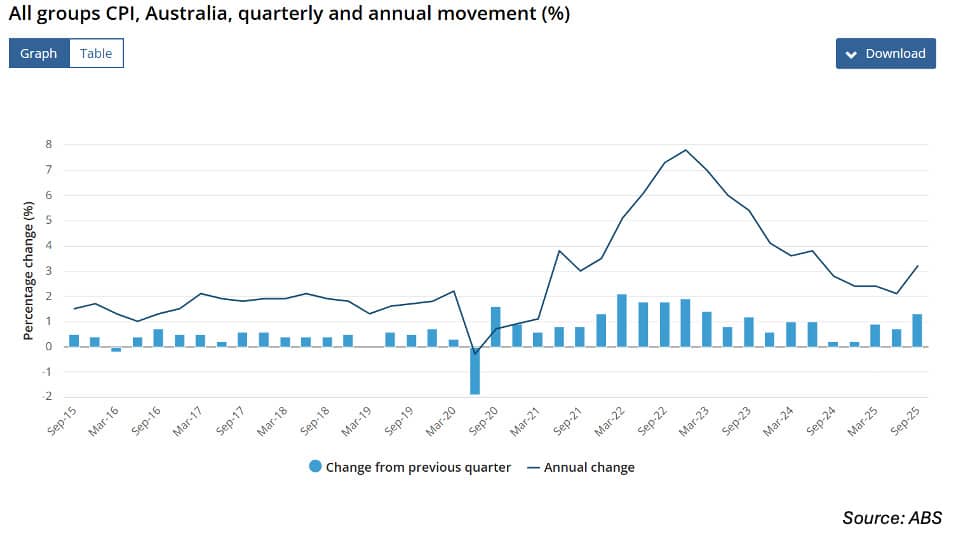

Quarterly inflation was announced this morning for the September 2025 quarter and was up 1.3%, taking annual inflation to 3.2%. According to the ABS, this is the largest rise since March 2023, and the greatest contributor was electricity at 9%.

The more meaningful trimmed mean measure was also up by 3%, from 2.7% for the June quarter. Apparently, this is the first time trimmed mean annual inflation has increased since December 2022.

Food and non-alcoholic beverages annual inflation was 3.1% for the September quarter. Other rises include housing at 2.5%, recreation and culture 1.9% and transport 1.2%.

The ABS also released the September 2025 monthly CPI indicator, which rose 3.5% in the 12 months to September, up from 3% in the 12 months to August.

The rises would be a concern to the RBA monetary policy board, and I doubt it will cut interest rates on this new data.

Interestingly, T. Rowe Price commentators are expecting the US to reinflate with expected tax cuts and fiscal spending:

- Our lead article is from Arif Husain, who discusses his thesis that even though the US Fed is in a rate-cutting cycle, he expects the US 10-year Treasury yield to head towards 6%.

- I sat down with Ken Orchard, Head of International Fixed Income, to record a new podcast. Even though Orchard’s macro view is contrary to others, he recommends not fighting market trends. Orchard gives us detailed descriptions of his favoured sectors, market risks and what keeps him awake at night. It was great to interview two global commentators over the last week and interesting to have an American and a European view.

If US yields rise, will that set us on a different path to the US? New Australian inflation data adds weight to current cash rate settings. But there’s still potential divergence and much uncertainty.

BlackRock has a new ETF, which is global, diversified and charges a very low management fee, so worth taking a look.

The US government is still in shutdown, which is the second longest in history, and that means markets aren’t getting any new data. Chris Iggo from AXA IM looks at the implications for bonds and shares, as well as the impact of AI.

Australia’s popularity for global debt investors is growing according to a CBA article this week.

In Australian corporate bond issue news:

- Region Retail Trust raised $300m and priced its six-year senior unsecured fixed rate bond at 122 basis points over semi quarterly swap

- People First Bank raised $300m in a four-year floating rate note priced at 105 basis points over 3-month BBSW

- Ampol priced its 30-year, non-call 8.25 (30NC8.25) subordinated note deal at 200 basis points over semi quarterly swap, significantly tighter than price guidance of 225-230bps

- ANU launched a five-year senior unsecured fixed rate bond with price guidance of 85 basis points over semi quarterly swap

- Police Bank raised $100m in a three-year senior unsecured deal at 105 basis points over 3-month BBSW.

Have a great week!