Thomas Poullaouec, Head of Multi-Asset Solutions APAC at T. Rowe Price, and his team have published their latest insights on global asset allocation and the investment environment for Australia. September 2025.

OUTLOOK

We maintain a balanced view on risk assets, supported by fiscal stimulus and central banks’ easing, offset by signs of moderating economic growth and persistent inflation pressures.

Australian economic momentum is sending mixed signals. Monetary easing and fiscal spending are supportive, albeit fading.

U.S. economic growth is supported by fiscal spending and potential for Fed easing, although uncertainty remains around tariff impacts.

Outside the U.S., growth outlooks remain challenged by trade uncertainties, though increased fiscal stimulus, particularly in Europe, and central banks’ easing continue to provide support.

Key risks to global markets include the lingering impacts of global trade tensions, elevated inflation, potential policy missteps by central banks, a weakening labor market, and ongoing geopolitical tensions

THEMES DRIVING POSITIONING

Too Soon?

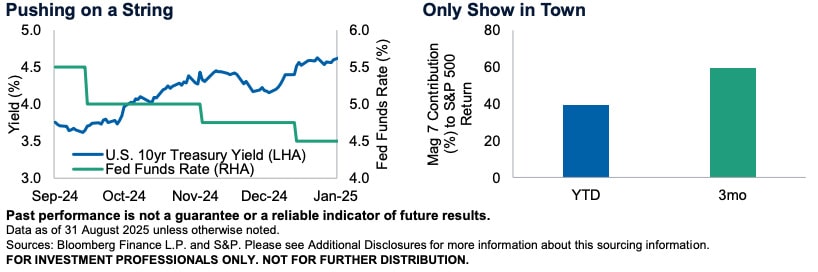

Following Chairman Powell’s Jackson Hole speech, markets have nearly fully priced in a 25 basis point rate cut this month, with Powell adopting a more balanced tone and acknowledging potential labor market weakness. This shift echoes last year’s pivot when the Fed moved to prioritize the labor market as inflation neared its target. The bond market, however, saw the moves as premature, pushing Treasury yields nearly 100 basis points higher as the Fed lowered short-term rates by the same amount. Today, with additional fiscal stimulus on the horizon, elevated Treasury issuance, and tariffs continuing to threaten inflation, the bond market may once again deem the timing too soon and inflationary, sending yields higher. With longer-dated Treasury yields already under upward pressure, any perceived misstep by the Fed could prove costly, as they try to strike a precarious balance between stabilizing the labor market without stoking inflation.

Also read: Moody’s Downgrades US Sovereign Rating

Perfection

With equity markets trending near record levels and valuations becoming stretched once again, concerns about narrow leadership and reliance—particularly in the U.S.—on A.I. spending are a growing concern. Markets have priced in a high degree of certainty that the pace of AI spending will continue and that those companies that are investing heavily in AI technology will see a significant payoff. It is unquestionable that AI technology will be transformative to many industries and lead to greater efficiencies over the long-term. The risk for investors today, however, is that the AI theme is the primary driver of the market and economic growth, with other areas of the economy still pressured by high interest rates, uncertainty around tariffs, and the job market. With the market so narrowly focused on every data point surrounding AI spending and AI company-related earnings outlooks, the risk of disappointment is high. Delivering perfection has almost become a requirement rather than a goal.

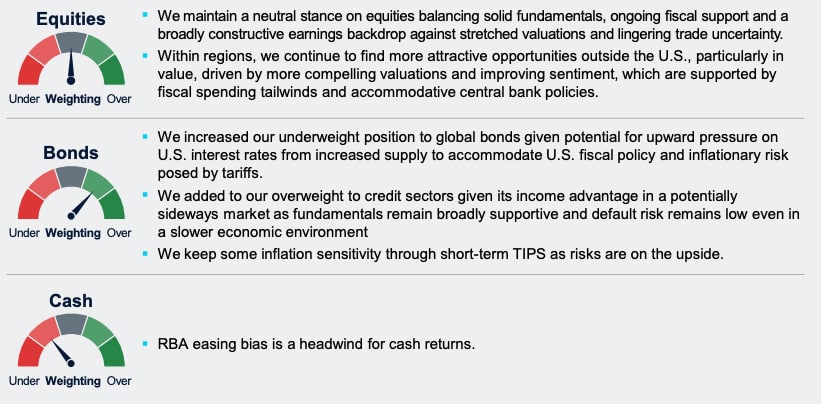

ASSET CLASS POSITIONING

Note: T. Rowe Price’s Australia Investment Committee comprises local and global investment professionals who apply views from the firm’s Global Asset Allocation Committee to make informed asset allocation views from an Australian investor perspective. The Committee is led by Thomas Poullaouec, Head of Multi-Asset Solutions APAC, based in Singapore.