Global geopolitical tension escalated this week, and oil prices skyrocketed but the conflicts didn’t impact fixed income or share markets in a meaningful way.

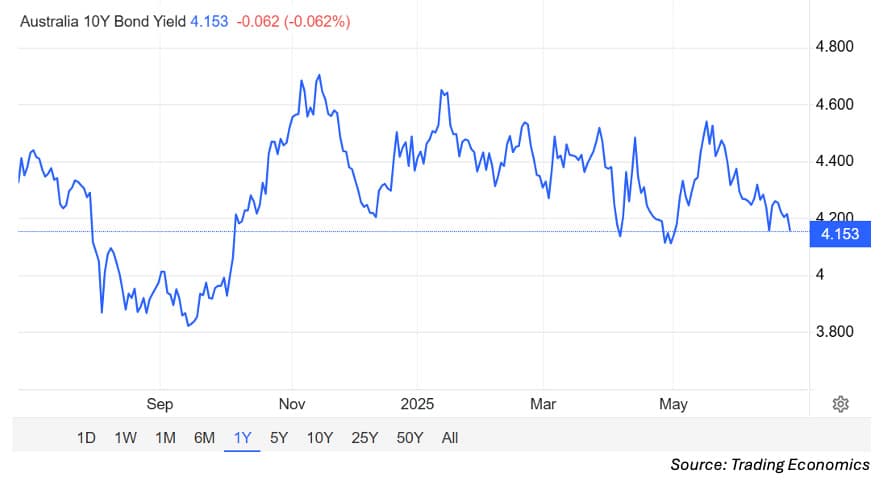

The Australian Government 10-year bond traded at the lower end of historic six-month data and finished yesterday at 4.154%.

Economist Seema Shah from Principal Asset Management provides an excellent explanation of tail risks and how markets reacted to past conflicts.

Asset Backed Security issuance remains steady, while new corporate bond activity has slowed. New corporate bond issues include:

- John Deere launched a five-year senior unsecured, fixed rate bond yesterday. Rated single A with price guidance of 120 basis points (bps) over semi quarterly swap

- Banque Fédérative du Crédit Mutuel raised $500m in a senior-preferred Kangaroo bond in a dual tranche structure that priced at 140bps over swap

- CNH Industrial Capital Australia issued a senior unsecured fixed-rate three-year bond with a 4.7% coupon and a 150bps margin to swap.

I was speaking to a reader yesterday who has accounts with two bond brokers. One holds his superannuation account, the other his personal account. Both understand he wants to invest in low-risk, investment-grade assets, but one was showing him some high-risk private credit deals earning 10% plus. He didn’t invest. My point is to stick to your goals, and if you want defensive assets, then stay in low-risk, investment-grade assets even if those high yields look tempting.

Our lead article this week is by Scott Rundell from Mutual Limited, who takes a look at Australian bank investments throughout the capital stack. It’s always good to understand the risk/return dynamics from any issuer, but with high current equity valuations, Rundell assesses bank floating rate note performance against the ASX200 dividend yield and 3-month term deposits. Hybrids also get a mention.

In case you haven’t already tuned in, we have a new podcast with Harry Hardy from Fidelity International, with a focus on whether the US dollar remains the world’s reserve currency and why it’s important to diversify.

Our last article is an interesting one. While Australians are embracing private debt, Anders Persson from global, multi-asset institutional investor, Nuveen, with US$1.3 trillion in assets under management, says they are seeing renewed demand for public credit.

Have a great week!