When it comes to setting interest rates, there is this saying, take the lift up but the escalator down. Rising inflation needs to be curbed quickly as it is so damaging, and one of the best ways to try and slow it is to raise interest rates fast. But once rates have peaked, it’s a slow journey down, step by step, as central banks do not want to overshoot and stimulate the economy and send interest rates sky-high once again.

However, curbing inflation is not a straight-line process.

So, it was not surprising to see the RBA leave the cash rate on hold at 3.60%, nor comment that they don’t foresee a rate cut in 2026, and rate rises are possible. Energy prices including oil, gas and electricity, impact everyone and feed into inflation. The government’s decision to remove electricity subsidies will impact household budgets and together with increasing housing costs, may keep inflation higher for longer.

Adam Bowe from PIMCO thinks it’s premature to conclude the easing cycle is over.

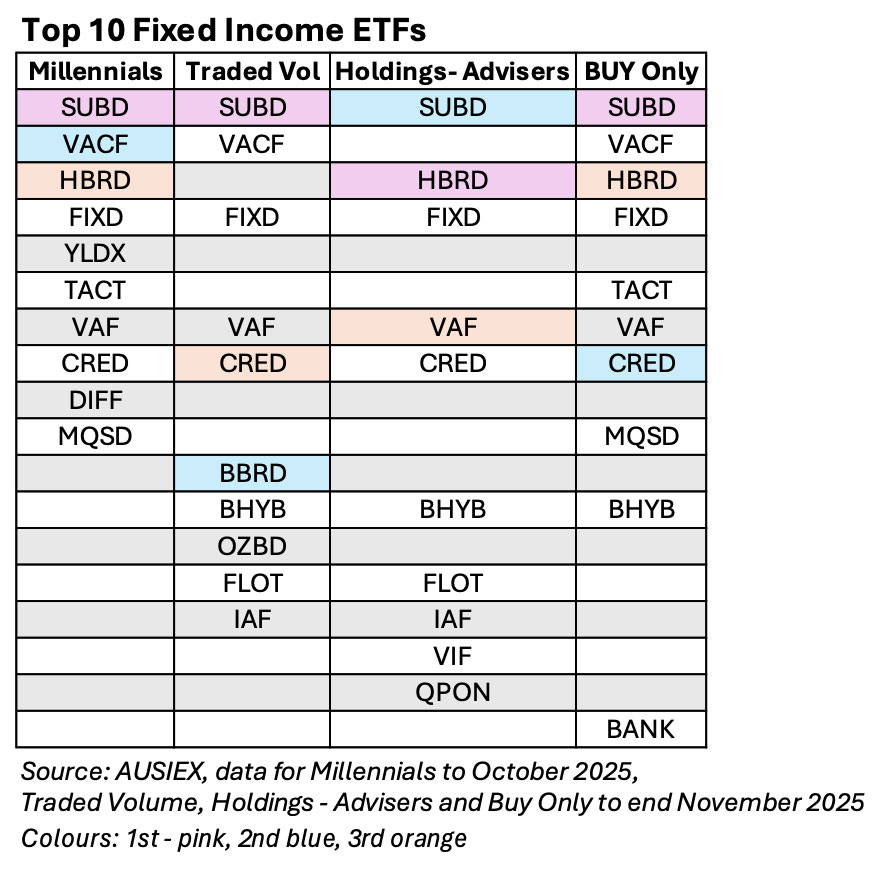

I’ve been writing a column for Intelligent Investor for many years and recently took the Top Ten Millennial Fixed Income ETFs theme further. AUSIEX also provided the top 10 trades by Traded Volume, Adviser Holdings and BUY Only, which I’ve plotted in the table below. The top ETF for each of the four groups is highlighted in pink, second in blue and third in orange.

VanEck has launched a new ETF, the Australian Fixed Rate Subordinated Debt ETF (ASX:FUSB). We will add to our Finder early next year.

Our lead article is from Michael Goosay at Principal Asset Management explaining portfolio positioning and his view on credit spreads and duration. The article has an excellent table showing the sub sector range of credit spreads, the average, and current spreads.

I’ve followed Brian Carney from Mawer for some time. He’s a commentator that resonates with me. So, I wanted to share his latest thoughts with you. There have been some big AI bond issues this year, with plenty more to come, worth an estimated US$4 trillion. They’re going to influence the market in a big way, so this article is well worth a read.

Private credit continues to polarise investors. Most loving the high yields, but others are a little more cautious, especially after a few notable local collapses. Paul Miron from Msquared Capital shares his views on the benefits and the risks.

Structured finance markets continue to go from strength to strength, and credit rating agency, Moody’s assesses the outlook for the domestic market.

Finally, just in case you missed it, here’s the link to our latest podcast with Clive Maguchu from State Street Investment Management.

In Australian corporate bond issue news:

- Ausgrid raised $750m in a five and 10-year senior secured deal. The order book was in excess of $1.94 billion.

- A $250m five-year fixed-rate bond priced at 110 basis points over semi quarterly swap

- A $500m 10-year at 140 basis points over semi quarterly swap

- Dexus Finance raised $500m in a dual tranche subordinated deal:

- $250m in a floating rate 30NC5.25 tranche priced at 3-month BBSW plus 175 basis points

- $250m in a fixed-to-floating rate 30NC8.25 tranche with a 6.3% coupon

- NatWest Markets raised $1 billion in a 3.5-year senior unsecured operating company deal, in two tranches:

- A $450 m fixed with a 5.026% coupon

- A $550m floating rate note at 97 basis points over semi quarterly swap.

Have a great week!