AUSIEX is Australia’s leading share trading platform with 30% of the market and is the leading ETF broker. It has 4,400 registered advisers from 1,000 different dealer groups.

Chris Hill, National Manager Strategic Relationships provided these insights gleaned from AUSIEX data about the growing number of millennials investing in fixed income.

Hill stated, “With markets at all-time highs, millennials are looking for an anchor. They are seeking defensive assets and like the stability the asset class offers. Using ETFs to invest is a simple way to get access. Advised millennials were found to be more diversified than retail non advised investors.”

AUSIEX provided these statistics:

- Investments by advised millennials outside of SMSFs, in Australian fixed income exchange traded funds (ETFs) jumped more than 50% over the past year

- Almost 10% of Australian fixed income ETFs holding value is held by advised millennials, compared to just 6% as at the end of July 2024

- Australian fixed income now accounts for 19.4% of all ETF holding value, an increase from 12% asset allocation over the past year

- The proportion of total Australian fixed income ETF holdings accounted for by Baby Boomers and Interwar generations decreased slightly in terms of their ETF asset allocation from July 2024 to Jul 2025. It is the increasing number of millennials moving into fixed income that makes it appear that older Australians are proportionally moving away from it.

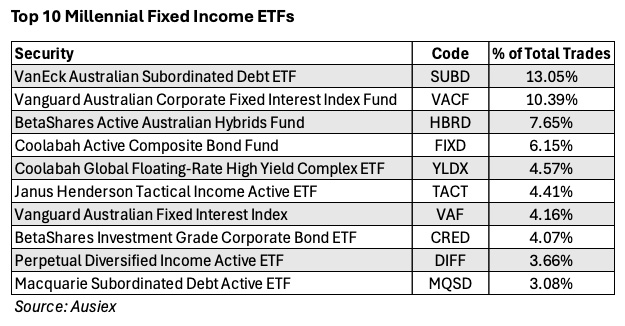

- VanEck’S SUBD is the top traded millennial ETF with 13.05% of total trade, followed by Vanguard’s VACF at 10.39% and Betashares HBRD at 7.65%.

While AUSIEX doesn’t cover the value of investments, Hill stated a study by UBS found that in an affluent and high-net-worth sample, millennials kept about 7% of their portfolio in fixed income, compared with 15% for older investors.

Further, a Morningstar report earlier this year suggested millennials held $104,000.

“Of cash and deposits, Baby Boomers lead with $242,000 followed by Gen X with $176,000, while Millennials and Generation Z hold $104,000 and $26,000 respectively. Baby Boomers’ are gravitating towards liquidity and higher cash holdings which reflect their inclination towards safer investments.”