As inflation risks continue to evolve, especially in the United States, the United Kingdom and most of the emerging markets, followed by the Eurozone, asset manager Amundi has released an investments insights blue paper looking at these trends and how multi-asset portfolios can be resilient in an inflationary regime. This is the executive summary of the paper from Matteo Germano, Head of Multi-Asset, and the Amundi Asset Management team.

Inflation dynamics drive monetary policy and financial market trends and play a key role in portfolio construction. Therefore, the ex-ante identification of a possible shift in the inflationary regime is needed to fine tune multi-asset portfolios. This is crucial in this post-Covid-19 recovery phase, as inflation is making a great come-back and investors are starting to question the sustainability of current market levels amid more persistent inflation. After decades of disinflationary trends, when interest rates stayed subdued due to central banks’ financial repression, globalisation, stagnant wages and China’s role in exporting deflation, the Covid-19 crisis has brought back inflation risks under the radar as the prevailing inflation regime shifts. A fragmented inflation puzzle is materialising, with differences among areas (inflation numbers are robust in the United States, United Kingdom and most of emerging markets, followed by the Eurozone, but are non-existent in Japan and very contained in China).

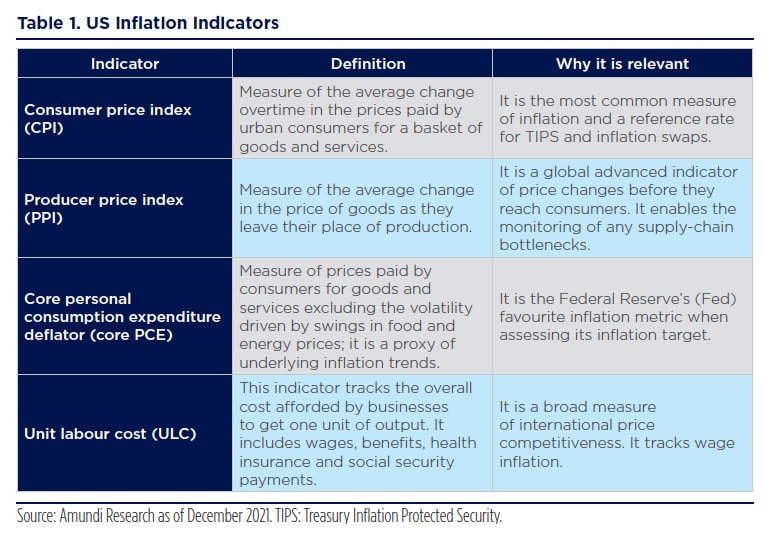

In 2021, we have entered a Hyperinflationary phase, with US CPI and PPI indicators in the 6-10% range on average. US CPI ended last year at 7.0% YoY, its fastest growth pace in almost 40 years. Such a scenario should persist in the first part of 2022, with inflation proving to be structurally higher than its pre-crisis levels. We foresee some normalisation of inflation trends from mid-2022 and, moving into 2023, we should fall back into a Normal inflationary regime (US CPI centred at 2.5%). In this situation, central banks will play a critical role in managing inflation expectations, particularly as we are at an inflection point. Central banks have already acknowledged that inflation is not transitory, but they remain behind the curve. There is a narrow window for action to ensure a smooth return to a normal inflation regime and communication will be key to avoiding major market selloffs. This task comes at a challenging time as markets are also assessing the health and economic impact of the new Omicron virus variant and its implications on inflation (particularly supply bottlenecks).

Against this backdrop, multi-asset investors need to act and rethink their portfolios, making them resilient to higher inflation. Targeting real returns becomes critical in a world of lower expected returns and higher inflation, and investors should be aware of the ‘nominal illusion’. To do this, investors should look at a broad set of asset classes that could prove resilient to inflation and help target real returns. Monitoring the evolution of inflation dynamics with sophisticated analytical tools such as the Amundi Inflation Phazer can help navigate a variety of inflation regimes and their investment implications. The different central banks’ reactions to desynchronised inflation is going to be a source of relative performance in an active asset allocation in 2022.

Also read:

Fixed Income In A Rising Rate World

Aviva Investors Forecasts Global GDP Growth and Inflation for 2022

In an inflationary regime – which we foresee for 2022 – equity markets tend to be less supported than in the Normal inflation regime that has prevailed over the past three decades. They are also less supported than in a Hyperinflationary Recovery, as experienced in 2021. In this environment, equity returns should stay positive, but in the low single digits. Any inflationary pressure arising in a strong growth scenario favours cyclical stocks over defensive ones. As such, investors should tilt their portfolios towards value and quality sectors across equity markets. Stock picking is also an important part of the toolkit in order to search for those companies or business models with stronger pricing power within a coherent fundamental valuation framework. Across the fixed income space, inflation-linked bonds tend to outperform corporate bonds in an inflationary regime, as credit spreads usually widen in inflationary times. As monetary accommodation is withdrawn under an inflationary regime, interest rates tend to head higher and a short duration bias should be favoured.

Withstanding our central inflationary scenario, the risk of remaining in a Hyperinflationary scenario for longer than expected is not negligible. Moreover, the energy transition is an additional element to consider. This could increase inflationary pressures in the current decade as new technology is barely available and the demand for energy-transition linked commodities is rising. Therefore, investors may want to hedge against the risk of a Hyperinflationary Recovery continuing beyond Q2-Q3 2022. In this environment, cyclical commodities have proved the best performing asset class. Building some exposure to commodity currencies may also prove to be beneficial under this scenario, while in a Hyperinflationary Recession gold should be efficient for hedging. In summary, we believe that multi-asset investors have a broad set of tools to deal with stronger inflationary pressures. In 2022, they should focus on well-diversified asset allocation and rotate their portfolios towards those asset classes that can benefit from higher inflation.

The full paper can be accessed here.