US debt sustainability is an easy issue to “kick the can down the road” for investors; something that will be a problem 10, 20, 30 years down the line, but not today.

To be clear, I don’t think there is an imminent risk of a major crisis (e.g. true defaults on Treasuries).

However, I do think it’s worth thinking about how things could evolve in the future. The market’s perception of this pathway shapes return outcomes in the near term in less dramatic, but still important ways.

The big picture view: Deficits and debt have been a consistent feature of the US, and this has not resulted in significant challenges for either the bond market or the broader economy. The debt level has increased from ~60% of GDP to ~100% today, driven mainly by two big events – the global financial crisis and COVID-19.

More recently, rate hikes have significantly increased the fiscal impact of this debt burden (interest expense is now the federal government’s third biggest spending area), bringing this issue front and center. Interest rates persistently above the economic growth rate could lead to a rapid deterioration, with the debt situation becoming unsustainable even if governments run balanced budgets.

Potential scenarios to deal with unsustainable debt:

One of four things would need to happen:

- Higher inflation – the Fed allowing inflation to run above 2% could help, but this path is unlikely to solve the problem long-term. Inflation expectations could shift up, eventually forcing the Fed into hiking rates. While the context and situations differ sharply from the U.S., Italy allowed for high inflation as a tool to manage its debt after World War II until it joined the euro. The result was currency depreciation, investor flight, and stagflation, which led to poor living standards and rising unemployment.

- Financial repression – some combination of debt monetization and pegging yields across the curve has been touted by the White House. This would be similar to Japan’s approach in the 1980s and 1990s, though again a very different context. While it could work, there are significant risks (inflation, loss of central bank independence, reduced faith in the USD) that would have to be carefully managed.

- Austerity – ultimately, fiscal restraint could be the necessary end game but is clearly politically challenging. Historically, significant market shocks have been required to prompt governments to take this step (e.g. the Truss government in the UK), and it usually happens after the central bank and/or Treasury have tried.

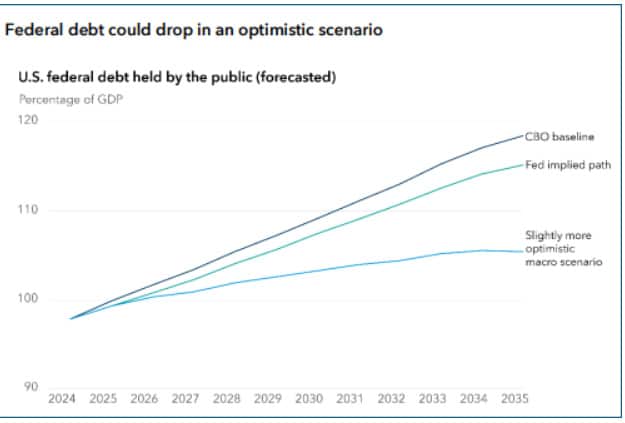

- Higher growth – the least painful, but potentially the most challenging to engineer solution. Significant non-inflationary productivity benefits from AI and robotics could be one pathway (see chart below).

What does this mean for investors?

A mass exodus and the collapse of the USD bond market seem unlikely. There are just very few realistic alternatives for the large pools of capital that need to be invested in defensive assets (e.g. 70-80% of the global credit market is dollar denominated).

However, the debt dynamics and related risk of Fed capture are already shaping rates markets – most notably in the shape of the yield curve and pick-up in rate volatility. In our view, global bonds (which heavily skew to the US) remain investable. We favour credit (with a defensive tilt) over sovereigns. US duration exposures tend to be focused on the short end of the curve, and yield curve steepeners have been prominent in portfolios (both of which have delivered strong results).

If the debt sustainability issue comes to a head, inflation and financial repression would likely follow, and austerity could ultimately be the only way out. This all speaks to a higher term premium on Treasuries and/or a weaker U.S. dollar until austerity becomes a real possibility.

There is still reason for optimism though. Long-term debt sustainability is fundamentally a function of future GDP growth, not just current deficits. An AI-driven productivity boost could significantly improve the US debt outlook.