Soft growth, sticky inflation and fiscal challenges have undermined confidence in the UK. However, the FTSE 100 index recently hit a new all-time high. As elsewhere, the UK market has seen its price-to-earnings ratio increase in the last three years. But valuations remain cheap relative to other markets, with a current multiple of just 12.8 compared to 22.5 for the S&P 500 and 14.3 for the Euro Stoxx. Earnings-per-share forecasts for both large- and mid-cap indices have also moved higher over that period, underpinning prospective returns. But income has been a huge contributor to UK equity returns. Over the past 20 years, total returns (dividends included) have been more than double the pure price return, with dividend returns averaging over 3.5%. With growth improving, inflation potentially set to fall, and gilt market real yields at multi-year highs, the UK offers income and value opportunities across both equities and bonds – despite the headline macroeconomic gloom.

Assessing the ECB’s policy stance

Eurozone interest rates have halved in just 12 months, and European Central Bank (ECB) policymakers believe monetary policy is now close, or closer, to neutral. We can assess how much closer the ECB’s policy rate is to this by looking at the gap between interest rates and core inflation. A year ago, rates were at 4%, and core inflation was running at 2.9%. This gap has evaporated – today rates are at 2% and core inflation stands at 2.3%. Another interesting metric is provided by forward curves. A year ago, both the one-year and five-year forward short-term euro interest rates were trading 100 basis points (bp) and 150bp below the deposit facility rate, respectively. But today’s rates stand right in between those forward rates, with the one-year forward trading 20bp below the deposit facility rate and the five-year forward 50bp above it. Note, the Eurozone’s potential growth and inflation target is probably 2.75%. Therefore, a long-run policy rate around 2.5% is not too distant from neutral..

Exporting disinflation risks

China’s deflationary backdrop persisted into its 34th month in July, with its Producer Price Index (PPI) unchanged. Persistent PPI weakness raises overcapacity concerns and affects export prices, increasing the risks of exporting deflation, ultimately challenging growth in other manufacturing economies. While this is largely tolerated, as many importers still grapple with elevated inflation, it could become problematic once their inflation rates fall within target ranges. China’s ongoing weak domestic consumption and strong manufacturing pose lasting disinflationary risks, and a weaker renminbi could be another potential conduit for deflationary spillover to other markets. China’s export competitiveness is broad-based, from technology to basic metals. With its trade increasingly redirected away from the US to European, and Asian economies, it makes them more susceptible to potentially greater competition from China. Meanwhile, emerging markets are increasingly exposed to a potential disinflationary impulse, with essential ‘core’ goods forming a larger part of Consumer Price Index (CPI) baskets and higher imports from China, as a proportion of consumption.

Implementation ideas

US HIGH YIELD

Rationale

Despite policy uncertainty, US companies continue to perform well – second quarter earnings growth for the S&P 500 universe of companies has delivered in the region of 10%. However, equity valuations are rich and drawdowns can be significant during periods of volatility. High yield potentially offers investors a more income oriented and lower volatility exposure to the US economy. So far in 2025, income return from a representative US high yield index is running at an annualised rate of close to 7%. Defaults continue to be low and supply and demand dynamics positive. Credit spreads have narrowed over the summer, but lower US interest rates will underpin total returns.

SHORT-DURATION INFLATION

Rationale

Concerns over inflation continue to impact the outlook, especially in US and UK bond markets, though less so in Europe. Import tariffs have driven US inflation higher, making it more difficult for the Federal Reserve to meet its 2% target. Short-duration inflation-linked bonds are typically suited to this environment as they benefit from accrued inflation while having limited exposure to interest rate volatility. Two-year US dollar inflation swaps – where two parties swap fixed rate payments – currently trade at 3.0% and inflation could potentially rise above that level in coming months. Inflation accrual and the potential for monetary policy easing will continue to underpin the solid performance of the global inflation-linked bond strategy.

ROBOTICS AND AUTOMATION

Rationale

The robotics and automation investment theme has innovation at its core and the rise of artificial intelligence (AI) brings significant additional capabilities to the technology. There are signs of AI-enabled robotic adoption in many industries such as logistics and surgery. From a cyclical perspective, capital spending appears to be improving along the supply chain, while many of the US government’s policies should support increased manufacturing investment. Trade policies, labour market shortages and further technological progress provide a strong backdrop for increased demand for automated and AI-driven robots throughout the economy.

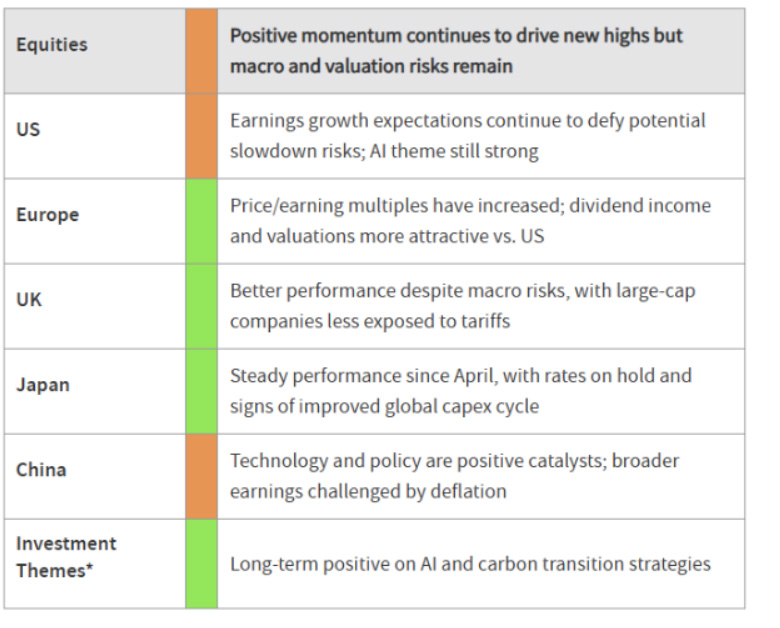

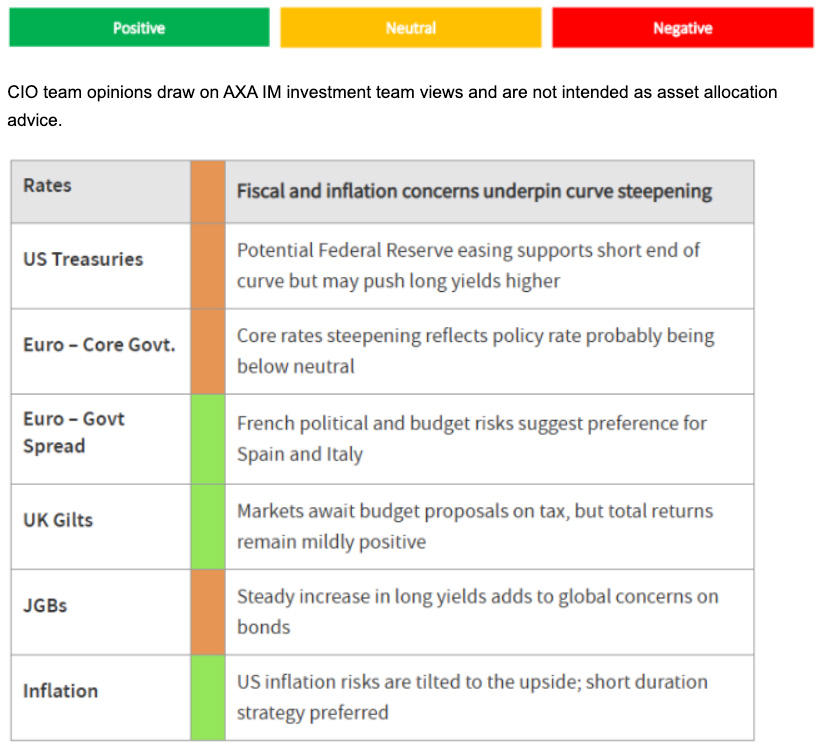

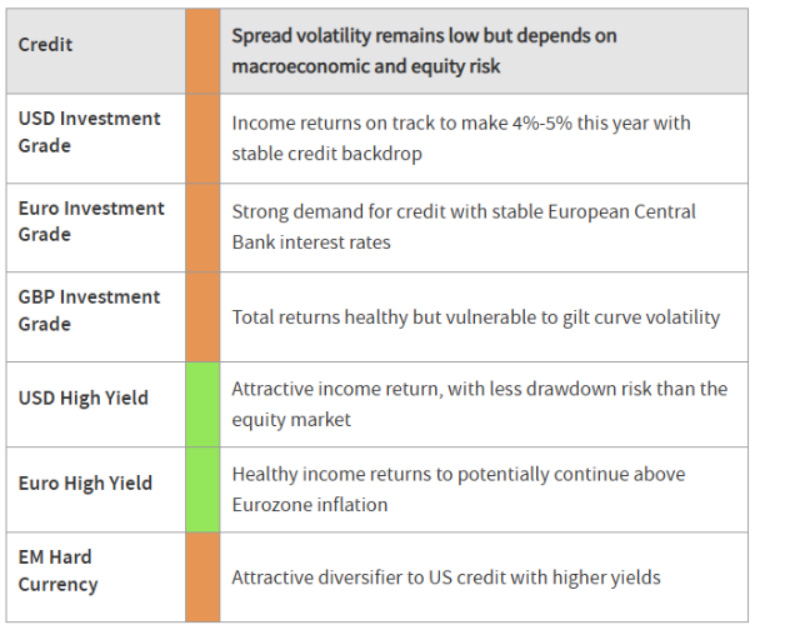

Exporting disinflation risks Asset Class Summary Views

Views expressed reflect CIO team expectations on asset class returns and risks. Traffic lights indicate expected return over a three-to-six-month period relative to long-term observed trends.

*AXA Investment Managers has identified several themes, supported by megatrends, that companies are tapping into which we believe are best placed to navigate the evolving global economy: Automation & Digitalisation, Consumer Trends & Longevity, the Energy Transition as well as Biodiversity & Natural Capital

Data source: Bloomberg