AI evolution is a bit like the invention of electricity. It has a very wide reaching impact on society, requires massive capital to develop, and will take time to return appropriate profit.

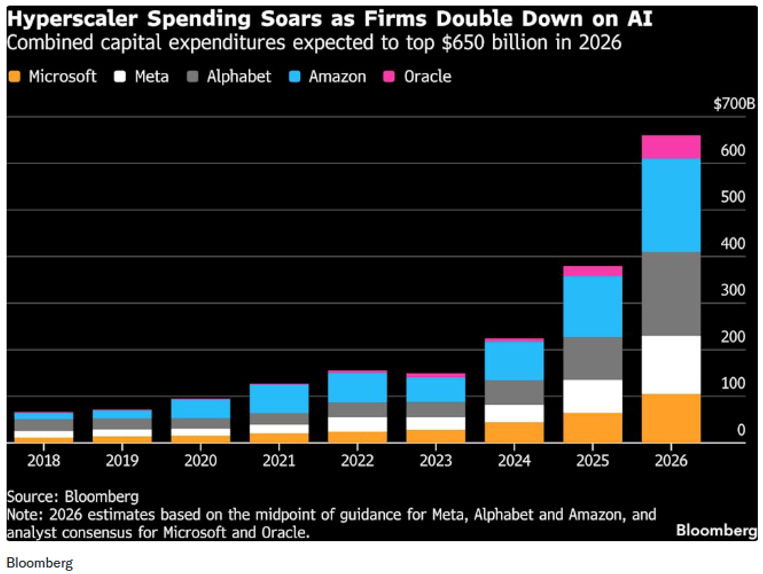

The five hyperscalers of the industry, Microsoft, Meta, Alphabet, Amazon and Oracle are projected to spend more than US$650 billion in 2026. The spending and capital needed to develop AI is growing exponentially, see the chart below.

The five are issuing bonds in size, think US$30-$50 billion and getting bids of more than US$100 billion as investors willingly lend for long periods and possibly yields that are too low. How much will developers need in 2027 and 2028? Who will lend them the funds and at what rate?

I go back to the Mawer podcast I listened to last year with Brian Carney and his comment that ‘the winners would be the companies that raise funds early, and the losers are going to be the lenders who lend money early’.

Emma Lawson from Janus Henderson brings us her popular Australian Economic View and highlights the domestic data centre pipeline. Lawson goes on to assess energy needs and the cost of other supporting investment and its contribution to growth.

Our lead article this week discusses AI creating a new credit risk cycle for bond investors from Richard Quin at Bentham Asset Management. Quin warns the pace of change is outpacing the ability of legacy companies to amortise debt, raising the risk of permanent loss.

We have some excellent domestic market commentators and Phil Strano from Yarra Capital Management has written a very insightful article about diverging Australian and US interest rates. Strano compares an ANZ Tier 2 with Australian three-year interest rates and comes to some interesting conclusions.

In an exciting development, the ASX and Bloomberg are launching the ASX-Bloomberg AusBond Futures Index that will help participants manage interest rates, credit risk and hedging and liquidity management.

Finally, VanEck has launched a new cash ETF – MONY with low fees of 0.15% and a yield to maturity of 4.4% at January 2026. MONY will rival Betashares’ AAA ETF, which is approaching $5 billion in funds under management.

Have a great week!