Credit markets continued to be characterised by a tug-of-war between attractive all-in yields and historically tight spreads in Q1. But Trump’s tariff announcements have driven spreads wider. Caution and a careful eye on fundamentals are key, according to Ninety One multi asset credit portfolio manager Darpan Harar.

For many months, strong fundamentals have provided a useful underpin to credit markets, but unprecedented demand has been the key driver of spreads compressing – making valuations perilously high in some traditional market segments. While this backdrop continued in Q1, trade tariff-related concerns had already begun to make an impact, with spreads widening across investment-grade and high-yield markets.

Unsurprisingly, the biggest moves in credit markets came post-quarter end, after President Trump’s “Liberation Day” tariff announcements. Following the news, markets have been highly volatile, with credit spreads widening materially across credit asset classes.

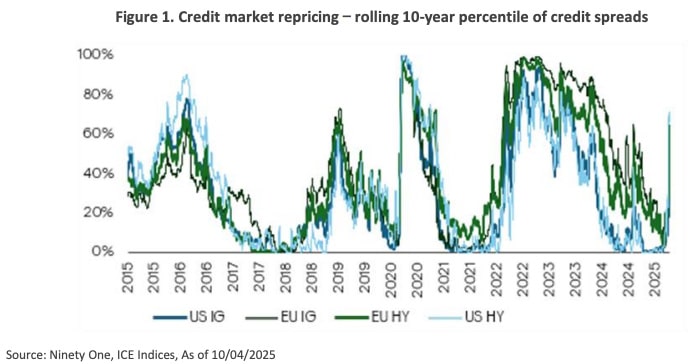

Darpan Harar, multi asset credit portfolio manager says: “Concerns over the global growth outlook and uncertainty around the impact of tariffs have driven a significant repricing across credit markets, with credit spreads in traditional markets, such as US high yield, materially wider than at the start of the year.”

The speed of recent market moves is remarkable. For instance, spreads in the US high-yield market have gone from being historically tight (5th percentile) to a more reasonable level (50th percentile) – Figure 1.

Forecasting the ultimate level of tariffs and quantifying their eventual impact on the global economy remains highly challenging. However, the near-term impact on the outlook for growth is unambiguously weaker, and the likely inflationary impact creates uncertainty over the outlook for monetary policy. Corporates will struggle to make decisions over investment and production in the short term, margin pressure from the tariff pass through is uncertain, and the typical response to this uncertainty is to hire less, produce less and invest less.

Ninety One’s Multi Asset Credit team has responded to this uncertain backdrop by generally favouring more defensive areas and domestically oriented sectors, which are less likely to be impacted by trade tariffs.

Harar explains: “Amid this heightened level of uncertainty, it is vital to focus on issuers’ underlying credit fundamentals and on their ability to withstand volatility. Investors must be selective to ensure they limit their exposure to businesses that are likely to face a material new shock to their operating model.”

More broadly, there is still a healthy degree of dispersion between asset classes, both in terms of valuations and fundamentals. Specialist areas of the credit market continue to stand out. Bank capital (AT1s), for instance, is supported by strong fundamentals and favourable demand/supply dynamics; most banks called their AT1s in Q1 and this theme looks set to continue given the extent to which banks have already pre-financed. Even here, though, selectivity is key.

“Overall, we currently prefer higher-quality components of the investment opportunity set. As risk premia start to rise, we expect new opportunities to begin to emerge over the coming weeks and will be proactive in taking advantage of areas of the market that offer compelling risk-adjusted return potential,” Harar said.