From Sriram Reddy, Managing Director – Credit, Man GLG

Introduction

We have been speaking about the end of the credit cycle for some time, but the speed

of the developments in the first quarter of this year has left us pretty surprised. A

sector that was seen as healthy – banking – has come under pressure largely through

poor risk management at a few institutions, which has led to broader concerns across

the banking industry. It does show that trying to time the end of the credit cycle can

be challenging, as it can occur “gradually and then suddenly”.

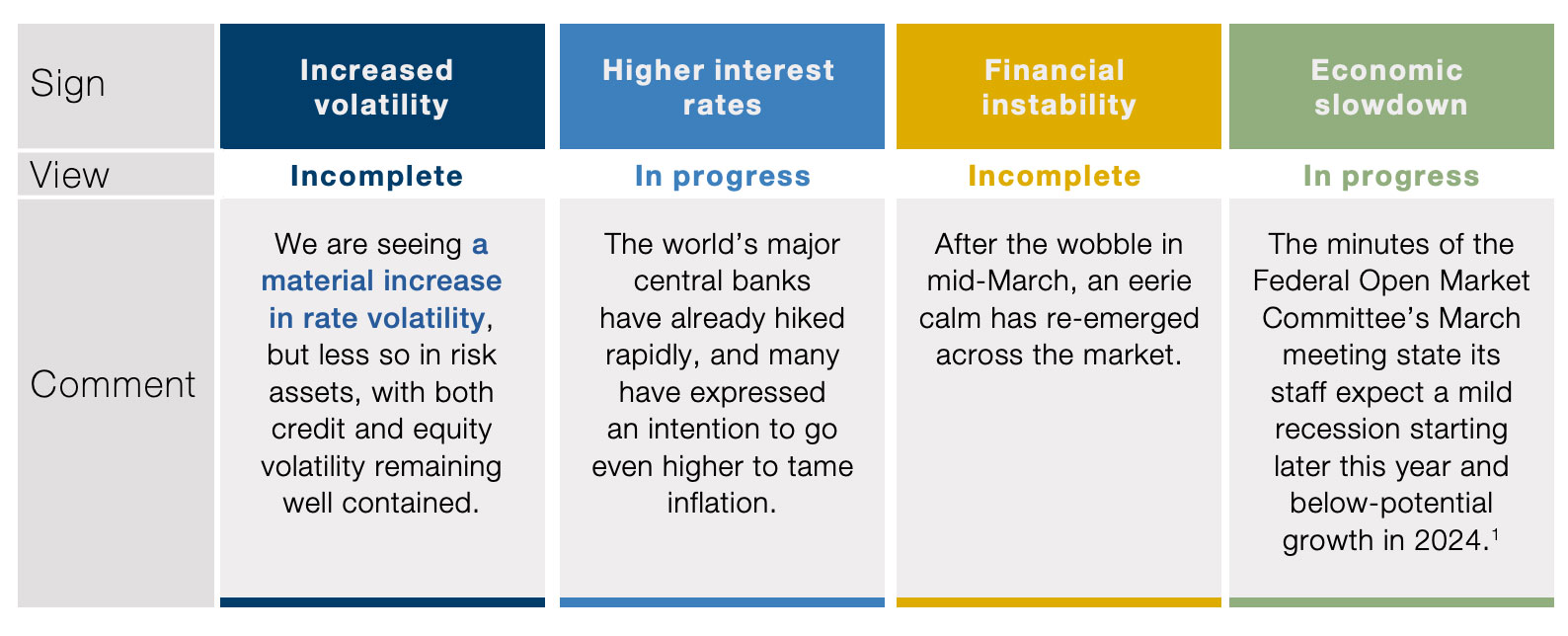

So what are the tell-tale signs of the end of the credit cycle?

The recent stress in the banking system may accelerate the move into the end of the

economic cycle, as it is likely to lead to slowing growth in bank lending. In combination

with higher rates, such tighter financial conditions are in turn likely to create a more

challenging backdrop for future economic growth. Looking at housing starts, consumer

confidence, PMIs, and the continued inversion of the yield curve also continue to point

to some uncertainties going forward. It is therefore perhaps not surprising to see small business optimism below even the Covid lows (Figure 1).

Also read: Five High Yield ETFs to Beat Inflation

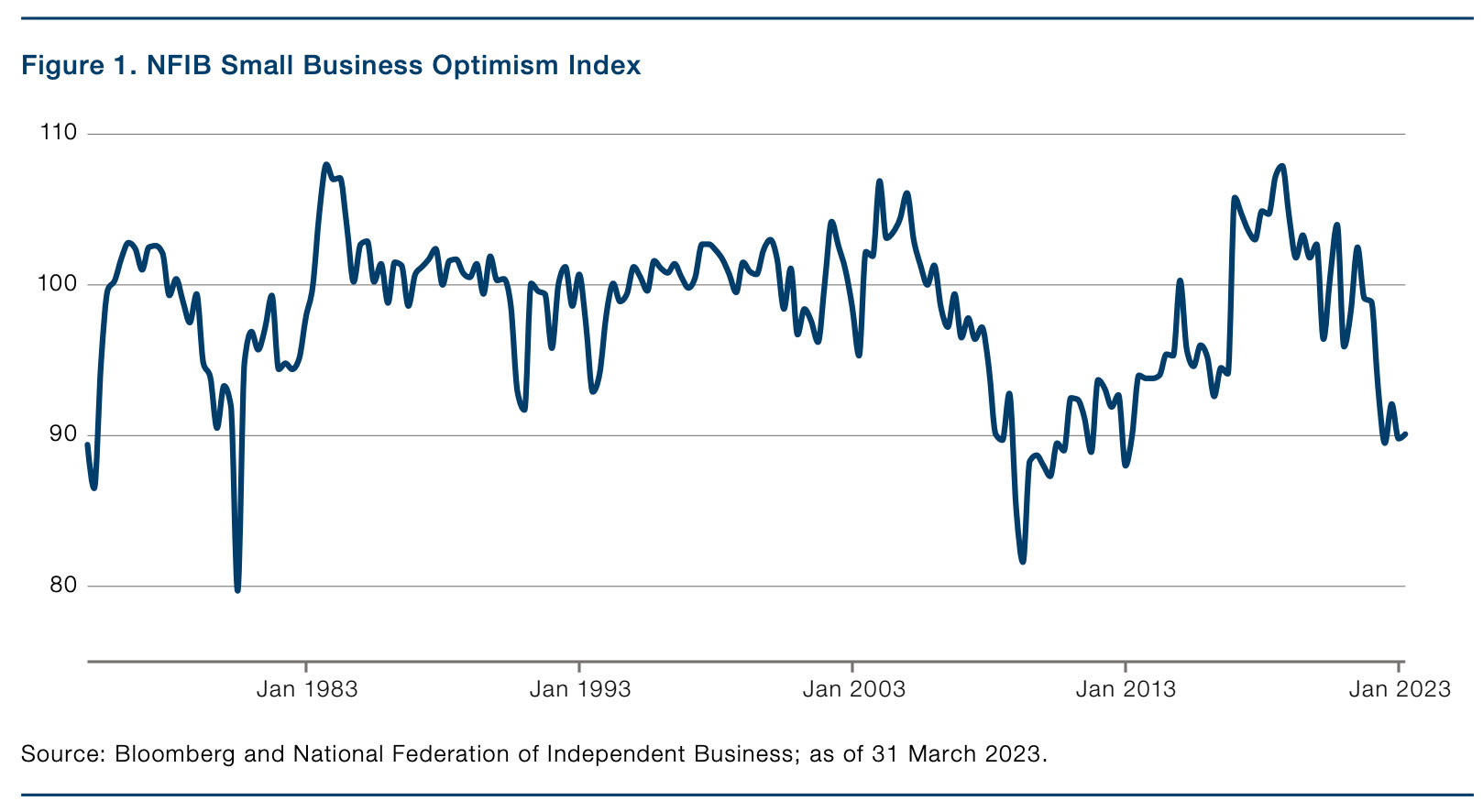

How should investors position for this? One option is to maintain a higher-quality bias

as spreads in investment grade, particularly in Europe, continue to remain elevated

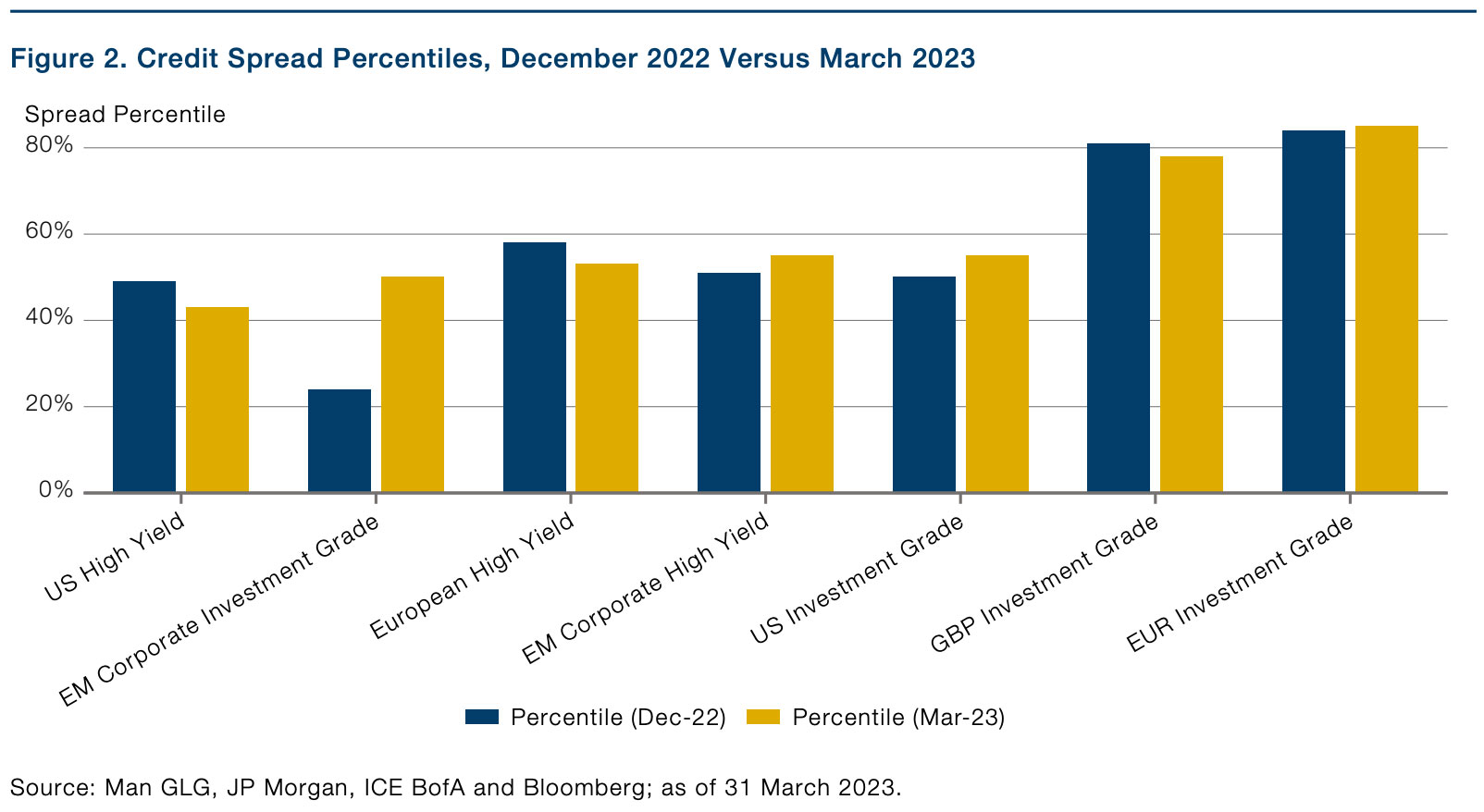

relative to history (Figure 2). Additionally, while not cheap on an absolute basis, the

lower-quality parts of the credit market are offering value relative to equities (Figure 3).

There are certainly pockets of opportunity across most markets, in our view, although

we do think that investors are better served to remain selective as dispersion is likely to

accelerate as growth slows and winners and losers bifurcate.

Q2 2023 Outlook

At Man GLG, we have one overriding principle: we have no house view. As such,

portfolio managers are free to execute their strategies as they see fit within pre-agreed

risk limits. Keeping that in mind, the outlooks below are from the different credit teams

at Man GLG.

Global Investment Grade: With all-in yields remaining high, we think that investors

can continue to benefit from an allocation to investment-grade credit. Investment

grade’s response to the market volatility experienced in mid-March also shows the

benefits that duration can offer investors. With terminal rates in the US reaching

circa 5%, we still think that interest rates offer attractive diversification for investors.

Additionally, the recent widening has once again created value for investors with a

strong preference for opportunities in GBP and EUR. We continue to keep a wary eye

on the US as the recent bank fragilities are likely to increase the chances of a hard

landing over the coming quarter. At the same time, valuations remain more expensive

than in Europe.

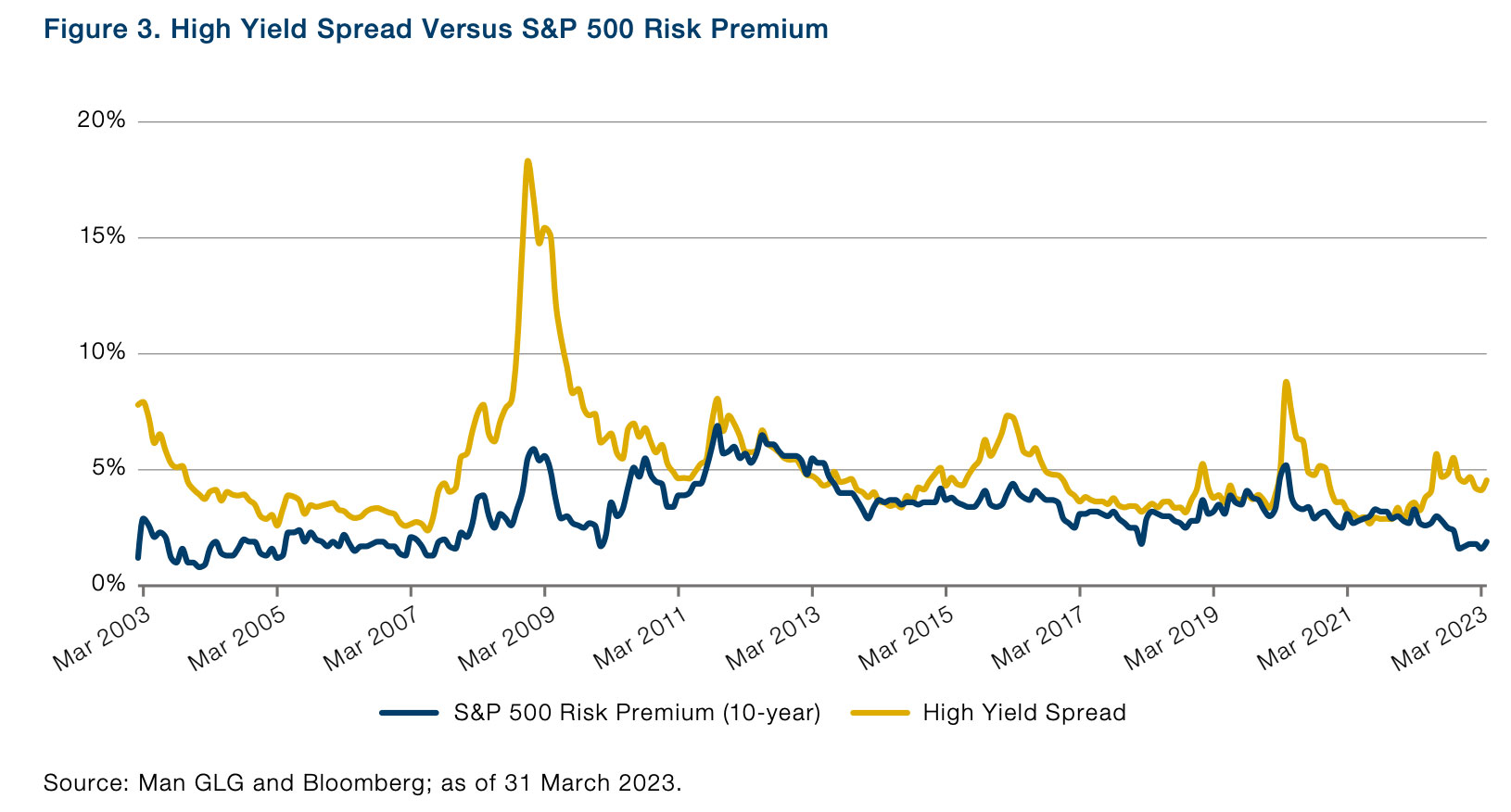

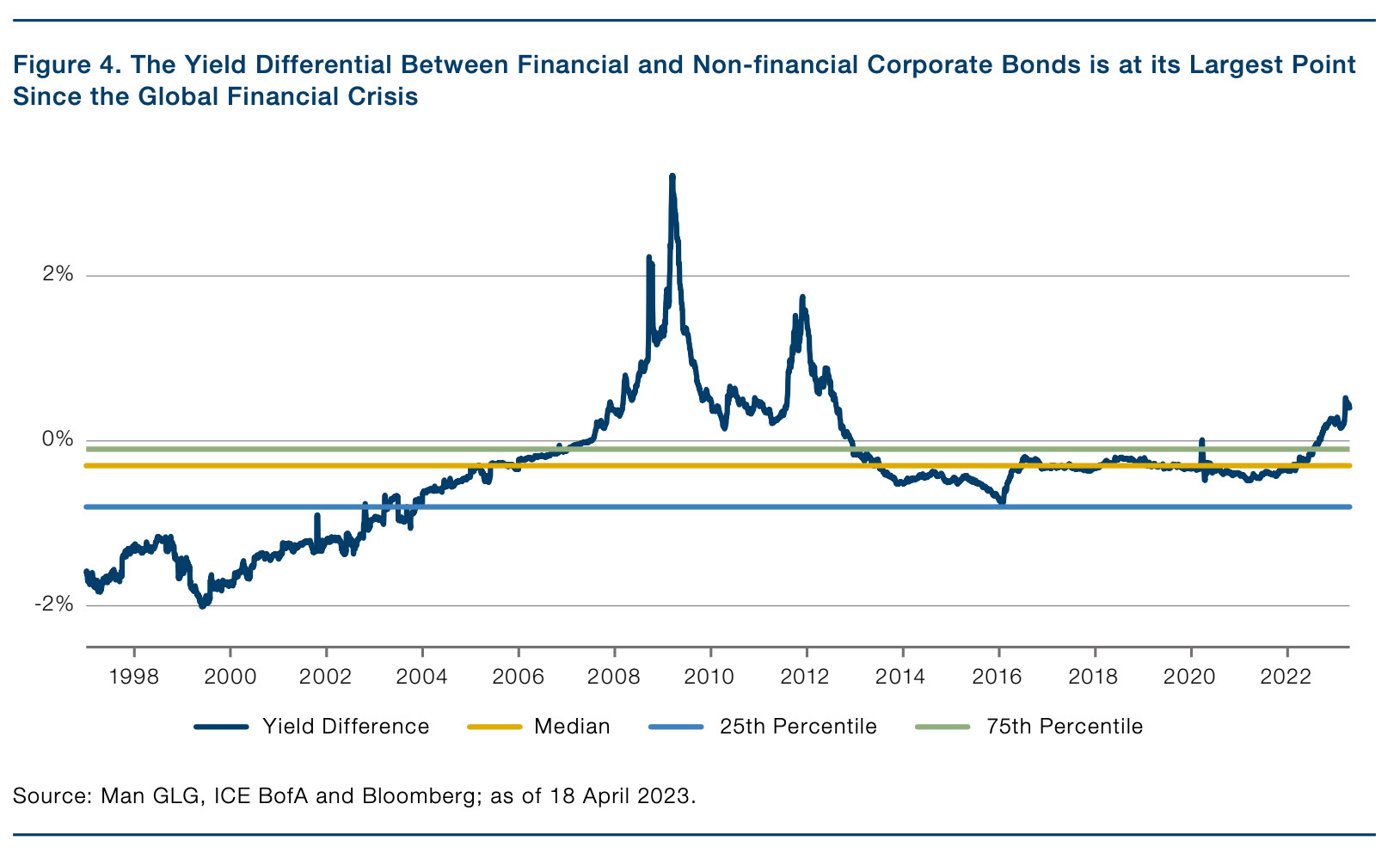

Although we are constructive on the broader market, we believe dispersion between

sectors, geographies and single names has created deep value opportunities for

bottom-up investors to seek to generate strong excess returns next year. For us,

value remains in Europe with a focus on financials companies, which remain in a robust

position compared with their US counterparts (Figure 4). Credit Suisse was an outlier,

in our view, not a precursor of things to come. Although value has started to emerge in

non-financial cyclicals, we continue to take a more cautious view on them. As growth

slows, we believe a higher risk premium will need to be attached to these sectors as

demand slows and profitability weakens. All in all, we see dispersion increasing as

growth slows and believe the backdrop creates an attractive opportunity set for high-conviction and active fund managers.

Global High Yield: Banking fragility in and of itself should not be a surprise; we think

it is just one of the consequences of the tighter monetary policy regime that we are

experiencing. We certainly believe that more pressure points will arise as financial

conditions tighten. We have been speaking about this for some time, and believe

that we are at the tail end of the credit cycle. The natural consequence of higher

rates is lower growth, with a lag. The pressure that banks are currently facing is likely

to accelerate the end of the credit cycle, as it would be difficult for banks to lend

aggressively while they are seeing deposits fly out the door. We expect the pressure

to be felt more acutely in the US relative to Europe, where banks retain much better

fundamentals alongside better regulatory oversight.

We remain optimistic about the stock-picking environment but believe that caution on

pure credit beta is warranted with spreads back to median levels. On a regional basis,

we continue to maintain a preference for Europe over the US as we feel that the latter

remains buffeted by expectations of a soft or no landing in the short term. On a sector

basis, we have a strong preference for companies with pricing power and focus on

consumer staples, healthcare and gaming. Additionally, we have a strong preference

for secured paper heading into a growth slowdown. Finally, we continue to watch a

number of special situations and stressed/distressed opportunities – it is notable that

€96 billion of European high yield trades at spreads above 700 basis points2 – and

would expect these opportunities to pick up materially as growth continues to falter.

Emerging-Market Debt: The turmoil in the banking sector has made the job of taming

still stubbornly high inflation meaningfully harder. At odds with the rate cuts priced

in by the market amid the crisis, the Federal Open Market Committee confirmed at

its March meeting that inflation remained the top priority. The recent oil production

cut announcement by OPEC+ contributed another layer of uncertainty to the global

economy by adding to inflation pressures both in developed and emerging markets.

In emerging markets, these headwinds join other strains such as capital outflows and

restrictive access to more expensive primary-debt markets.

This leaves the emerging-market debt outlook between a rock and a hard place:

calmer waters could prompt a hawkish repricing of US monetary policy, while

further accidents would lead to a retreat of risk appetite. This asymmetric risk/

reward reinforces the case, in our view, for a higher emerging-market risk premium.

Meanwhile, the B-rated (or lower) sector – where the probability of avoiding a default is

closely linked to success in managing refinancing risks – is still widely unable to access

funding markets. However, following the large tightening seen since October – and

with spreads only slightly wider year to date – we think these risks are not yet being

adequately priced. The same is true in currencies, following a 6.8% rebound in the

last six-month period.3 Lastly, in emerging-market local rates, we remain concerned

that some may trade more in line with risk assets than duration in the near term amid

heightened volatility.

1. Source: Minutes of the Federal Open Market Committee, 21-22 March 2023.

2. Source: Bloomberg; as of 31 March 2023.

3. Source: Bloomberg; as of 31 March 2023.

This is an excerpt from a longer article which can be viewed in full here.

Man GLG, was founded in 1995 and acquired by Man Group in 2010. The company

is a discretionary fund manager that is active across alternative and

long-only strategies, equity and credit. Across the Man group of investment

managers, they manage US$144.7 billion for global clients, with

institutional investors contributing 79% (2022) of the group’s funds under

management.

Sriram Reddy is a Managing Director for credit at Man GLG. He is responsible for coordinating business development, product development, marketing and client service efforts across both long only and alternative credit strategies. Sriram joined Man Group in 2022. He was previously a Credit Investment Director at Schroders. Prior to that, Sriram worked at BlackRock for more than 12 years in multiple roles, most recently as an Investment Strategist within the BlackRock Investment Institute.