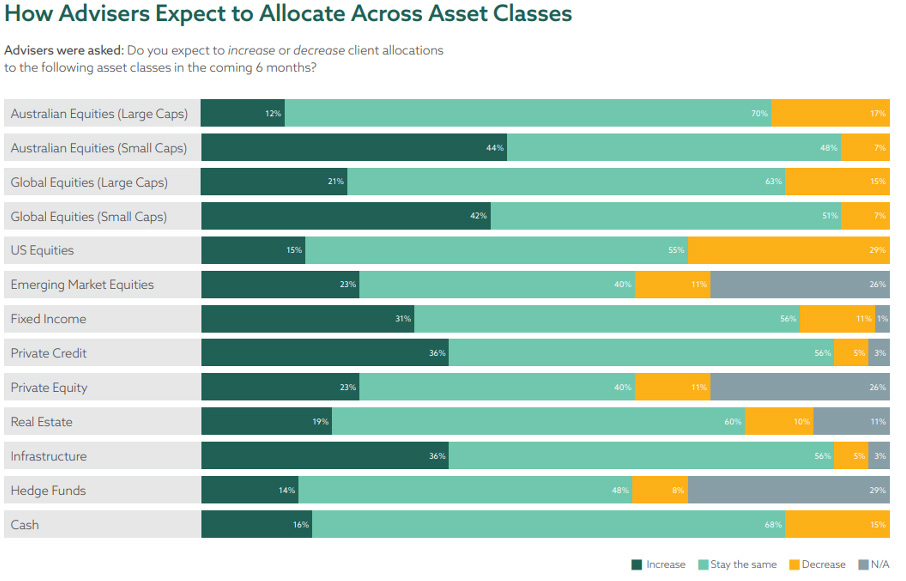

Where are financial advisers expected to allocate in the next six months? Fidante recently published its Adviser Markets Survey, which found the top three asset classes where advisers expect to increase allocations are: Small Cap Australian Equities, Global Small Cap Equities, and, in joint third, Private Credit and Infrastructure.

We publish two must-read Australian private credit articles. The lead article is from QIC and details the five pillars it considers as best practice in private credit and why ASIC scrutiny will make the asset class stronger. Yarra Capital has written an excellent paper comparing US and Australian private credit and argues that Australia is a superior market.

I was very interested in trading platform, AUSIEX’s data on millennial investment in fixed income. They trade about a third of the market and have more than 4,000 advisers using the platform. Check out where millennials are investing, as the article includes the top 10 fixed income ETFs.

Infrastructure has long been a highly sought-after asset class for diversification, long-term stability, and income, and it was great to see alternative investment firm Stonepeak launch a note last week to be listed on the ASX mid-December.

The US Senate has passed a spending bill to end a record government shutdown, extending funding until 30 January 2026. There’s US$125 billion of US Treasury issuance waiting in the wings over three auctions. The market should easily absorb the new issuance, with as many as four rate cuts expected to bring the US Fed Funds rate back to neutral, at around 3%.

According to Benoit Anne from MFS Investment Management, it’s been another ‘Goldilocks year’ for fixed income and he discusses the interest rate gap between the US and Europe, which may create attractive opportunities.

Finally, popular contributor Chris Iggo from AXA IM thinks converging central bank interest rates should be supportive for carry-based fixed income strategies.

In Australian corporate bond issue news:

- Airservices Australia (AsA) is taking indications of interest for a 12-year fixed rate senior unsecured rate bond with price guidance of 120-125 basis points over semi quarterly swap

- Bank of Queensland launched a three-year senior unsecured floating rate bond with price guidance of 82 basis points over swap

- ANZ has priced a short three-year senior unsecured deal with two tranches:

- A $2.5 billion floating rate note priced at 61 basis points over 3-month BBSW

- A $650m fixed rate tranche with a 4.25% coupon

- Victoria Power Networks has priced a $100m increase to its April 2032 green bond at 107 basis points over 3-month BBSW

- NAB priced a 10NC5 Tier 2 subordinated bond in a dual tranche deal:

- A $1.1 billion floating rate note priced at 130 basis points over 3-month BBSW

- A $650m fixed-to-floating rate note with a coupon of 5.0824%

- Transgrid has mandated a 30NC5.25 and/or 30NC10 subordinated notes

- Westpac priced A$4 billion five-year senior and 20-year tier-two subordinated deal:

- A $2 billion five-year senior floating rate note at 73 basis points over 3-month BBSW

- A $1 billion senior fixed rate tranche with a 4.5% coupon

- A $1 billion 20-year fixed-rate Tier 2 bullet with a 6.135% coupon

- Goodman Australia has priced a $500m fixed-rate six-year senior unsecured deal with a 4.904% coupon

Have a great week!