Fixed income offers more attractive valuations and higher income than equities again. In addition, fixed income has historically offered lower volatility than equities, as well as de-risking solutions and potential diversification benefits. Now is the time to consider bonds.

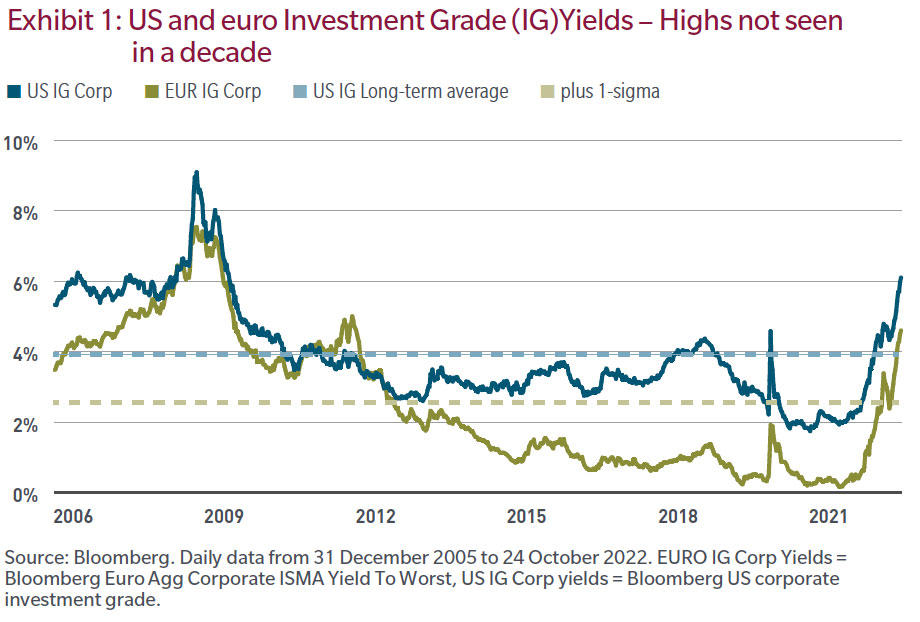

#1. Fixed income has become relatively cheap. The valuation of fixed income has improved considerably over the past few quarters, and we are now observing levels not seen in a decade. This is true for credit spreads,1 which have adjusted much higher, but even more so for corporate bond yields which have benefited from the combined effects of the rate and spread corrections.

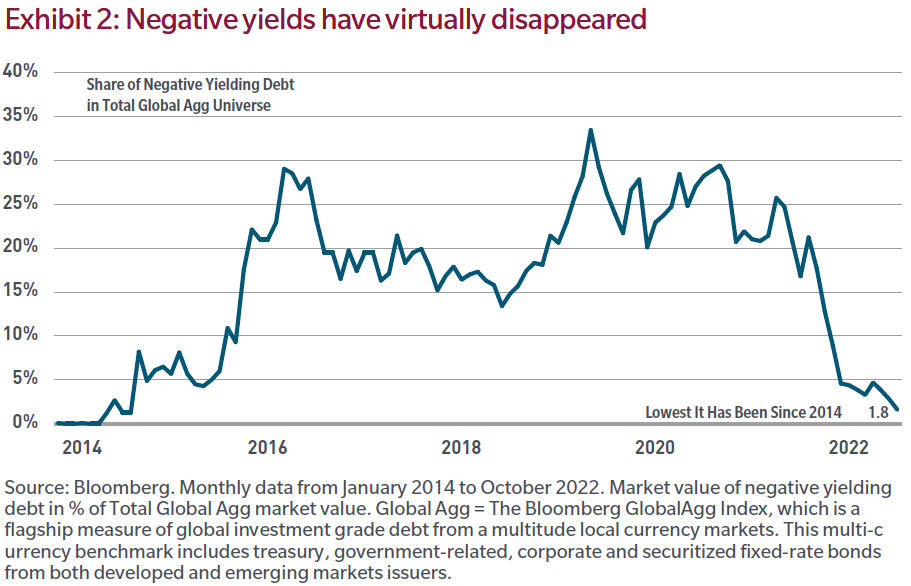

#2. Fixed income may generate attractive income again. One of the major challenges for fixed income in the past has been that yields were too low, partly reflecting the impact of multiyear monetary policy easing and low, stable inflation rates. In fact, in many markets around the globe, yields had turned outright negative, with nearly 30% of global debt showing a negative yield at the end of 2020. The backdrop has now dramatically changed, with fixed income displaying higher yields again, potentially generating attractive income. This is true for lower-risk developed market government bonds, but also for the riskier subsectors of global fixed income, such as high yield or emerging market debt, which now exhibit yields of about 10% in order to compensate for the higher credit and default risks.

Also read: The Lowdown on BetaShares New Fixed Income ETF (ASX:HCRD)

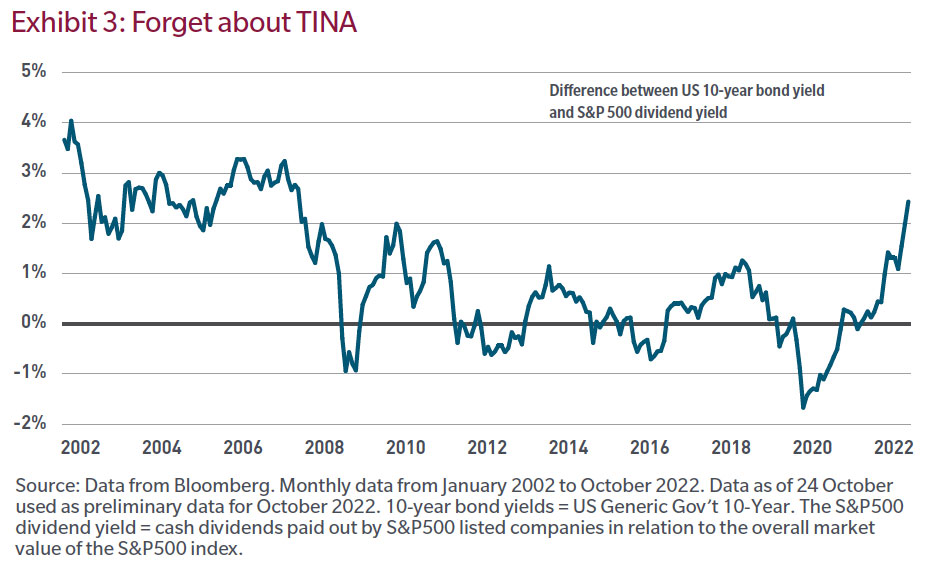

#3. Fixed income represents an attractive alternative to equities again. Fixed income had fallen out of favor in asset allocation processes, especially in relation to equities. In recent years, “TINA” (there is no alternative to equities) was the prevailing asset allocation strategy. In our opinion, this is no longer the case. Fixed income has made a comeback as an attractive alternative to equities in the context of a multi-asset portfolio.

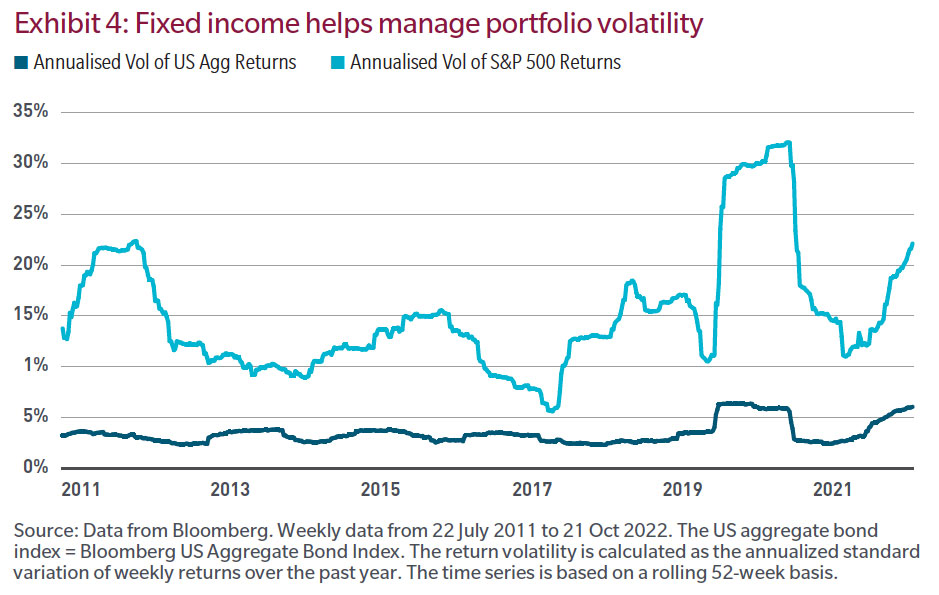

#4. Fixed income may offer an attractive de-risking solution. Some investors may feel the need to de-risk their portfolios in the face of rising macroeconomic uncertainty or elevated market risks. For these investors, fixed income may help manage the volatility of the overall portfolio while also helping generate potentially higher income, historically a relatively more stable component of total returns.

#5. Fixed income is an important piece of the liquidity management toolkit. We believe liquidity management is an essential part of any investment process, especially at times of heightened volatility. Similarly, an adequate allocation to liquid instruments is a pillar of sound liquidity management. Government bonds and highly rated cash corporate bonds, along with equities, have historically offered market liquidity that may be needed in special circumstances, in contrast to alternative investments or private assets. Recent market events have highlighted the importance of liquidity, and highly rated fixed income can be a useful component of the liquid asset allocation.

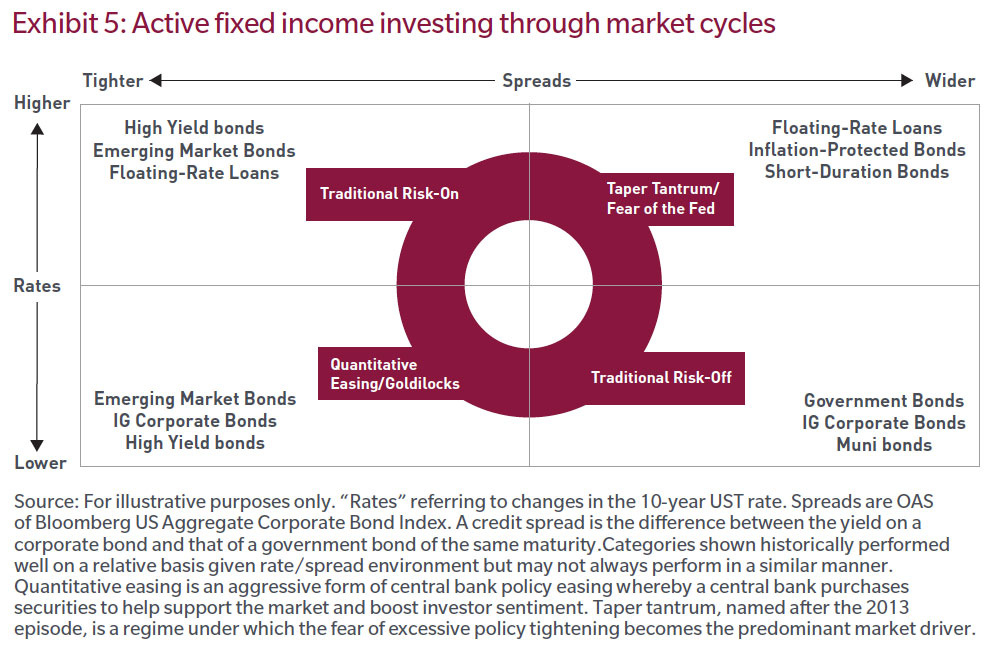

Given the challenges of investing in fixed income through market cycles, we advocate for active fixed income. Macroeconomic uncertainty and market volatility are bound to remain elevated in the period ahead. In order to help manage these risks, we favor the use of active fixed income, whereby portfolio managers can utilize many levers to seek returns, including active asset allocation, yield curve and duration views, as well as a thorough, credit-research-driven security selection process. As illustrated in Exhibit 5, some fixed income sub-asset classes historically have performed better under specific market regimes in place, reflecting their sensitivity to a certain risk appetite backdrop and macro environment. As a result, active asset managers may be able to reposition their portfolios depending on the various market cycles.

1 The credit spread is the difference between the yield on a corporate bond and that of a government bond of the same maturity.