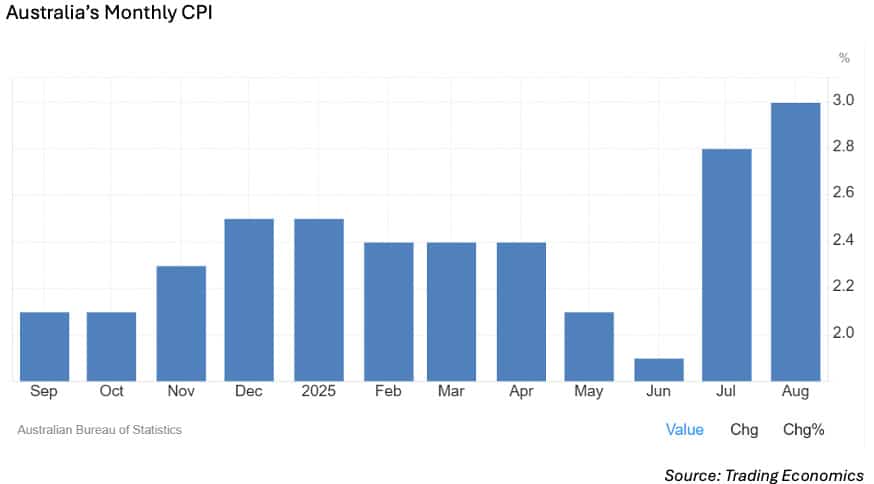

The RBA Monetary Board, as widely expected, kept the cash rate on hold at 3.6% yesterday. The decision follows a higher than anticipated 3% monthly inflation result last week.

August CPI rose 0.2% from the previous month and was attributed largely to higher housing inflation, up 4.5% from 3.6% in July. Electricity prices contributed, surging a whopping 24.6% as state government rebates diminished.

Even though CPI was higher, the Board’s key trimmed mean inflation figure declined from 2.7% to 2.6%. The question is, where to next? Practically all commentators believe there are further rate cuts ahead.

However, there are a range of opinions as to how many cuts and when, with Pimco stating yesterday:

- Today’s meeting outcome is consistent with our medium term view that the RBA will continue to ease policy with a destination around 3% next year.

- There are two remaining inflation prints before year end, the Q3 CPI in October followed by the first complete monthly CPI in November, so both the November and December RBA meetings will be closely watched…

We also publish part of Rabobank’s 4Q 2025 Interest Rate Outlook Report. They are more dovish, expecting three cuts.

Our lead article this week is the launch of Real Asset Management (RAMs) $300 ASX-listed secured income notes.

Robert M. Almeida, Jr. from MFS Investment Management takes a look at historic currency devaluations and the consequences – rapid inflation. The article provides an important perspective on investing in current markets.

Australian fixed income is attracting global attention, according to NAB economist Sally Auld. Strong capital inflows have helped drive our dollar higher against the US dollar but Auld believes it has further to climb. This is a general article, also covering currency and commodities.

Positively, the ASX is going to provide more data about the bond, repo and money market activity.

In Australian corporate bond issue news:

- AMP Bank has launched a 10-year, non call five (10NC5) Tier 2 transaction. Price guidance is 205 basis points over 3-month BBSW

- Judo Bank has raised $150m in a 10NC5 Tier 2 transaction. Price guidance was 245 basis points over 3-month BBSW, but tightened significantly to 215bps

- Port of Melbourne raised $400m in a senior unsecured seven-year fixed-rate deal with a 5.1% coupon

Have a great week!