Australian quarterly CPI was 0.7% for the quarter to June 2025, meeting market expectations. Over the 12 months, the preferred trim mean was 2.7%, down from 2.9% in the March quarter. Annual CPI inflation was 2.1 per cent in the June quarter, down from 2.4 per cent. The rate increases the chance of a cash rate cut when the RBA Monetary Policy Board next meets in mid-August.

US Fed Chair Jerome Powell has been under pressure to cut US interest rates. Donald Trump has even threatened to fire him for keeping rates on hold. Tonight, the US Federal Reserve meets to decide. Commentators expect rates to remain on hold and for there to be a cut later in the year.

Rather than publishing the articles I’ve been sent, I thought a selection of comments on the Fed Funds Rate might be more interesting:

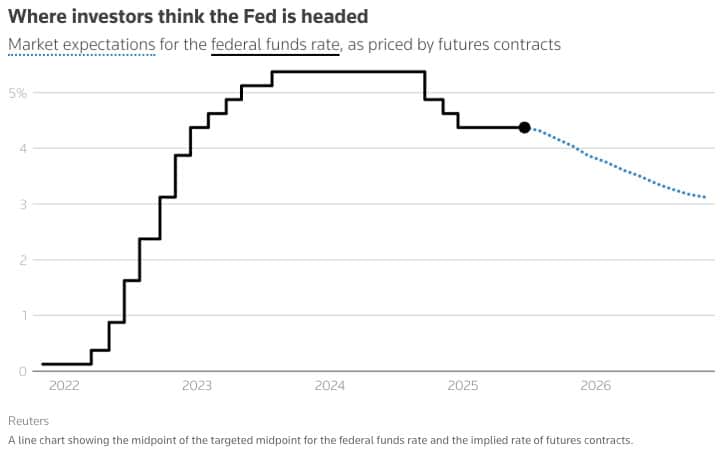

- Overall, we believe a reasonable path forward given our economic outlook is a return to a neutral policy stance by the end of 2026, with interest rates settling near the midpoint of the Fed’s estimated neutral range of 2.6%–3.6% (down from the current level of 4.25%–4.5%). This is lower than the FOMC’s current 2026 Summary of Economic Projections median projection of 3.6%, but it remains within the central tendency range. Tiffany Wilding, PIMCO

- …Powell probably will continue to express a wait-and-see approach. Given the uncertainty regarding the landing zone for tariff policy, the Fed will want more time to assess the fallout… A week before the FOMC meeting, the market was pricing about a 65% probability of a cut in September. This likelihood will collapse to something closer to either 0% or 100% as we get closer to September 17. Erik Weisman, MFS Investment Management

- I expect the FOMC to keep interest rates unchanged at 4.25% – 4.5%. The most interesting aspect of Wednesday’s decision will be a potential dissent by Waller and Bowman, which is my baseline expectation. This should be interpreted as dovish by the market and further fuel speculations that once more Trump appointees have joined the Board of Governors of the Fed (from Q1 2026) interest rates should move down faster… I think that Powell will try to direct the committee toward holding out for the next cut for as long as possible. Combining this reasoning with my relatively upbeat outlook for the economy, I think that a cut in October is more likely than in September. Blerina Uruci, T. Rowe Price

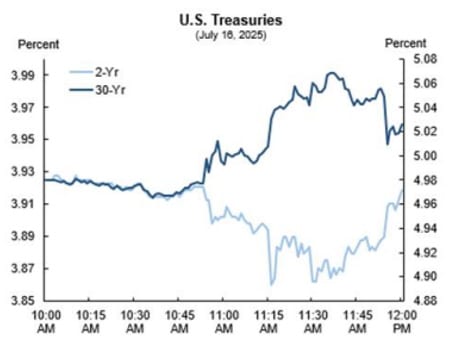

- Although headlines pertaining to potential efforts to oust Fed Chair Powell didn’t derail the risk-on market tone, the market reaction on July 16th provided a glimpse into the possible fallout from challenges to the Fed’s independence (see the accompanying chart panel). The front end of the U.S. curve rallied on the presumption of easier monetary policy from a Powell successor, while the back of the curve sold off in an indication of a higher term premium—e.g., a potential increase in the 10-year term premium from about 0.70% towards the historical range of 1.45%—amid looser anchors around long term inflation expectations. Daleep Singh, PGIM Fixed Income

I found this graph below on a Reuters note, showing market expectations for the Fed funds rate, as priced by futures contracts. It shows a final rate of around 3% at the end of 2026.

Government yield curves have been steepening, and Benoit Anne from MFS Investment Management says that it’s for the wrong reasons and it’s about debt sustainability issues and the pricing of higher-risk fiscal premiums. Too much debt is never a good thing! Anne argues the risk to long-end rates is to the upside.

Japanese government bond yields are rising, and there’s a growing concern that higher domestic rates will lead Japanese investors to withdraw from global markets and invest at home. Chris Iggo from AXA Investment Management consistently provides excellent insight, and this article is well worth reading.

There are two new fixed income products this week. Bennelong has announced a global Income fund, and Blossom has announced an account for loved ones under 18.

We publish the last instalment of the excellent Credit Portfolios, Valuations and Liquidity series by Richard Quin of Bentham Asset Management. Great reading if you have invested or are thinking about investing in private credit or other managed funds.

Have a great week!