Daintree Capital co-founders Justin Tyler and Mark Mitchell discuss current trends that are impacting and shaping the outlook for investors in fixed income securities.

In particular, they focus on global fixed income markets, central bank policy, portfolio construction, and where they see the best value today.

Q: What’s the biggest shift in the outlook for fixed income?

A: Growth risks remain significant, especially in the US where labour markets, consumption and construction data are softening. At the same time, we look to be at a crossroads where inflation risks are increasing through services pricing and lagged tariff impacts. The next phase for fixed income markets may be growth-led, as central banks curtail easing cycles and sacrifice growth to keep inflation under control.

Q: Will the US Federal Reserve still cut rates?

A: Some level of policy support is likely, but not the aggressive easing previously priced. Labour market weakness, including large payroll revisions and falling job-finding rates, supports targeted easing. Threats to Fed independence should see the short end of the US curve remain bid even if inflation accelerates.

Q: Are tariffs more inflationary or recessionary?

A: Tariff effects are being absorbed by corporates, thanks to strong profit margins. However, the reversal of pre-tariff import front-running suggests weakening export growth, which could lead to a more durable drag on global economic growth.

Q: What about China and why does it matter to Australian income investors?

A: China’s consumer confidence collapsed post property crisis, and export momentum is weakening. If stimulus is introduced, Australian commodity prices and terms of trade would likely benefit, supporting domestic credit and sovereign strength.

Q: Is Australia following a different path to the US?

A: Australia may be in an early-stage upswing. Disposable income and business orders are improving, albeit from low levels. Still, we believe rate cuts are delayed rather than cancelled given our belief in a weaker global backdrop. A long hold phase is likely in Australia before a little more easing in late 2026.

Also read: Expectations for Fed Cut Mount as Funding Concerns Linger

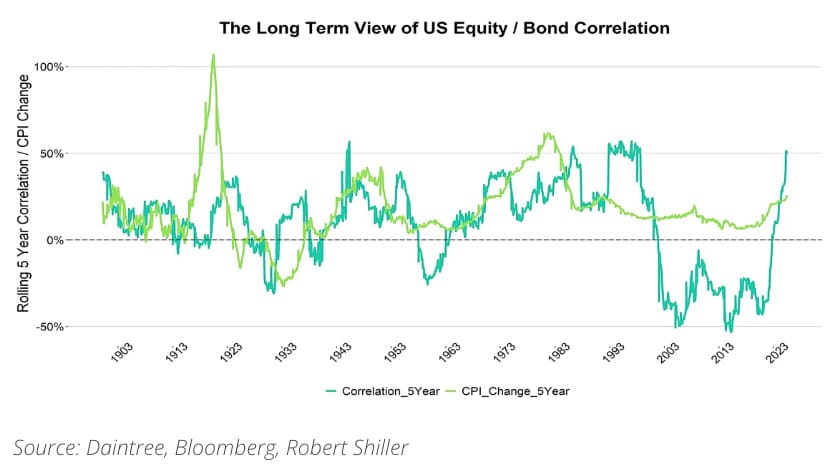

Q: Is duration still a reliable hedge?

A: Not in the current regime. Duration only hedges when inflation is low and stable. Structural forces like the energy transition, reshoring, and higher government debt suggest we are re-entering a positive bond-equity correlation environment, reducing the protective role of duration.

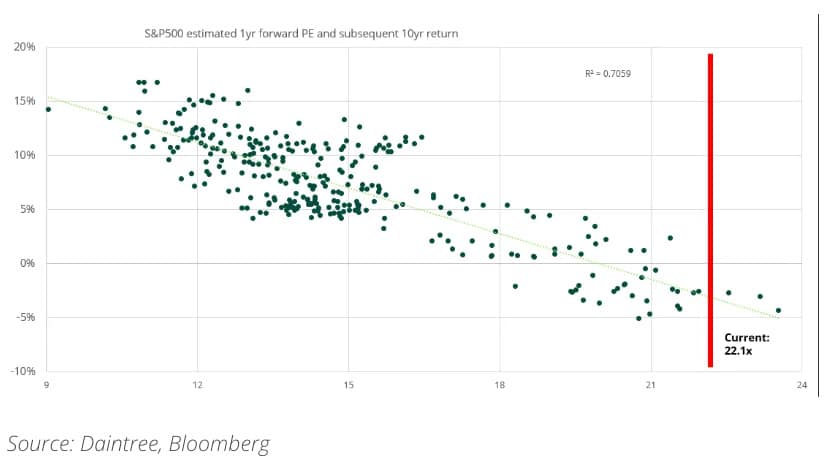

This is particularly problematic in an environment where equity markets are expensive – data on the US market is used as an example below:

Q: Where is the best value in fixed income?

A: The best value is in shorter-dated Australian investment-grade credit. AUD credit offers a 50–100bps pickup over US and Europe for equivalent risk. Structured credit provides additional premium with high collateral quality. Fixed income is allowing investors the opportunity to increase the defensiveness of their portfolios without compromising income.

Q: How are Daintree portfolios currently positioned?

Core Income: Yield ~5.5%, very low duration, A– rating, 30–40% structured credit.

High Income: Yield ~6.5%, low duration, BBB rating, 40–50% structured credit, 30–40% high yield.

Final takeaway:

“Fixed income is doing what it should: protecting capital, generating income, and anchoring portfolios defensively — without the return sacrifice that was a feature of the environment just a few years ago.”