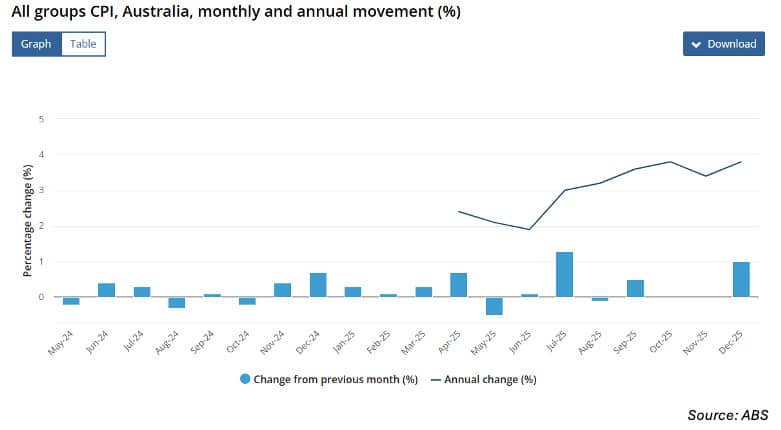

According to the ABS, inflation jumped to 3.8% in the 12 months to December 2025, up from 3.4% in November.

The more important trimmed mean measure was also higher at 3.3%, up from 3.2% in November. The rate is clearly outside the target 2-3% range and increases the chance the RBA Monetary Policy Board will increase rates when it next meets early February. See the chart below, showing higher annual changes since June 2025.

Housing was the main culprit up 5.5%, followed by recreation and culture, at 4.4% and food and non-alcoholic beverages, up 3.4%.

The huge popularity of Tier 2 subordinated debt saw the spread differential between senior unsecured and Tier 2 reach new lows of around 45 basis points last week. Since November 2022, Australian major bank Tier 2 margins have contracted a whopping 165 basis points to 115 basis points and senior unsecured contracted 50 basis points to 70 basis points. Tier 2 securities have been a clear beneficiary in replacing hybrid securities.

Another possible replacement for bank hybrid capital may be corporate hybrids and AusNet Service Holdings is back in the market this morning with a 30 year, non call 10 (30NC10) hybrid transaction. First call will be 4 February 2036. Price guidance is 190-195 basis points over swap with floating or fixed to floating coupons.

Chris Iggo from BNP Paribas is back with another insightful article on government spending and debt levels. Iggo believes 2026 will deliver ‘solid bond returns’ and suggest a couple of attractive sub sectors.

We’ve started updating our ETF Finder and have been surprised to find a staggering 19 new ETFs were launched in 2025. The new Coolabah Global Carbon Leaders Complex ETF, launched late 2025, is very interesting, incorporating ESG and leverage.

Betashares has produced a report on the Australian ETF market in 2025. It’s got some interesting observations, including inflows, outflows and the most popular ETFs, it’s well worth reading.

Private credit continues to boom and as evidence of its evolution, global asset manager, PGIM has announced it is expanding into private credit secondaries.

The Japanese bond market has been in the news lately, as government bond spreads have widened significantly. Janu Chan from Bite-Sized Economics explains the underlying issues.

Have a great week!