When markets inevitably change course, risks and opportunities reset, with one investor’s new opportunity another’s pitfall. This is the essence of a dynamic market and why we love playing an active role.

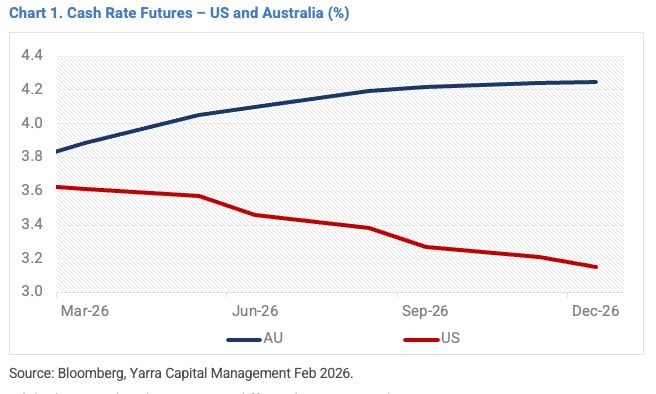

In this instance, the direction change is Australia’s late 2025 bond selloff, culminating in a 25bp hike from the RBA this week and with the prospect of more hikes through 2026. Looking forward, current market pricing for 2026 shows a widening gap between the RBA cash rate and the FED funds rate, with the pricing of rate hikes in Australia in stark contrast to the US where easing appears virtually certain (refer Chart 1).

While the year ahead can pan out differently since actual movements in interest rates in some instances can bear little resemblance to the futures market at any point in time, pricing is always eventually reflected in security valuations across Australian credit and thus impacts investment decisions.

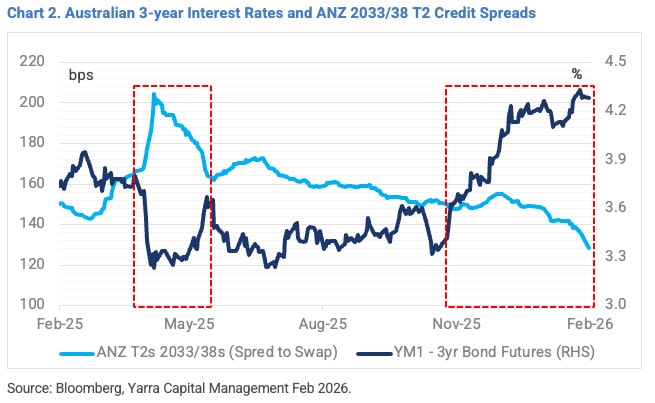

For us, higher bond yields in the closing months of 2025 enabled a rebuild of strategic duration at ~1.7 years across both our Enhanced Income and Higher Income funds. While market timing is never perfect, this duration positioning – where we have a skew to the front end – should help limit any drawdowns from risk offs in 2026. This period reminds us of April 2025, where both funds generated positive performance despite credit spreads moving materially wider. We believe a similar scenario can play out in 2026 (refer Chart 2).

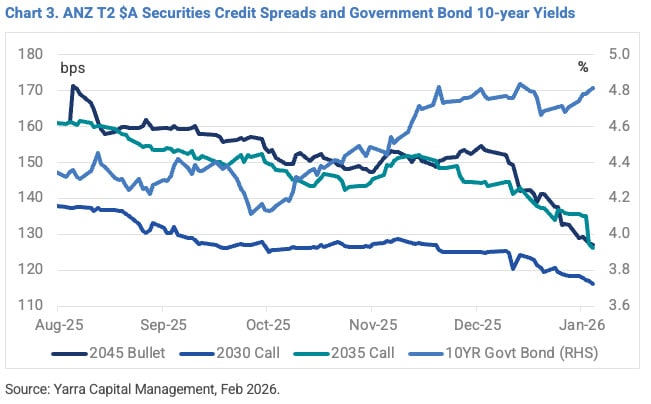

Another key theme through 2025 was the 6%+ “mania” which appears to be back with gusto. A pool of investors attracted to higher outright yields, especially longer dated major bank T2s, appear to be forgoing adequate credit spread compensation and happily accepting higher spread and interest rate duration risk to achieve their 6%+ yield objectives.

Our analysis of the ANZ T2 credit curve illustrates the poor credit spread compensation that is currently on offer for the longer dated 2035 (call) and 2045 (bullet) maturities (refer Chart 3).

Unsurprisingly, the significant contraction in the credit spreads on longer dated T2s is closely correlated with the rise in government bond yields and ANZ’s T2 credit curve, as with the other major banks, is unattractively flat. We have taken this opportunity to rotate out of these longer-dated T2s given the inadequate spread compensation, preferring instead to be invested in shorter dated T2s such as the 2030s which are paying comparable credit spreads but with much less risk.

While we are rotating out of longer-dated T2s, we remain comfortable investing in longer dated securities provided the credit spread compensation is commensurate to the risk assumed. In early February, we invested in the 5 and 10-year BBB rated Aroundtown bonds. While these securities are more off Broadway than the major bank T2s, the 10-year securities priced at an attractive 200bps credit spread and a yield of 6.72%. This deal provided ~70bps additional compensation for two notches lower credit quality (i.e. approximately double the normal compensation over A- rated major bank T2s).

Resetting for 2026, we continue to look to optimise the risk-adjusted return profile of our funds. With projected yields of ~6-7% for both the Enhanced Income and Higher Income funds, we remain well positioned to continue meeting return objectives, and in doing so expect to continue providing our investors with consistent and stable defensive income.