This is an excerpt from the Rabobank Australian Interest Rates 4Q Market Outlook.

Summary

- The Australian economy is in recovery with growth accelerating, inflation near the target and the labour market close to full employment

- RaboResearch forecasts that the Reserve Bank will deliver three more 25bp cuts between now and May 2026 as falling inflation, continued labour market softening and trade headwinds eliminate the case for restrictive monetary policy

- RaboResearch expects short-end Aussie sovereign yields to fall as the market reprices Cash Rate expectations lower

- We believe that long end yields are likely to remain elevated and anchored by the US Treasury market

- We see some scope for lower swap rates of 1-3 year tenors, though the influence of falling sovereign yields is likely to be somewhat offset by rising swap spreads

Economic background

Economic recovery is underway in Australia with household disposable incomes rising, growth in demand accelerating and inflation converging on the midpoint of the Reserve Bank of Australia’s 2-3% target.

The RBA has reduced the Cash Rate by 75bps since February to sit at 3.60% at time of writing. The Q2 national accounts illustrated a shift from government spending being the main driver of economic growth to the private sector being the main growth driver. Growth in the quarter was +0.6% QoQ, which is close to our estimate of the economy’s potential growth rate on an annualised basis.

A fall in the household savings rate in Q2 suggests that some of the strength in household consumption might not be fully sustainable without further lifts in disposable incomes.

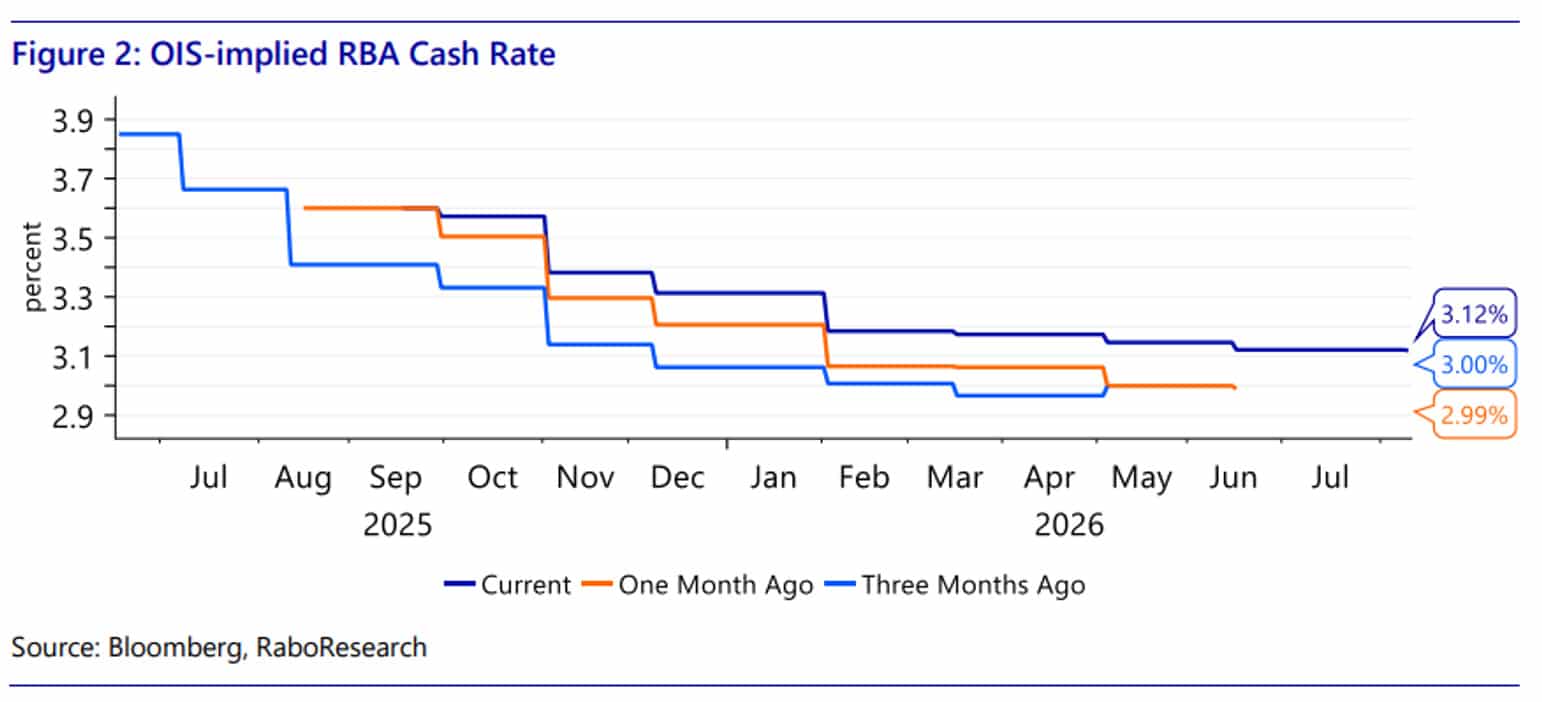

The path of the Cash Rate implied by the Overnight Index Swaps market has repriced higher in recent months:

RaboResearch forecasts the RBA to deliver 25bp cuts to the Cash Rate in November 2025, February 2026 and May 2026. This would take the cash rate down to a terminal rate of 2.85%, approximating our estimate of the neutral rate.

Our forecast is more dovish than the broader market, but we believe that economic headwinds from tariff impacts and second-round effects on trading partner growth are likely to restrict growth sufficiently to elevate the case for additional (albeit gradual) monetary easing. This is especially the case as the labour market continues to show signs of softening and inflation shows few concrete signs of re-accelerating.

Outlook for sovereign rates

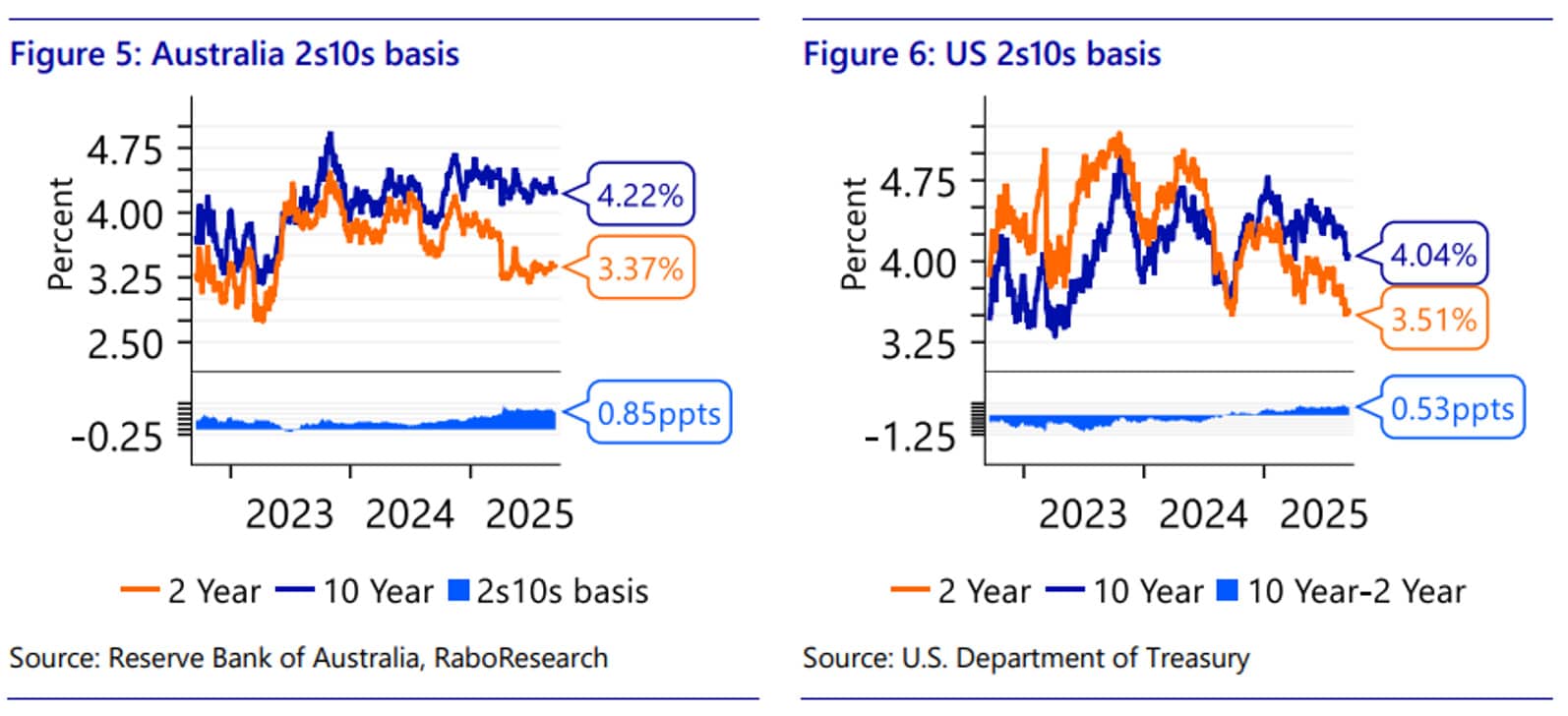

While policy rates have been falling in most Western economies, longer-term interest rates have remained comparatively elevated. This has led to a mechanical steepening of yield curves as rates for tenors of 1-3 years have exhibited greater sensitivity to movements in policy rates than 10 and 30-year rates.

Interestingly, the Australian sovereign curve is currently much steeper than the US curve, despite the United States having a much larger debt to GDP and running much larger fiscal deficits as a share of GDP.

Also read: As the Paradigm Shifts, Liquidity is Here to Stay

The US curve has also remained flatter than the Aussie curve despite market expectations of a comparatively aggressive rate cutting cycle from the US Federal Reserve. This may reflect the US’ status as the issuer of the world reserve currency (the USD) and/or its much larger and more developed capital markets than is the case in Australia.

Australian capital markets are becoming more developed as Australia’s compulsory pension contribution scheme matures and provides a large pool of savings for investment. Nevertheless, Australia typically still needs to offer a premium over the United States to attract international investment.

RaboResearch sees potential for the Australian yield curve to steepen further in the months ahead if we are correct in our view that policy rates will fall further than markets are currently pricing. We expect that long end yields will be anchored by the US Treasury market and remain comparatively elevated.