By Ken Hanton, Independent Fixed Income Specialist

This year, as is always the case, there will be many moving parts that will determine the final outcome, for the Australian securitisation market, but after two very strong years, there’s no reason to expect there will be a material pull-back. But if there is going to be a pull-back, I’d expect it would be driven more by factors affecting global fixed income markets (impacting offshore demand) than domestically generated ones.

My expectation is that non-ADI residential mortgage backed securities (RMBS) and asset backed security (ABS) issuance should again be strong in 2026 ($56bn issued in 2024 and $62bn in 2025), my starting point is that total public issuance has a good chance of falling somewhere in the $75bn – $80bn range.

While a lot of markets look to be fully priced, and a global pull-back will happen at some point, such an environment could mean that issuance comes out below the lower end of this range and the spread differential between AAA and BBB rated notes might widen as well. Alternatively, a stronger year for bank issuance where RMBS issuance approaches somewhere in the region of ~$20bn, while not my expectation, would likely mean conditions remain very supportive for non-ADI issuance and total public market issuance could easily go past the $80bn mark. Either way, I’d expect the Australian market is going to remain a globally relevant securitisation market in 2026.

2025 Securitisation Review

Following on from a record 2024, 2025 turned out to be another very strong year for the Australian securitisation market.

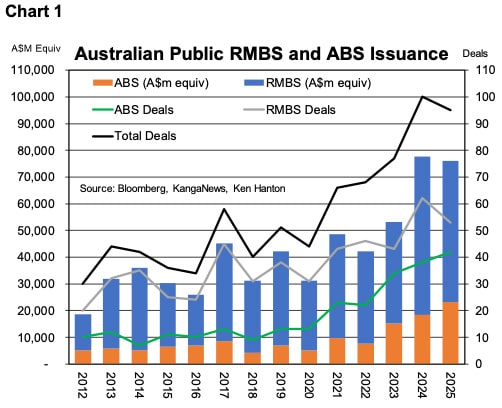

There were 95 RMBS and ABS deals priced in the Australian public market totalling an AUD equivalent of $76bn excluding refinance notes, only marginally lower than 2024’s all-time record of $77.6bn from 100 deals. At the halfway mark for 2025, it was looking like the full-year number might be something closer to $60bn, but after a highly productive 3Q25 ($20.2bn of RMBS and ABS issued compared with $14.8bn in 3Q24), I was thinking that issuance might fall somewhere between $65bn-$70bn. RMBS and ABS issuance in the 4Q25 was $25.2bn (4Q24: $19.4bn) meaning public RMBS and ABS issuance in the 2H25 was $45.5bn, which was $11.3bn higher than 2H24 (thanks to higher ABS issuance) and highest level of issuance in a half ever, (surpassing the $43.5bn issued in 1H24).

By collateral type there were 53 public RMBS deals in 2025 for total AUD equivalent issuance of $52.9bn versus 62 deals for $59.2 bn in FY24. And going from strength to strength, there were 42 public ABS deals in 2025 for $23.1bn versus 38 deals for $18.5bn, which is comfortably a new all-time record for the market.

Authorised Deposit taking Institution (ADI) RMBS issuance was lower than expected at $14.1bn ($22.4bn), whilst non-ADI issuance was once again exceptionally strong with 41 deals totalling an AUD equivalent of $38.9bn versus 43 deals for $36.7bn. There were 18 non-ADI prime RMBS deals in 2025 totalling $18.7bn compared to 19 deals for $18.3bn and 23 non-conforming RMBS deals totalling $20.2bn versus $18.4bn.

As mentioned above, issuance of ABS reached new highs in 2025. Adding increased diversification to Australia’s securitisation market, the Auto, Consumer and small to medium enterprises (SME) and commercial backed mortgage security (CMBS) sub-segments also made new issuance records in 2025.

The depth and strength of investor demand (domestic and offshore) stood out as key contributor to the level of issuance in 2025.

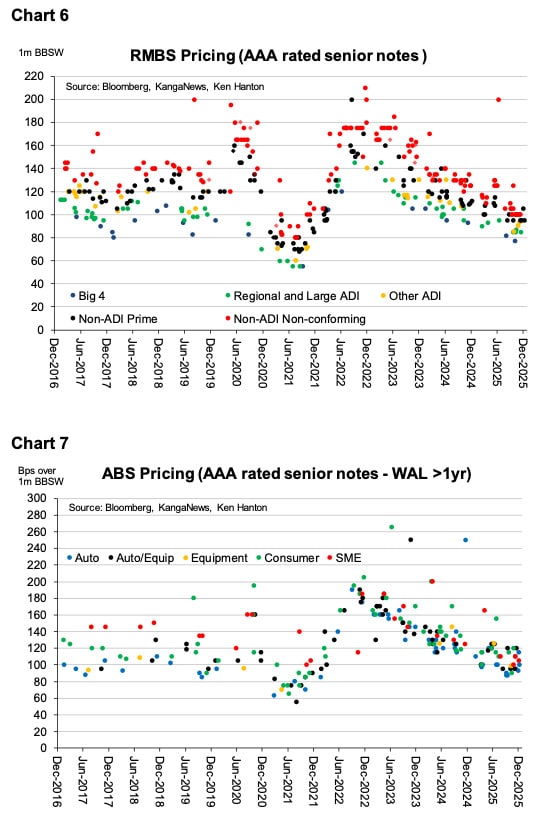

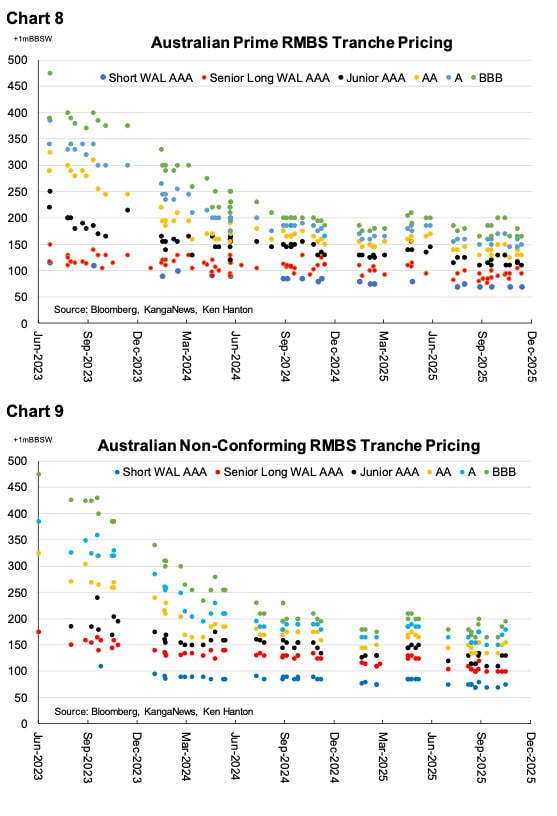

Demand also meant that spreads tightened throughout the year. Senior AAA rated prime RMBS spreads (in the public primary market) ended 2025 around 15bps tighter than where they started the year, whilst non-conforming spreads ended the year around 25bps tighter. ABS spreads on the other hand performed even a little better, ending 2025 around 25bps-30bps tighter depending on the issuer and collateral type.

In 2024, there was a massive compression in the spread differential between senior AAA rated notes and junior BBB rated notes (mainly driven by the strength of investor demand for junior AA, A and BBB rated notes). At the start of 2025, I thought this spread compression might have been overdone and there was a good chance it could reverse. However, as the year progressed and the strength of investor demand for lower rated notes remained unabated, the spread differential between AAA rated notes and BBB rated notes, were little changed, in fact slightly tighter if anything.