Thomas Poullaouec, Head of Multi-Asset Solutions APAC at T. Rowe Price, and his team have published their latest insights on global asset allocation and the investment environment for Australia. November 2025.

OUTLOOK

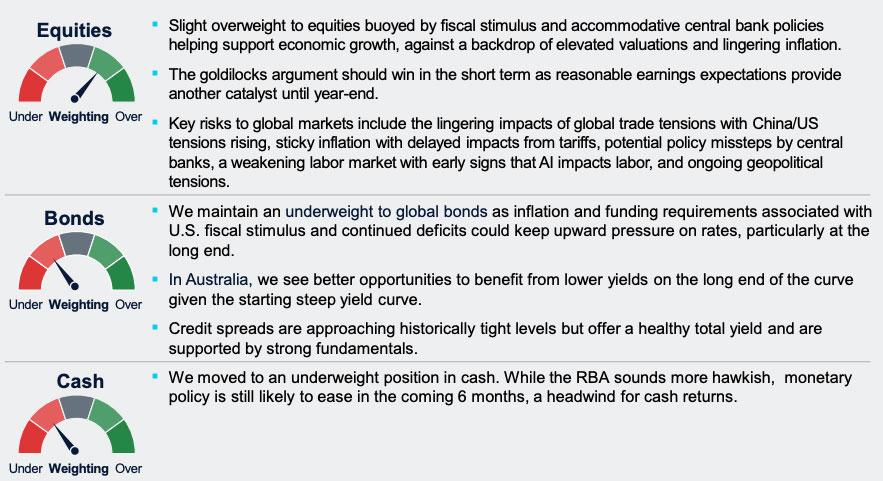

Our view on risk assets remains balanced, with fiscal stimulus and accommodative central bank policies helping support economic growth against a backdrop of elevated valuations, where a lot of good news has been priced in.

U.S. economic growth is underpinned by ongoing fiscal spending and potential for further Fed easing, though outlook remains uncertain amid limited economic data and a lack of clarity around tariff impact.

In Australia, economic momentum is slowing as labor and inflation data complicate the RBA’s decision on rates. For now, the central bank is maintaining a relatively hawkish policy stance.

Elsewhere, growth supported by fiscal and monetary stimulus helping offset potential weakness from tariffs. A de-escalation in trade tensions and improving sentiment toward China are also supportive.

Key risks to global markets include sticky inflation, potential policy missteps by central banks, a weakening labor market, lingering trade tensions and ongoing geopolitical tensions.

THEMES DRIVING POSITIONING

Driving in the Fog

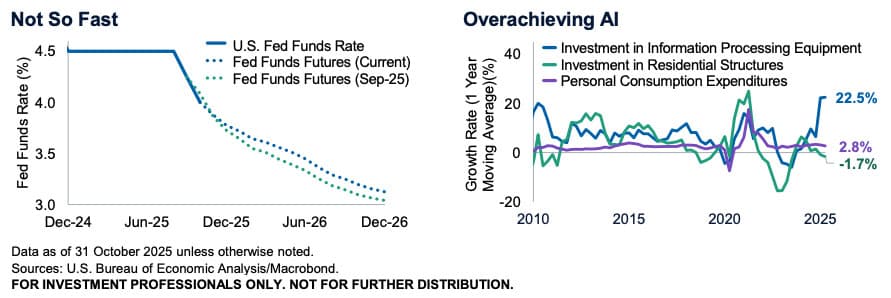

The Federal Reserve’s latest 25bps rate cut and decision to end quantitative tightening were widely anticipated, yet the underlying dissent among Federal Reserve voting members underscores growing uncertainty about the economy’s trajectory. With one member advocating for a more aggressive 50bps cut and another opposing any reduction, the Fed is clearly wrestling with conflicting signals, exacerbated by limited economic data. This led Powell to caution that a December cut is not guaranteed amid the “fog”. Markets responded by backing out rate cut expectations, but with still little clarity in the direction of the economy and more concerns about the direction within the Fed. It’s tough enough driving in the fog, but it’s even worse when everyone in the car wants to go in a different direction.

Also read: Flexible Credit Income Fund Launched For Australian Investors

Reason for the Jitters?

After a near 40% uninterrupted run higher off early April lows around Liberation Day, U.S. equity markets have been a bit more jittery as of late. High valuations, scrutiny around AI spending and more recent focus on debt financing for AI infrastructure have been highlighted as catalysts of concern. Adding to these worries has been the ongoing U.S. government shutdown, incoming private data showing a weakening labor market, slumping consumer confidence and the direction of the Fed mired by a lack of information. On the flip side, earnings growth remains robust, M&A activity has picked up and the narrative around supportive fiscal and monetary policy still holds. AI spending, however, has been the primary driver of economic growth, earnings, and market performance, offsetting weakness elsewhere in areas like housing, manufacturing, and the labor market. Given these imbalances we remain broadly neutral across risk assets, and cognizant of the growing bifurcations across the economy.

ASSET CLASS POSITIONING

Note: T. Rowe Price’s Australia Investment Committee comprises local and global investment professionals who apply views from the firm’s Global Asset Allocation Committee to make informed asset allocation views from an Australian investor perspective. The Committee is led by Thomas Poullaouec, Head of Multi-Asset Solutions APAC, based in Singapore.