Thomas Poullaouec, Head of Multi-Asset Solutions APAC at T. Rowe Price, and his team have published their latest insights on global asset allocation and the investment environment for Australia. August 2025.

OUTLOOK

We upgraded to a balanced view on risk assets factoring in still supportive fiscal and monetary policies and earnings growth, offset by ongoing trade tensions and moderating economic growth.

While still expected to moderate and facing potential tariff-related inflation pressures, U.S. economic growth is supported by uptick in fiscal spending.

Australian economic momentum seems to be peaking after months of surprising resilience. Monetary easing and fiscal support should provide a buffer.

Outside the U.S., many economies’ growth outlook at risk to the impacts of trade policy, though increased fiscal spending—particularly in Europe—are providing support.

Key risks to global markets include the impacts of global trade tensions, threat of higher inflation, central bank missteps, weakening labor market, and ongoing geopolitical uncertainties

THEMES DRIVING POSITIONING

Pressure’s On

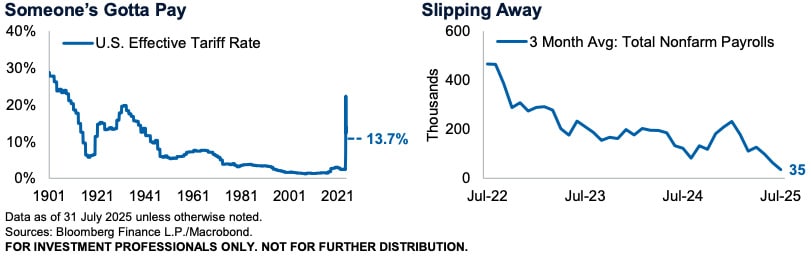

Another tariff deadline passed on August 1st, followed by a one-week extension, intensifying pressure on those countries still working to secure a deal and avoid higher tariff rates. Although there was initial uncertainty after Liberation Day regarding the likelihood of multiple deals, it has become evident that the second Trump administration is determined to deliver—negotiating bilateral “fair” agreements with more favorable terms and concessions than many expected. Europe serves as a prime example, having agreed to a 15% tariff along with a commitment to buy USD750 billion in U.S. energy and invest USD600 billion more in the U.S. economy. Similar concessions came from Japan and South Korea as they weighed the consequences of further escalation. With most of the U.S.’s major trading partners having reached deals, the focus now shifts to a potential agreement with China, one of the final and most significant challenges. While markets have reacted positively to progress on these deals, the long-term effects remain uncertain.

Also read: Moody’s Downgrades US Sovereign Rating

Health Check

The latest labor market data revealed some worrisome signs, with July’s nonfarm payrolls falling well below estimates at only 73,000 new jobs added, and significant downward revisions for May and June of 258,000 fewer jobs. Similarly concerning was that the areas of job gains were primarily within non-cyclical sectors–education and healthcare. The labor market has been surprisingly resilient since recovering from COVID, and a key reason the Fed has been cautious to reduce rates. The recent weakness echoes patterns observed last summer when markets were surprised by sudden job market deterioration, raising concerns that the Fed was behind the curve, before they followed through with their first rate cut. Today, with the Fed hyper-focused on prospects for higher inflation related to tariffs, let’s hope they don’t miss early signs that the job market may be less healthy than it appears.

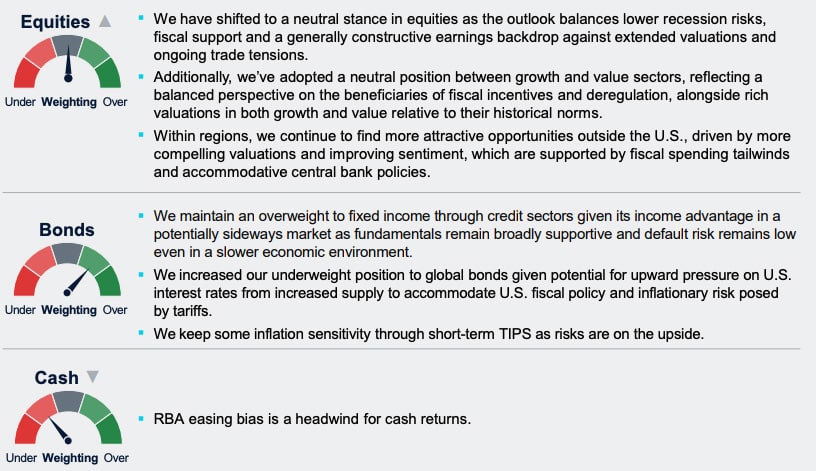

ASSET CLASS POSITIONING

Note: T. Rowe Price’s Australia Investment Committee comprises local and global investment professionals who apply views from the firm’s Global Asset Allocation Committee to make informed asset allocation views from an Australian investor perspective. The Committee is led by Thomas Poullaouec, Head of Multi-Asset Solutions APAC, based in Singapore.

![New High Yield Earlypay Notes Paying BBSW + [6-6.5%] p.a.](https://www.fixedincomenews.com.au/wp-content/uploads/2022/04/Earlypay-100x70.jpg)