As credit spreads normalised through 2025, yield‑hungry investors have turned to leverage

to maintain 6%+ returns — pushing some parts of the market uncomfortably close to pre‑GFC behaviours. But the rising use of repo‑based leverage and structured enhancements can turn stable IG portfolios into vehicles for equity‑like drawdowns. Investors need to be careful to understand the true risk‑return trade‑off.

In 2025, with credit spreads normalising, and in some segments moving below long-term

averages, a number of yield hungry credit investors responded by adding risk to meet

investment objectives. These additional risks to sustain portfolio yields of 6%+ varied from

increasing credit risk, interest/spread duration and/or leverage.

While mostly still at manageable levels, increased debt funding of credit securities is

nonetheless a throwback to the heady pre-GFC era where synthetic and physical leverage

was more commonplace. Indeed, we are now also hearing of less sustainable practices once again creeping into the credit investment lexicon.

From our discussions in the marketplace towards the tail-end of 2025, the use of leverage is principally occurring through the use of repurchase agreements (repo) of eligible collateral up to an eye watering 15-times for AAA rated securities, as well as via placement of senior secured leverage to enhance portfolio yields in both private and public credit portfolios.

New levered investment products that have recently entered the market offer a floating rate running yield from a portfolio likely comprised of major bank T2 hybrids (T2s) and

investment grade (IG) corporate bonds. Products such as these typically seek to enhance

yield by deploying 3-3.5-times leverage.

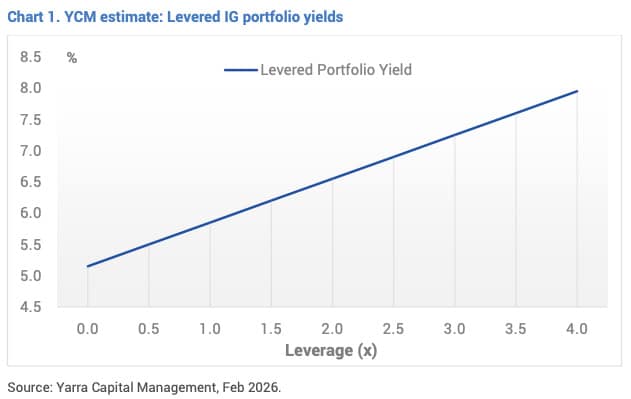

Leverage enhances yields and amplifies performance (both positively and negatively) from

changes in spreads and any impairments/defaults. Working off current pricing, an IG

portfolio yielding ~5.0-5.5% p.a. with ~3-times leverage moves what is an already enhanced yield into a yield in the 7%+ range (refer Chart 1).

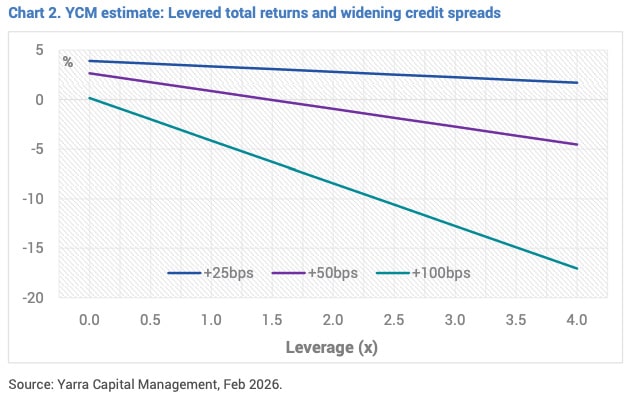

The use of leverage to enhance returns can work very effectively in environments of stable or contracting credit spreads. It is a double-edged sword, however, with the combination of widening credit spreads and leverage usually resulting in significant drawdowns.

For instance, working off an estimated credit spread duration of ~5 years, a widening spread environment would quickly overwhelm underlying yields, with a ~100bp spread expansion on 3-times leverage generating a negative total return in the range of 10-15% from what is an underlying low risk IG credit portfolio (refer Chart 2).

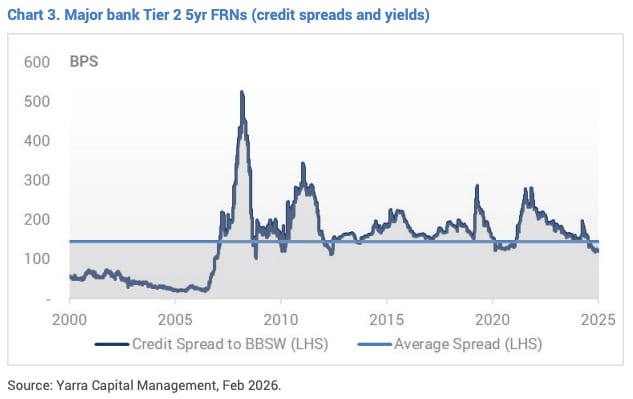

Given fixed income investors generally have a low tolerance for negative returns over a 12- month period, the use of significant leverage to enhance returns could be somewhat of a dubious exercise, especially when you consider today’s starting point. As evidenced by major bank T2s, credit spreads have performed over the last 2-3 years and now sit around their long term averages across most segments of Australian credit and significantly below the previous peak in 2022 (refer Chart 3).

At current spread levels, the probability of a +/-100bp move is weighted to the positive and in the current macroeconomic environment is entirely possible over the near to medium term. In such an event, which can occur two to three times each decade, the prospect of equity like drawdowns from levered credit funds should give credit investors pause for thought.

Put more simply, credit investors in these levered structures should be thinking hard about whether they are comfortable taking what is effectively equity drawdown risk for a miserly 1- 2% in additional yield. We would suggest that this represents incredibly poor compensation for the risk assumed at this point in the cycle.

In contrast to levered credit funds, both the Yarra Enhanced and Higher Income Funds are still providing attractive 6-7% yields with precisely zero leverage. Moreover, while it is true that a 100bps widening in credit spreads would lead to value diminution for both these funds, high unlevered yields combined with active management should protect against negative returns over any 12-month period. We do not believe the same can be said of levered credit funds running a similar mix of underlying credit assets.