Thomas Poullaouec, Head of Multi-Asset Solutions APAC at T. Rowe Price, and his team have published their latest insights on global asset allocation and the investment environment for Australia. May 2025.

OUTLOOK

We remain cautious on risk assets as trajectory of global growth and inflation face potential challenges from disruptive trade policies.

U.S. growth expectations continuing to slow as negative sentiment surrounding tariff impacts weighs. Despite tariff threats on growth, Europe and China policy support could provide an offset. Australian economy continues to be resilient with further fiscal support post elections, policy easing and expected support from China.

Disruptive trade policies could force central banks to make uneasy choices whether to support growth despite threats of higher inflation, which is most pronounced in the U.S.

Key risks to global markets include escalating trade wars’ impact on growth and reaccelerating inflation, central bank missteps, and geopolitical tensions.

THEMES DRIVING POSITIONING

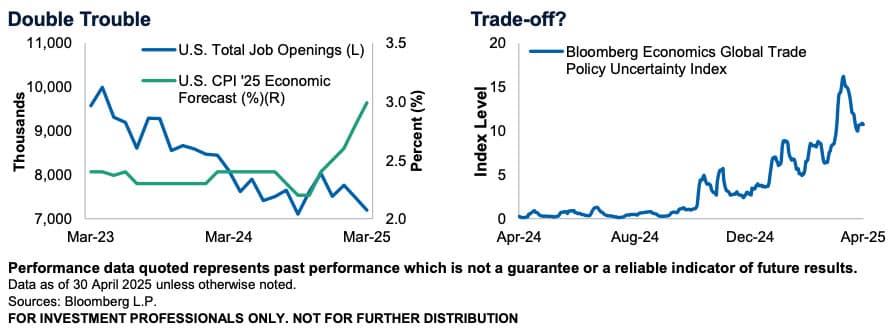

Duelling Mandates

While the Federal Reserve has faced challenges in its dual mandate of maximizing employment and price stability in the past, today’s environment may soon become acutely difficult. After nearly reigning in what they mistook as “transitory” inflation post-COVID, they could now be facing new inflationary pressures from tariff-led trade policies. These same policies, however, could also weigh on economic growth and lead to rising unemployment. Higher prices, lower growth and rising unemployment are an unwelcome confluence for Fed policymakers also facing political pressure to lower rates. For now, the labor market remains intact allowing the Fed to stay on the sideline. This could change quickly, though, and markets are already betting that rate cuts may be coming sooner than later as trade policy weighs on growth. Given the Fed could soon find itself dueling its dual mandates, we’re cautious on risk with a tilt toward inflation-sensitive assets.

Also read: Moody’s Downgrades US Sovereign Rating

Spring Thaw?

What had started with targeted tariffs toward China back in February by the new administration quickly escalated into a global trade war, especially after the April 2nd “Liberation Day” announcement of a baseline 10% tariff and reciprocal tariffs. A week of extreme volatility followed and the administration seemed to relent by announcing a 90-day pause, which was cheered by investors hoping that the extreme tariff measures were just part of a negotiating tactic. Recent headlines suggest that maybe it is working, with many countries seeming to be in negotiations with the U.S. And most notably, it appears that China is open to talks while also exempting some goods from its recently imposed retaliatory tariffs on the U.S. While much uncertainty remains on the impacts to growth and path of the negotiations, there have been some signs of thawing tensions in Washington, D.C. this spring. Against the still uncertain path ahead, we’ve moderated exposure to risk assets.

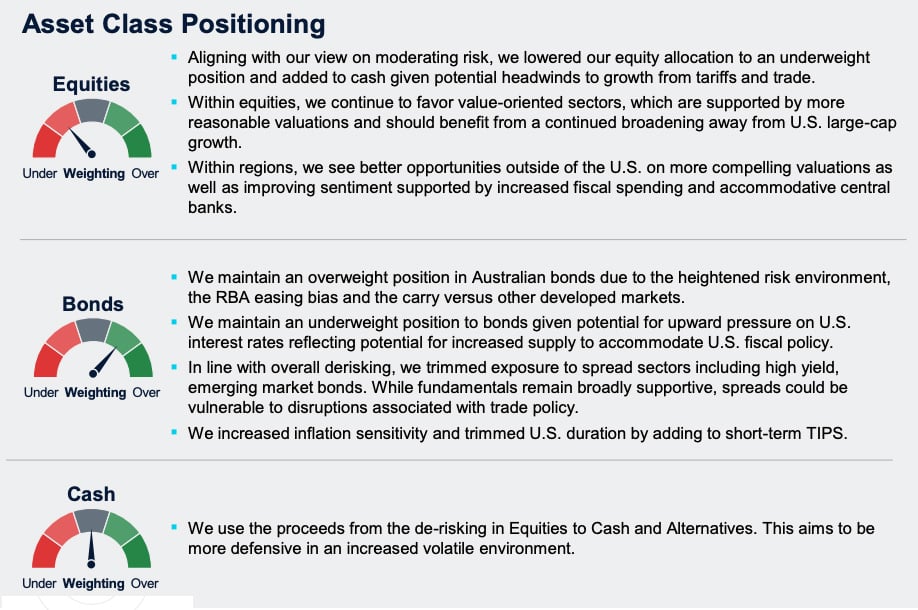

ASSET CLASS POSITIONING

Note: T. Rowe Price’s Australia Investment Committee comprises local and global investment professionals who apply views from the firm’s Global Asset Allocation Committee to make informed asset allocation views from an Australian investor perspective. The Committee is led by Thomas Poullaouec, Head of Multi-Asset Solutions APAC, based in Singapore.