There is mounting concern that US government tariffs and tax cuts may seriously disrupt the US bond market. JPMorgan CEO Jamie Dimon and billionaire hedge fund investor Ray Dalio are among a growing number of prominent professionals warning about unsustainable spending that could trigger a loss of confidence.

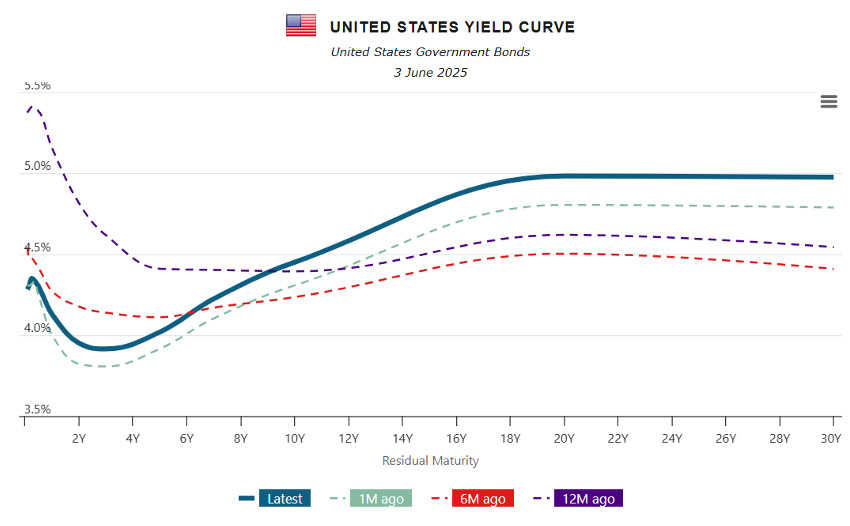

See the steepening US yield curve below from World Economics. Note the steepening of the latest curve shown as a solid line, compared to one month ago in the dotted green line, six months ago in red, and 12 months ago in purple. The 10-year yield is also the highest over the four periods.

The uncertainty is unsettling. Yesterday, the RBA Monetary Policy Board minutes showed the Board considered a 50 basis point cut, a sure sign that another cut may be imminent.

Our lead article this week is Betashares’ announcement of $50 billion in funds under management and its launch of private credit products in the US.

Cathy Braganza from Insight Investments says high-yield investment spreads may offer what investors fundamentally require, compelling compensation for default risks.

We have two excellent articles examining what’s happened in the bond market last month. Emma Lawson from Janus Henderson is back with her popular monthly review and we publish a quite different version from Chamath De Silva of Betashares. De Silva includes numerous insightful graphs. One I really liked showed credit spread changes.

Finally, we have a very good article comparing West Australian and Victorian state government bonds also from Emma Lawson.

Have a great week!