Looking back on 2025, it’s been a rollercoaster year for interest rates. We’ve lurched from multiple rate cuts to a shallow easing cycle and now the bond market expects two rate hikes in 2026!

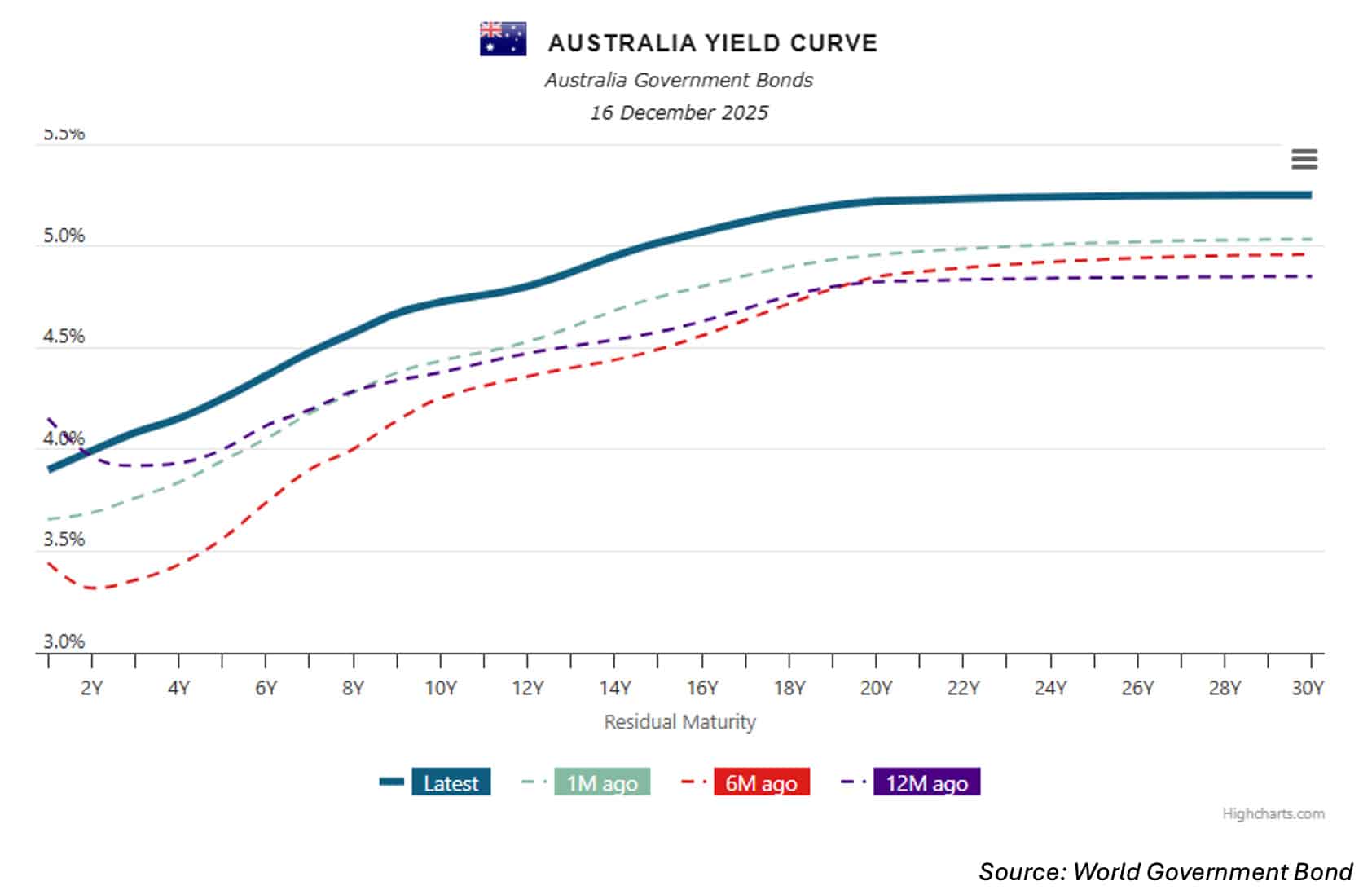

The Australian 10-year government bond yield spiked to over 4.8% last week, a whopping 55 basis points higher than the US 10-year yield. It’s worth remembering that risk assets need to earn a decent margin above government bond yields to compensate for additional risk and it may be worth reassessing if you are being paid enough for the riskier part of your portfolio.

I had thought the current 3.6% cash rate was close to neutral until the latest October CPI release. But with inflation well over the 2-3% target, the RBA may need to raise rates. Possible hikes will lead investors to prefer floating-rate securities.

Subordinated debt and asset backed securities, including residential mortgage-backed securities are two sub sectors worth considering. VanEck’s Australian Subordinated Debt ETF (ASX:SUBD) comes to mind as does as does Betashares Australian Major Bank Subordinated Debt ETF(ASX:BSUB) and newly launched VanEck Australian RMBS ETF (ASX:RMBS). See the fund finders to search for other options or refer to the Five Fixed Income Strategies whitepaper published mid-year.

The entire government bond yield curve has jumped from where it was a month ago.

While it’s not so good for mortgage holders, it’s good news for income investors.

Jay Sivapalan from Janus Henderson suggests following government policies to find opportunities. He has a very interesting suggestion for his highest conviction position.

Anders Persson of Nuveen sets out three key themes for 2026 and then lists specific actions to consider in this well-written and highly recommended article.

In the US, Business Development Companies (BDCs) were created by Congress back in 1980 to support small and mid-sized businesses that struggled to get bank financing. They are publicly traded investment vehicles that lend to private companies. Mawer says investors can learn much about private credit by looking at this high yield, highly transparent market. There are a few good learnings for those invested in or thinking about private credit.

There’s a new bond scam being advertised on social media.

I can’t finish up the year without recognising the devastating shootings at Bondi, and my heart goes out to all those families, and their loved ones touched by this horrific act. Those brave people that raced to help, I would hope, better show the true Australian spirit.

Have a safe, peaceful festive season. We will be back on deck mid-January.