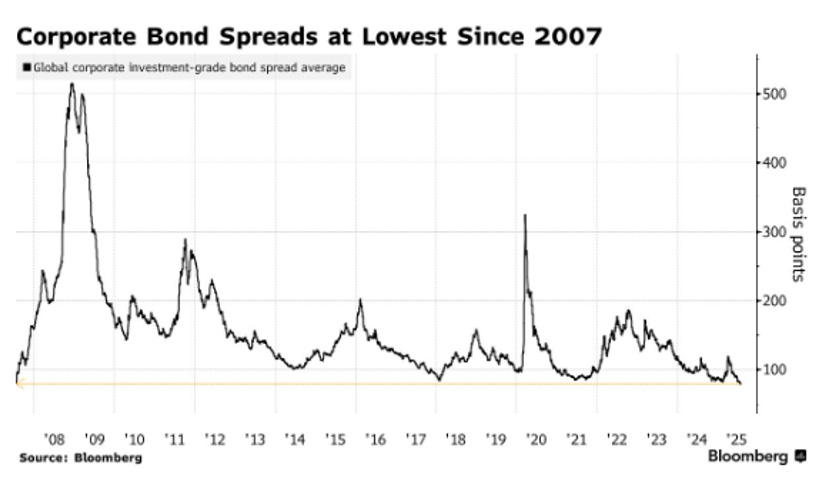

Global credit spreads have reached the lowest levels since 2007. US and European investment-grade corporates were both 87 basis points (bps) as at 4 August 2025, after highs around 200bps in 2022, while US high yield was 301bps down from approximately 600bps over the same period. According to a Bloomberg article, despite reduced recession risks and recent trade agreements, Goldman Sachs has advised its clients to keep some hedges in portfolios believing there are still enough downside risks.

Talking about credit spreads, we have an excellent article from Clive Maguchu and Marie Tsang at State Street Investment Management about the attractiveness of using Australian bonds for income. They believe that while spreads are narrower than historical averages, underlying fundamentals are favourable.

There are two new products this week. A new Betashares global bond ETF and PGIM announced a AAA-rated Collateralised Loan Obligation (CLO) fund.

Just this morning, ANZ announced it is taking indications of interest for a dual-tranche subordinated debt issue. Recent short supply of new issues means that it is likely to see strong demand. Tranches include:

- A 15-year non-call 10 (15NC10) fixed to floating rate tranche with price guidance of 180bps over semi quarterly swap

- A 20-year fixed rate bullet with price guidance of 200bps over s/q swap.

Dyno Nobel, previously Incitec Pivot, issued its first bond late last month since 2019. The deal was more than eight times oversubscribed with bids topping $4 billion. The company raised $500m in a dual-tranche senior unsecured issue:

- A 7.25-year tranche with a 5.4% coupon rate, or a margin of 155bps over s/q swap

- A 10-year tranche with a 5.817% coupon or 170bps over s/q swap.

Emma Lawson from Janus Henderson is back with her excellent monthly summary of the domestic market with an employment focus.

The US government keeps on issuing debt, and Adam Marden from T. Rowe Price assesses the consequences. Debbie Cummingham of Federated Hermes, thinks the US Treasury Floodgates are opening and I wanted to share her insightful comments:

When the US federal debt limit was reinstated in January, the Treasury Department’s use of extraordinary measures commenced (political gamesmanship has made this quite ordinary, unfortunately). This allowed it to tap federal retirement funds and its own cash balance to manage interest and repaying maturing securities while meeting its other financial obligations. Since Congress finally raised the debt ceiling as part of the One Big Beautiful Bill Act last month, the Treasury has issued net new bill supply of approximately $200 billion and is expected to continue at a robust pace with an additional $400 billion through September.

What does this substantial supply mean to the money markets? Simply that the government will have to offer higher interest rates to ensure demand. That, in turn, should put upward pressure on the yields of liquidity products. With the Fed on hold for at least another month, the environment should remain attractive to investors. The popularity of money market funds—hitting nearly $7.5 trillion in assets under management in June (government data)—implies just that.

The US Federal Reserve held rates steady last week for a fifth-straight time. The next meeting of Federal Reserve officials now won’t take place until September in Jackson Hole, where they will have two months of data to analyse. Haran Karunakaran from Capital Group commented on the decision.

Have a great week!