Interest rates are incredibly low and there is an enormous amount of cash looking for a home. So much so, that any new bond issues are quickly over bid – more money is being offered to companies than what they want to raise.

Consequently, companies can upsize the offer, decrease the spread (interest offered over and above the benchmark rate) and scale back investors.

Often when new issue bonds begin to trade in the secondary market, bond prices rise and the yield declines. This is a tough market for direct investors.

But, it’s also a great market for active fund managers to demonstrate their capabilities!

Two stand out performances until the end of April 2021 were from domestic fund manager, Coolabah Capital with its Long Short Credit Fund earning a net 11.72% and international global giant Ares, who has just ticked over a year with its relatively new Global Credit Income Fund earning 12.09%.

Who would have thought double-digit fixed income returns were possible in such a low rate environment?

Coolabah Capital Long Short Credit Fund

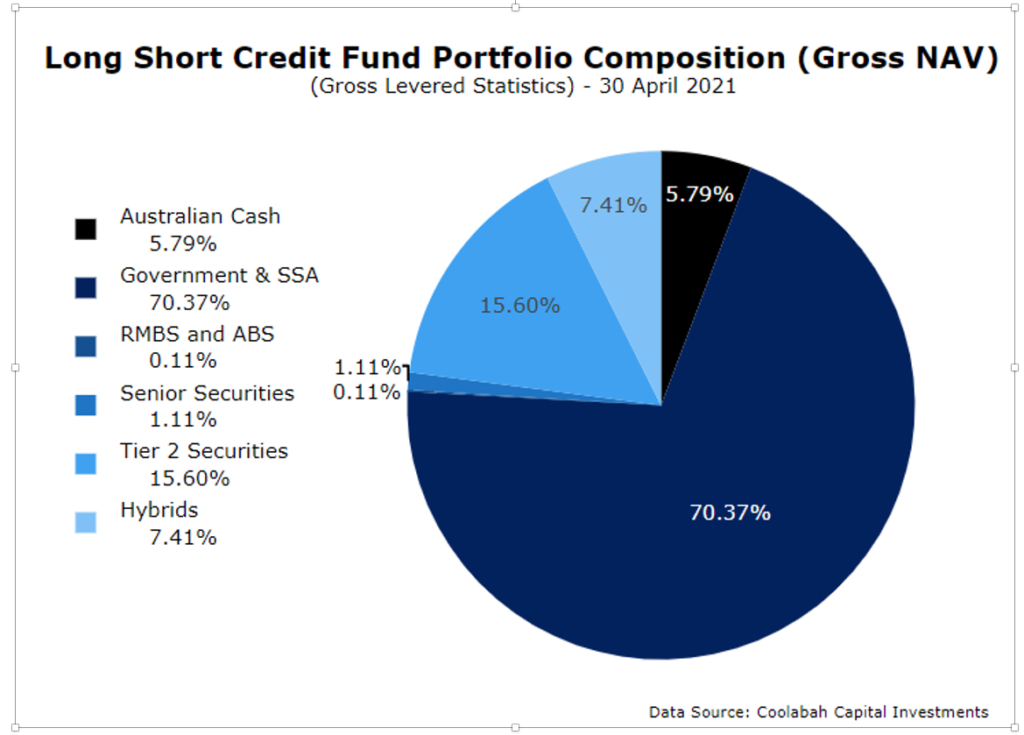

Coolabah’s Long Short Credit Fund essentially invests in cash and highly rated government bonds, that it trades frequently and uses hedges to mitigate many of the risks. The company use 30-40 propriety models to find discrepancies in the prices of the securities.

A video on Coolabah’s website featuring portfolio manager Ying Yi Ann Cheng, claims the company typically trades 70 times a day in securities worth $100 million. That’s a very active fund!

Coolabah’s approach is based on its mathematical models and the model’s assumptions and I would expect the fund to perform better in more volatile markets where there are more discrepancies in prices/ yields.

The company is supported by 13 analysts and five portfolio managers with impressive, global credentials. Chief Investment Officer, Chris Joye, who is a columnist for the Australian Financial review is known for pre-empting market moves – most recently the trajectory of house prices.

The fund is relatively new and it’ll be interesting to watch it in coming years. Its models should improve with more data – every trade will give them better insight into the market. But I expect it’ll be difficult to get 10% plus returns in a low volatility market.

Even though the fund invests in low risk fixed income securities, the hedges it uses are high risk and the funds product disclosure statement, rates risk as five out of seven, with seven being the highest number on the scale. Even though I’ve deemed the fund as a fixed income fund given its investment in government bonds, Coolabah classify it as an “Alternative/ Hedge” fund in its monthly fact sheets.

Key points

- The LSCF targets returns of RBA cash rate plus 4-6%p.a.

- Minimum investment – $1,000, minimum additional investment $1,000. Savings plans available from $100

- See the April 2021 Monthly Fact Sheet for more information

- Invest via the company’s website – https://coolabahcapital.com/

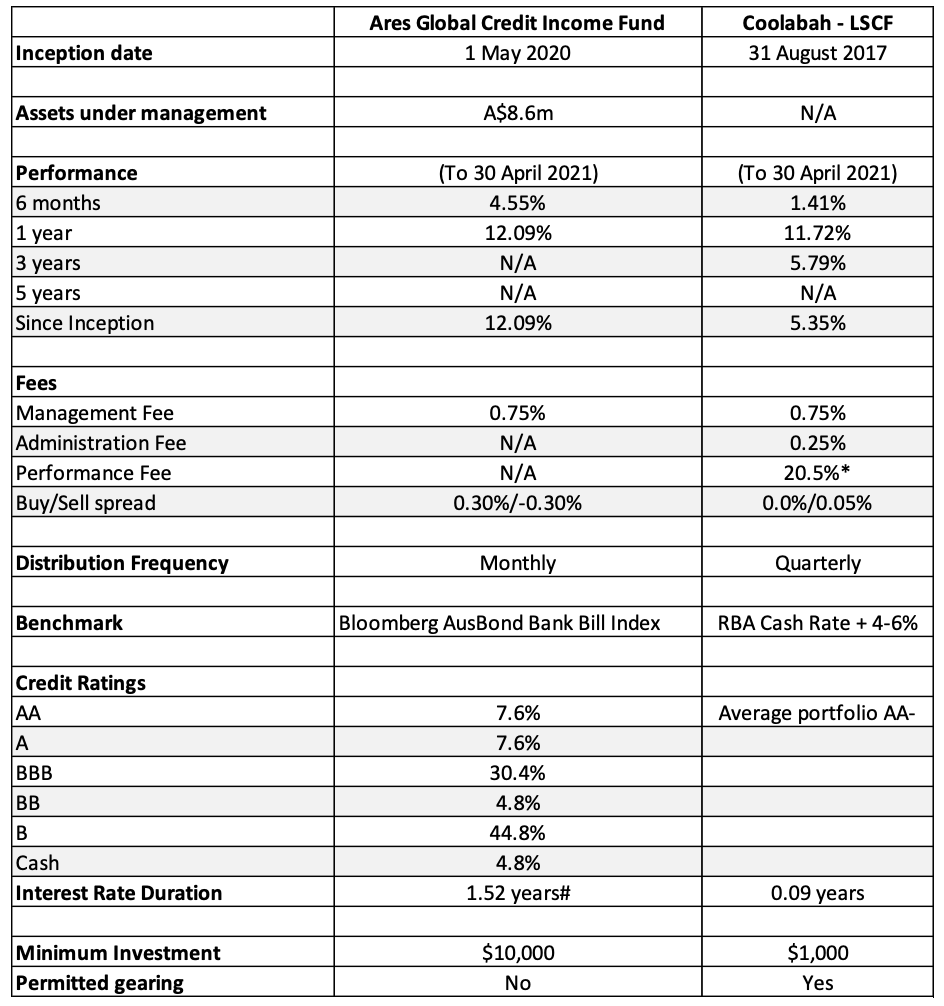

(For more information, see table below comparing the LSCF to the Ares Global Credit Income Fund)

Ares Global Credit Income Fund

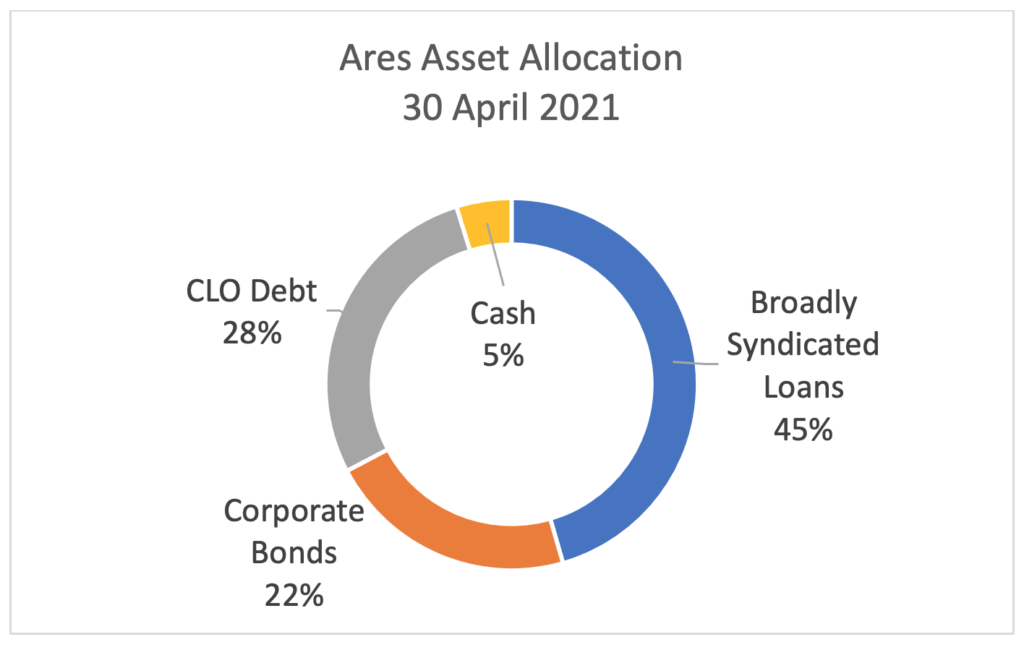

This fund aims to deliver a stable monthly income with a focus on downside protection and capital preservation by investing in a diversified portfolio of credit assets. Investments include syndicated loans, corporate bonds and alternative credit.

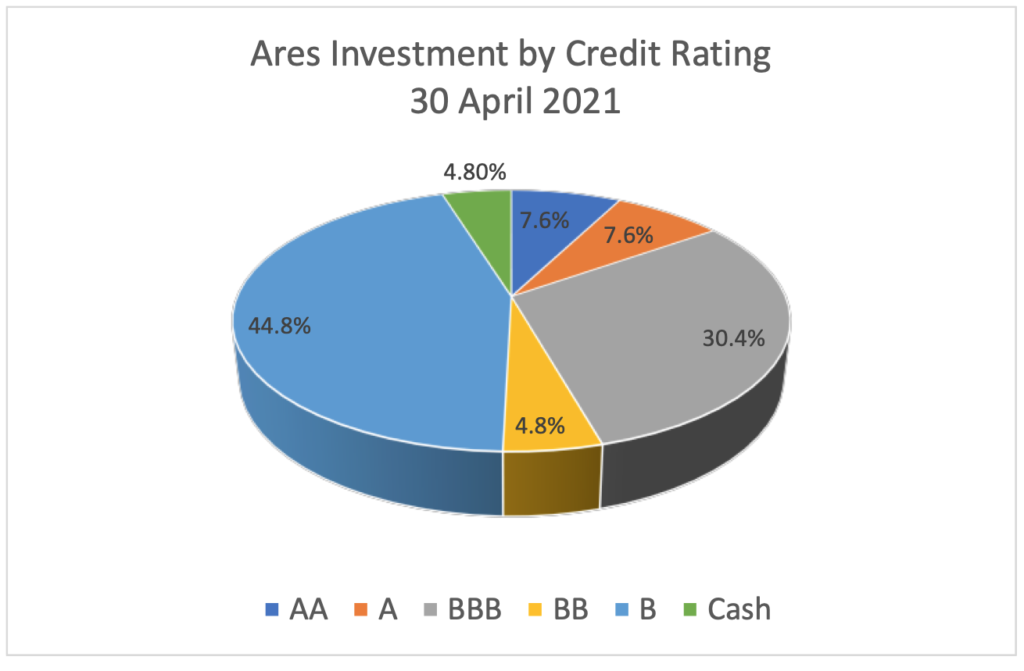

This is a high risk strategy with roughly a 51% allocation to investment grade securities and 49% to sub investment grade (maximum 50% allocation to sub investment grade securities). The bulk of both allocations are at the lower end of the range – 30% in BBB rated and 45% in single B rated investments. Unlike the Coolabah LSCF, the Ares Global Credit Income Fund invests outright in higher yielding fixed income investments, including corporate loans and securitised corporate loans.

If you consider 45% of the portfolio are in the single ‘B’ range, then according to the S&P Global Corporate Average Accumulation Default Rates, for a year is 3.4%, two years 7.9% and three years 11.9%. However there have been no defaults in the fund since inception and Ares prides itself on lower than market average default rates. For example, since December 2009, the average annual default rate on Ares loans was 0.82% versus the Credit Suisse Leveraged Loan Index default rate of 2.63%.

For more on credit ratings see Interpreting Credit Ratings – What Do They Mean For Fixed Income?

The Ares fund has a wide mandate and can invest across geographical locations, asset classes, credit rating bands and industries. As at 30 April 2021, 74% of investments were North American and 22% European.

The high yield compensates investors for default or credit risk, as well as likely illiquidity in stressed markets and various other risks.

Source: Company

Note: CLO – Collateralised Loan Obligations – Definition – A collateralized loan obligation (CLO) is a single security backed by a pool of debt. The process of pooling assets into a marketable security is called securitization. Collateralized loan obligations (CLO) are often backed by corporate loans with low credit ratings or loans taken out by private equity firms to conduct leveraged buyouts.

With a CLO, the investor receives scheduled debt payments from the underlying loans, assuming most of the risk in the event that borrower’s default. In exchange for taking on the default risk, the investor is offered greater diversity and the potential for higher-than-average returns.

Source: Company

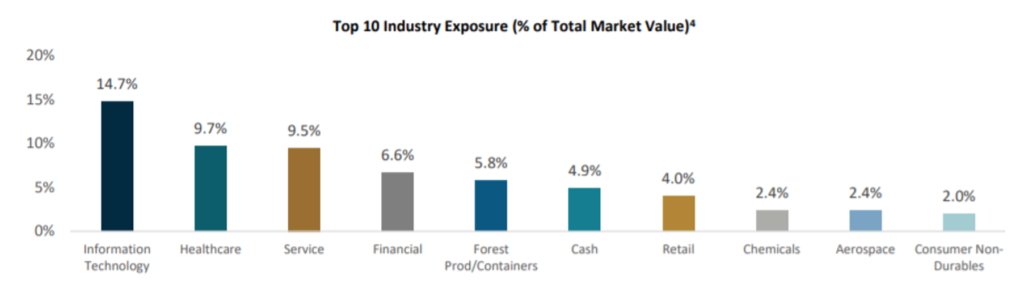

While the fund doesn’t list the names of the companies that it has lent to, it does provide a sector split with top allocations to the Information Technology (14.7%), Healthcare (9.7%) and Service (9.5%) sectors. The most recent fact sheet states the fund lends to 75 debt issuers with a current average spread of 356 basis points (100 basis points = 1%).

Key Points

- The Ares fund aims to exceed AusBond Bank Bill Index over a three-year period

- Minimum investment – $10,000 available to retail and wholesale investors

- The fund is a joint venture with asset manager, Fidante Partners. For more information, see the April 2021 Monthly Fact Sheet

- Invest through Fidante Partners

Compare the two – side by side

Note: * Of any amount in excess of the RBA cash rate plus Management and Administration Fees

# LIBOR floors contribute c.50% to the total effective duration, providing asymmetric exposure

Summary

Both funds are considered high risk but invest in different ways to achieve recent, stand out, high returns.

The Coolabah LSCF’s underlying securities are highly rated government bonds and the portfolio manager trades often, based on its proprietary models finding discrepancies in the market.

In contrast, Ares use its global network to invest in high yield corporate loans. The securities may be tradable but would likely be illiquid in a stressed market. The Ares fund pays monthly interest, a significant benefit for income seeking investors.

Note: The funds mentioned in this article are not recommendations. Please do your own research and discuss with your financial adviser before investing.