From Mike Della Vedova, Michael Connolly, and Samy Muaddi, T. Rowe Price

Key Insights

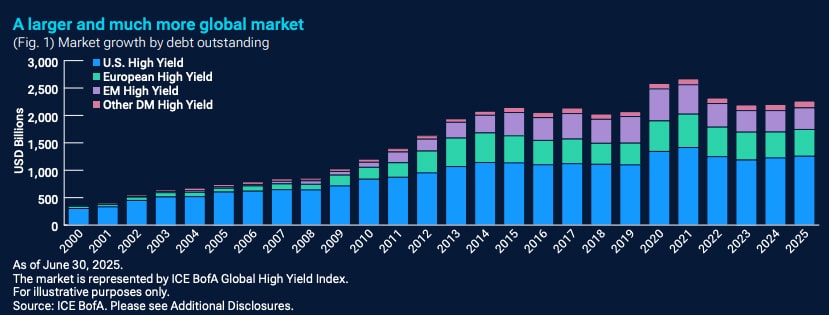

— The high yield market is more global and varied than ever before, creating potential opportunities for diversification, which is especially important for investors in today’s markets.

— With improved credit quality, we believe the asset class is more resilient and better equipped to navigate more uncertain and volatile markets.

— Allocating to global high yield offers investors a potential source of attractive risk‑adjusted income and total return.

Against a backdrop of global trade tensions, U.S. policy uncertainty, and geopolitical risks, investors are seeking diversification.1 With a global high yield approach, there’s potential to find a wide range of opportunities across different countries, sectors, and issuers.

The market has undergone a meaningful transformation since the global financial crisis (GFC). We believe the days of double‑digit defaults are over—the asset class is now larger, more robust, and more diverse than ever before. In this article, we highlight how the global high yield market has evolved to feature a more attractive opportunity set that can provide investors with a source of quality risk‑adjusted income potential.

A larger more global and diverse opportunity set

The global high yield bond market is about six times larger than it was in 2000, and the investable universe has become much more global and diverse over the last two decades. At the end of 2000, U.S. issuers made up over 80% of the market. As of June 30, 2025, this had dropped to less than 60%, with European issuers accounting for 22% of the broad market and emerging market issuers at around 17%.2

This expansion has led to a more diverse opportunity set within the asset class, encompassing various industries, economic cycles, and legal regimes. It’s an area ripe for active investing. Two current economic scenarios highlight the opportunity. Stimulus in Germany aimed at defense and infrastructure and broader increase in fiscal expenditures and investments in Europe should provide a meaningful boost for European economic growth in the future. Similarly, emerging market corporates offer a gateway to a variety of markets and regions that have had faster growth, diverse sectors, and issuers that have often possessed better credit fundamentals than their developed market counterparts. Conducting bottom‑up research is vital to uncover the industries and companies capable of navigating these changes as they take hold.

“…the investable universe has become much more global and diverse over the last two decades. – Michael Connelly, Portfolio Manager

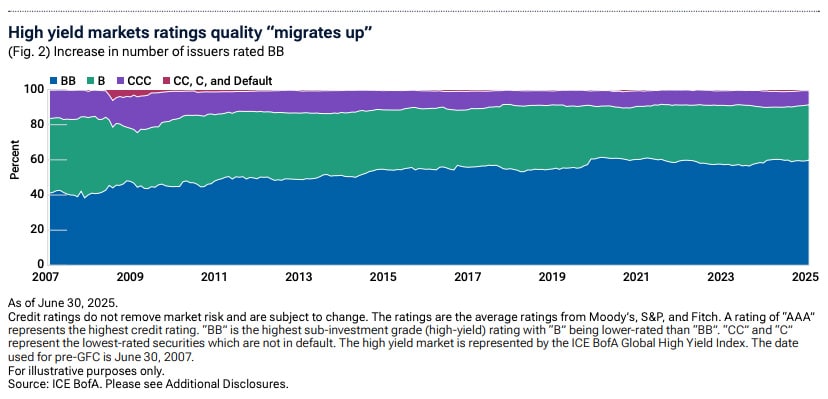

Evolution to a higher credit quality market

The current high yield market is barely recognizable from the pre‑GFC days. Using the the ICE BofA Global High Yield Index as a proxy, the high yield market has shifted upward considerably in credit quality. At the end of June 2007, only 41% of the index was rated BB—the highest sub‑investment‑grade rating— today, that figure is around 60% (Fig. 2). This improvement in credit quality is also evident at the other end of the credit spectrum. CCC rated issuers fell from an average of 15.7% of the index in 2007 to just 7.9% at the end of June 2025.

Also read: Don’t Reach for Yield – Protect Capital

In addition to improved credit quality, high yield companies overall are larger and generate higher earnings on average than prior to the GFC. This provides them with greater financial flexibility. The rise in secured bond issuance is another positive. It suggests higher recovery rates3 because investors can claim on specific assets or collateral. Taking all these factors together, the asset class is in a position of strength to navigate more uncertain and volatile markets.

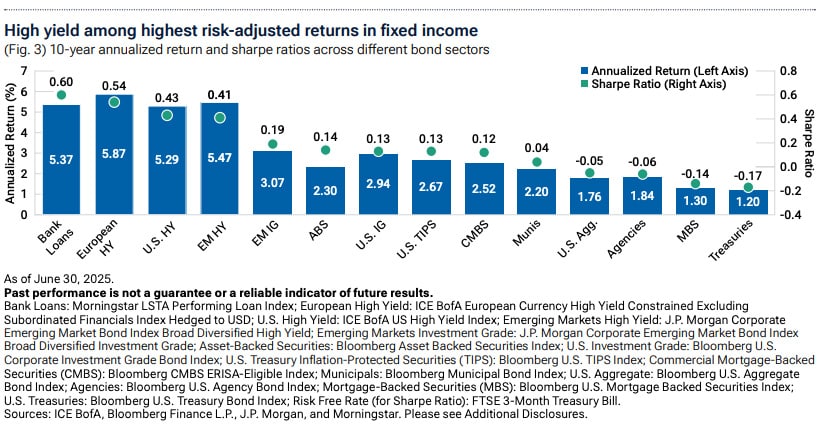

Leading risk‑adjusted returns

Another important benefit we have observed over the last decade is the attractive risk‑adjusted returns4 global high yield markets achieved. While absolute expected return is certainly a vital consideration when evaluating an asset class, volatility is also important. The Sharpe ratio, which measures return in excess of the risk‑free rate per unit of standard deviation, is a useful metric to compare risk‑adjusted returns across different sectors. Over the last 10 years, the three components of the global high yield market—the U.S., Europe, and emerging markets—have generated leading risk‑adjusted returns in the fixed income space as shown in Figure 3.

For investors, this means that incorporating global high yield bonds into the mix with other fixed income investments in a portfolio has the potential to enhance the overall Sharpe ratio. A comparison with equity also tells a compelling story. At current yield levels, the return potential of the U.S. high yield market is close to historical U.S. equity market returns but with a fraction of the volatility. This makes high yield an attractive diversifier of an equity allocation, in our view.

“the asset class is in a position of strength to navigate more uncertain and volatile markets.

– Samy Muaddi, Portfolio Manager and Head of Emerging Markets

Market realities

At present, some investors are apprehensive about investing in this space, especially given tight credit spreads5 and uncertainties around the impacts of tariffs on economic growth; inflation; and, ultimately, corporate balance sheets. Although the default environment is currently low, the recent rise in liability management exercises6 underscores the importance of fundamental research and the careful scrutiny of legal documentation. (T. Rowe Price. October 2024—Looking under the hood at the rise of liability management exercises.)

A high yield allocation should be considered strategic and long‑term rather than tactical, making it important to adopt a longer‑term perspective. With stimulus expected in three of the world’s largest economies—the U.S., Germany, and China—global growth should get a boost over the longer‑term horizon as such measures take time to have an effect. Ultimately, we believe this will be supportive for high yield.

“A high yield allocation should be considered strategic and long‑term rather than tactical, making it important to adopt a longer‑term perspective.

– Mike Della Vedova, Portfolio Manager

Conclusion

The case to consider allocating to global high yield is compelling, in our view, especially at a time of heightened U.S. policy uncertainty. With a global lens, the investment universe is large, and there’s potential to benefit from exposure to divergent economic and credit cycles. The market is much improved in terms of credit quality and now stands more robust. High coupons should provide investors with consistent and meaningful income. This helps to dampen price volatility, delivering attractive risk‑adjusted returns over time. Although credit spreads are back to tight levels, all‑in yields remain attractive. And with current geopolitical crosscurrents, an active approach that prioritizes bottom‑up research and rigorous risk management at individual position and overall portfolio levels is essential.

1. Diversification cannot assure a profit or protect against loss in a declining market.

2. Source: ICE BofA. Please see Additional Disclosures.

3. Recovery rates are the percentage amount that an investor recovers of their principle in the event of a default.

4. Past performance is not a guarantee or a reliable indicator of future results.

5. Credit spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing spreads indicate improving creditworthiness.

6. Liability management exercises are transactions that can involve exchanging existing debt for new bonds or loans, raising additional capital, or shifting assets. The goal is to gain time to improve the company’s finances and avoid expensive bankruptcy proceedings.