From Moody’s Ratings

Mortgage delinquency rates, which have started to decline in most areas around Australia, are set to continue to go down over the next year as interest rate cuts make home loan repayments more affordable. Declining home loan delinquency rates are credit positive for Australian residential mortgage-backed securities (RMBS) we rate. However, pockets of weakness will remain in regions where housing market and employment conditions lag the rest of the country, with parts of Melbourne a notable area of risk.

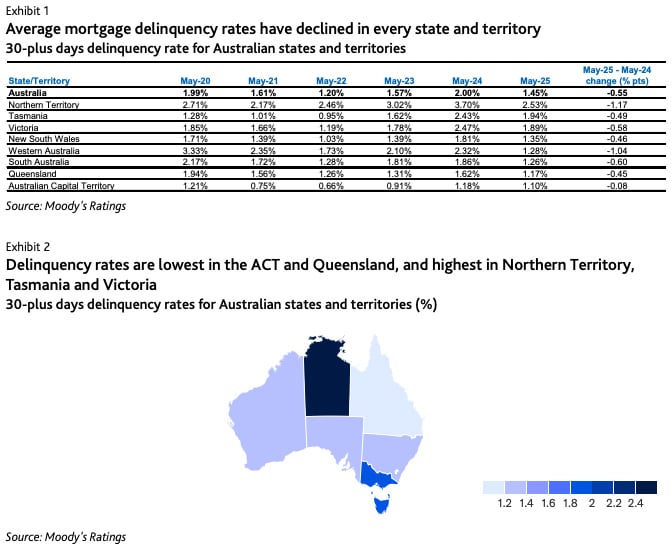

Our latest geographical breakdown of Australian mortgage delinquencies shows average home loan arrears rates declined in every state and territory over the year to 31 May (Exhibit 1). Delinquency rates were lowest in the Australian Capital Territory (ACT) and Queensland in May, and highest in the Northern Territory, Tasmania and Victoria (Exhibit 2)

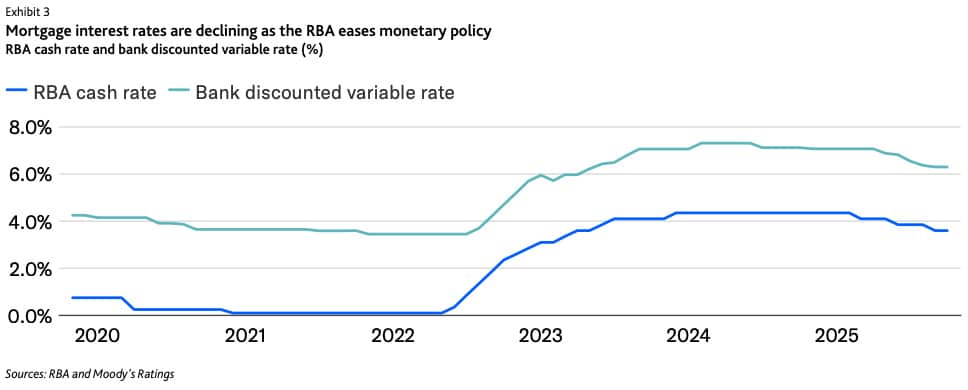

Interest rate cuts are the key reason why mortgage delinquency rates are improving. The Reserve Bank of Australia (RBA), which raised interest rates 13 times from May 2022 to November 2023, has cut rates three times this year, reducing the official cash rate to 3.60% from 4.35% (Exhibit 3). With inflation within the RBA’s target range, additional rate cuts are likely over the next few months, which will further reduce mortgage repayment amounts for floating-rate home loans and lead to lower delinquency rates.

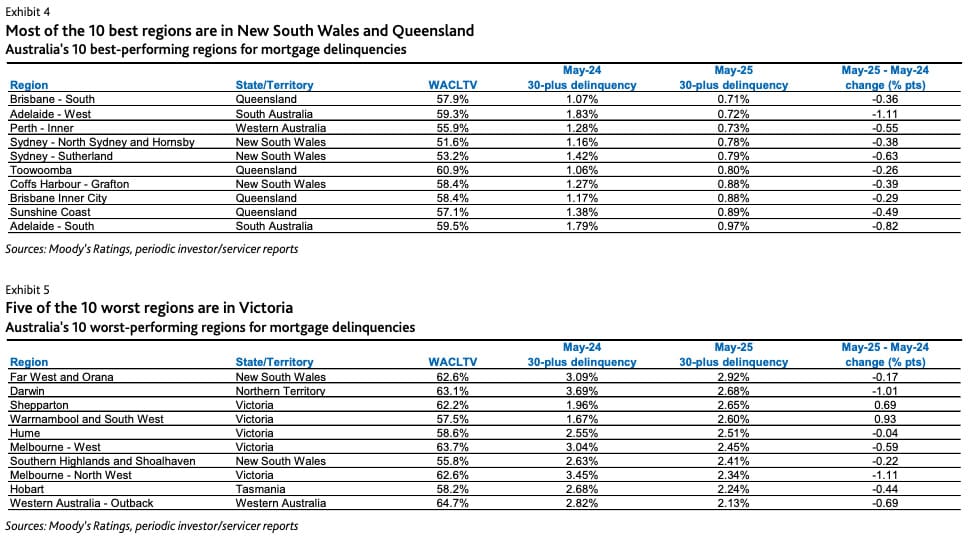

Our analysis shows mortgage delinquency rates declined in 79 local regions within states and territories and increased in only eight areas over the year to May. Exhibits 4 and 5 show the 10 best and worst performing regions in Australia for mortgage delinquencies. Home price growth was typically strong in the best-performing regions and generally weaker in the worst-performing areas.

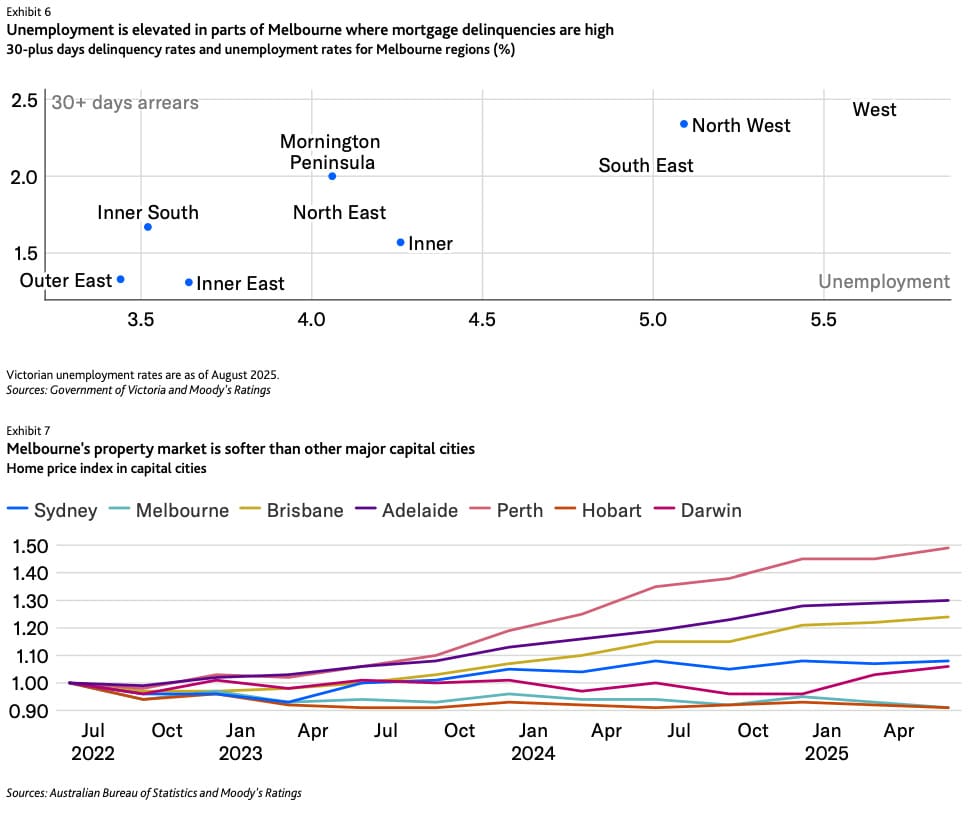

Many of the worst-performing regions are in Victoria, including in the West, North West and South East regions of Melbourne. The unemployment rate in these three regions is higher than other parts of Melbourne (Exhibit 6). Also, the housing market in Melbourne is weaker than most other Australian capital cities, with average prices in the city declining 8% over the last three years, a period when property values increased strongly in most other major cities (Exhibit 7). Stricter investment property laws1 that take effect in Victoria in November will create an additional challenge for the state’s property market. The changes will ban rental bidding, tighten criteria for rent increases and introduce mandatory minimum rental compliance standards, which may dampen demand for investment properties. Additionally, there has been a net interstate outflow of people from Victoria over recent years, and while there has been a large net inflow of people from overseas, many international migrants are students and are not in the market to purchase property. This creates less demand for homes and contributes to the stagnation of home prices.

We expect parts of Melbourne where unemployment is relatively high and where the property market is soft will remain a weak spot for mortgage delinquencies over the next year. Mortgages on properties in Melbourne make up around 23% of the loans in Australian RMBS we rate.

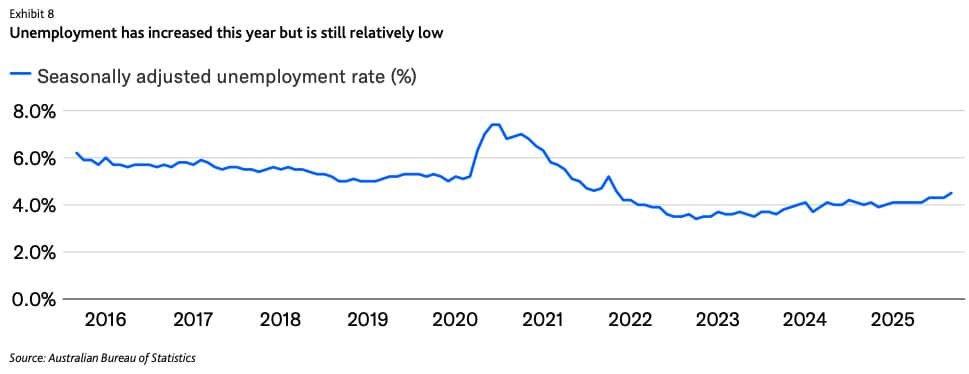

Employment conditions in Australia overall are relatively strong, despite an increase in the unemployment rate to 4.5% from 4.3% in September (Exhibit 8).