Thomas Poullaouec, Head of Multi-Asset Solutions APAC at T. Rowe Price, and his team have published their latest insights on global asset allocation and the investment environment for Australia. October 2025.

OUTLOOK

We maintain a balanced view on risk assets, buoyed by fiscal stimulus and accommodative central bank policies helping support economic growth, against a backdrop of elevated valuations and lingering inflation.

Australian economic momentum is sending mixed signals. Monetary easing and fiscal spending are supportive, albeit fading. The economy has been surprising on the upside but some leading indicators are starting to decline.

U.S. economic growth is supported by fiscal spending and the possibility of further Fed easing, as concerns have shifted to the labor market.

In the rest of the world, growth supported by fiscal and monetary stimulus helping offset potential weakness from tariffs. A de-escalation in trade tensions and pro-growth policy shift improving sentiment toward China.

Key risks to global markets include the lingering impacts of global trade tensions, sticky inflation, potential policy missteps by central banks, a weakening labor market, and ongoing geopolitical tensions.

THEMES DRIVING POSITIONING

Staying Power?

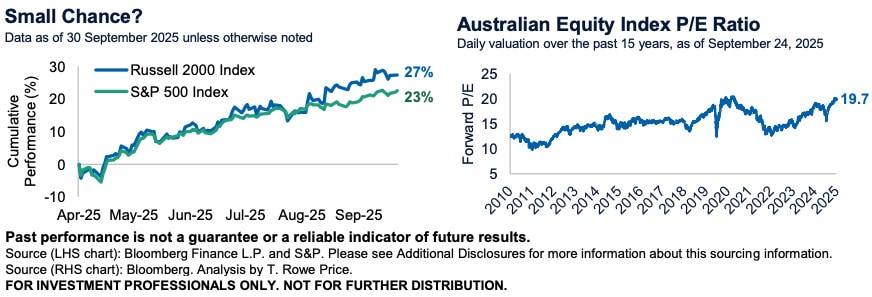

Hopes for lower interest rates have sparked several small-cap rallies in recent years, seeing them finally outperform large-caps, but unfortunately the rallies have been short-lived. The latest Fed cut has reignited enthusiasm for small-caps, now seeing them ahead of large-caps by nearly 4% since April lows, with most of the gains coming since August. It may not just be the Fed reengaging on rates cuts this time around that’s driving outperformance, as other tailwinds may provide staying power. Among these is the recent passing of the One Big Beautiful Bill, a resurgence in M&A activity, the administration’s push on deregulation, and a de-escalation in trade tensions. And while relative valuations are still on their side and small-caps are seeing an uptick in earnings expectations, the risk of inflation keeping rates elevated and the recent weakness in the labor market possibly pointing to slower growth warrant a balanced view.

Also read: What Happens if US Debt Becomes Unsustainable?

Australia Underwieight

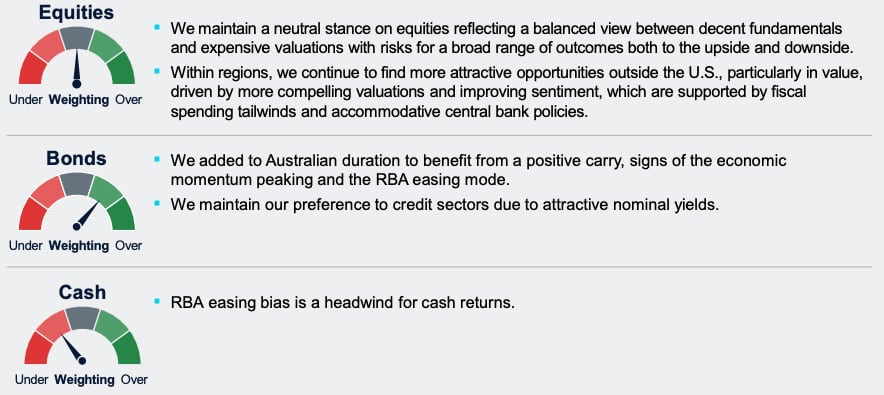

We remain underweight Australian equities as the index is not cheap while forecast earnings growth is very weak relative to the rest of the world. The latter seems unlikely to change in the short term, as in the Q2 results season forward guidance was weak, with more earnings misses than usual. Earnings trends based on MSCI data are still meaningfully lower than in other regions. While Australia’s domestic economy has been resilient, offering support to domestic oriented equity sectors, some leading indicators have been less positive. They point to a possible deceleration of an economy that has been reliant on fiscal support for too long. Despite this, the Reserve Bank of Australia continues to maintain a relatively hawkish stance for now. The board took a unanimous decision to leave the cash rate unchanged at 3.6% in September, citing “stronger-than-expected data on growth and inflation” and “indications that inflation may be persistent in some areas.”

ASSET CLASS POSITIONING

Note: T. Rowe Price’s Australia Investment Committee comprises local and global investment professionals who apply views from the firm’s Global Asset Allocation Committee to make informed asset allocation views from an Australian investor perspective. The Committee is led by Thomas Poullaouec, Head of Multi-Asset Solutions APAC, based in Singapore.