Key Takeaways

- We believe that global credit is well positioned in the period ahead as an asset class that may deliver attractive defensive characteristics, regional diversification and interesting alpha opportunities.

- Despite the challenging global environment, there are a number of factors that may help support the asset class. Global credit may benefit from investors needing to de-risk their multi-asset portfolios. In addition, we believe that the global macro backdrop will remain supportive, reflecting positive macro developments, including a more stable growth outlook for China, ongoing global monetary policy easing and planned fiscal expansion in Germany.

- The asset class is supported by solid fundamentals, attractive all-in yield valuations and strong inflows.

- Overall, our view is global credit is likely to display strong resilience, thereby offering an attractive de-risking opportunity in the face of elevated market uncertainty.

Global credit exhibits attractive defensive characteristics

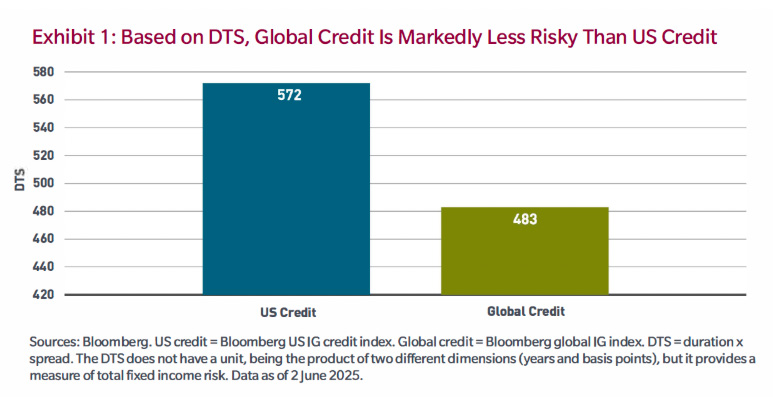

Looking at the two sources of fixed income risk — duration and credit risk — global credit carries less risk than its US counterpart, as illustrated by the lower duration times spread or DTS. In particular, at around 5.9 years, the duration of the global credit index is shorter than US investment grade. It’s worth highlighting that, in our view, the duration of the global credit index is adequately positioned — meaning that it’s not as long as typical government bond indices, but long enough to provide some potential hedge against rising recession risks.

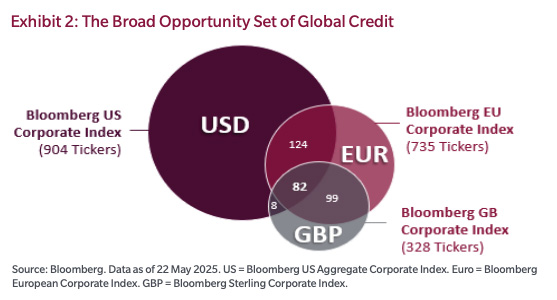

We believe global diversification has proven to be a valuable investment approach. With so much focus this year on policy credibility risks, especially in the United States, adopting a diversified strategy at the global level has been beneficial. By construction, global credit offers a larger investable universe and a much broader source of country risk exposures, ranging from the US to Europe to other developed markets and emerging markets. In addition, global credit also offers some diversification away from governments’ rising fiscal risks, a major item on radars of global investors. As we have observed over the past few months, over-exposure to the US has created challenges for the global investor, especially in view of the declining US dollar. Finally, the broader the investable universe, the larger the potential for security selection alpha opportunities, given the greater breadth of idiosyncratic credit stories. As illustrated by Exhibit 2, the global credit index offers a wide opportunity set, with an index including well over 2,000 tickers, representing a market value of nearly $13 trillion. It’s also worth pointing out that a large number of single-name issuers have debt strategies that involve issuing debt across multiple currencies, thereby offering potential cross-currency relative value opportunities for investors.

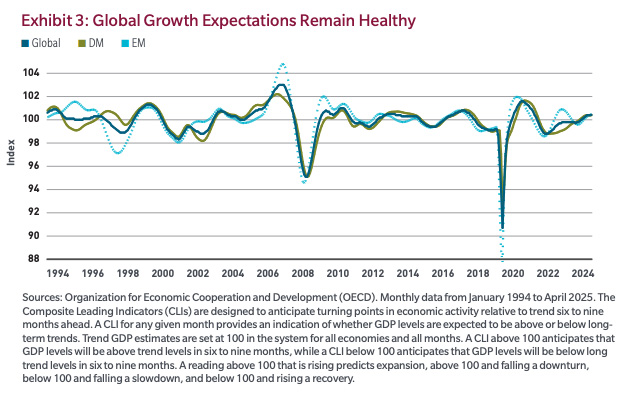

Despite a challenging macro environment, global credit should remain well supported in the period ahead. While it’s true that the ongoing trade war has triggered a downgrade in growth expectations, we don’t believe that the global economy is subject to elevated recession risks. In the US, the growth shock is unlikely to tip the country into recession, given the resilience displayed by the consumer. Elsewhere, we believe the recently announced government spending package in Germany should help boost the growth outlook for Europe. Finally, we are encouraged by the significant stimulus measures undertaken by Chinese policymakers — both on the fiscal and monetary policy fronts — which are beginning to bear fruit and provide a foundation for a more positive growth outlook. Overall, the global macro backdrop is likely to remain supportive of the asset class.

What Does This Mean For Investors

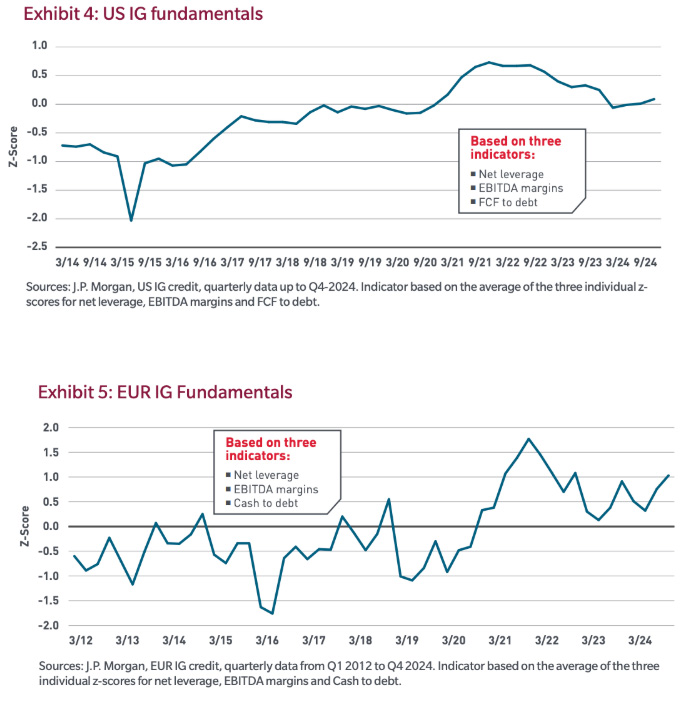

The asset class is supported by solid fundamentals, attractive yield valuations and healthy technicals. In the US, IG fundamentals remain supportive despite a more challenging macro environment. Meanwhile in Europe, euro IG fundamentals continue to show remarkable strength, helped in particular by strong earnings and cash positions.

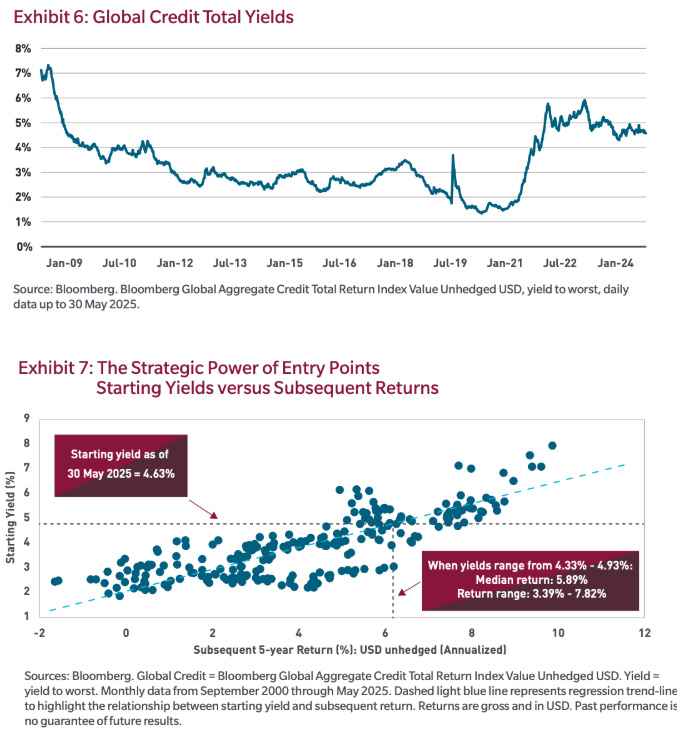

Elsewhere, our EM team is of the view that EM fundamentals remain resilient. On the valuation front, we believe that the total yield valuation backdrop looks compelling, with yields currently trading at about 4.6%, corresponding to a 78% 10-year percentile. Finally, flows over the past few months have been robust, especially in Europe, boosted by the lowering of policy rates in the region. Meanwhile, even though market rates have stayed on the higher side, the strong issuance pipeline, which has been met by robust demand for yield, has helped manage funding needs and refinancing risks.