One billion dollars in fixed income ETF inflows helped the ETF industry grow by 5.7% in May, according to the latest Betashares Australian ETF Review.

Very strong inflows, combined with positive market performance, pushed the Australian ETF industry to a new record high of $273.7B in funds under management – a rise of $14.7B or 5.7%.

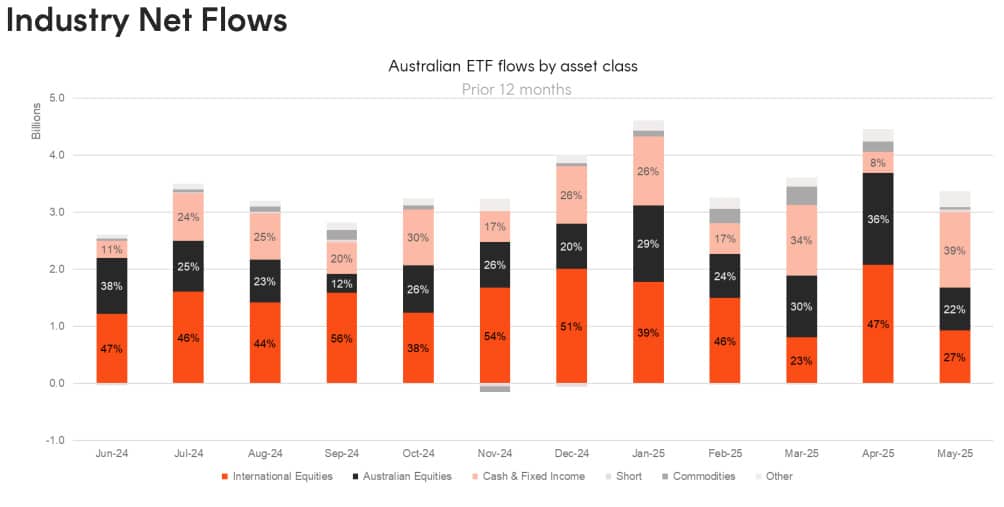

Industry inflows for the month were a strong $3.38B – the eighth consecutive month of flows above the $3B mark.

Betashares said for the last 12 months the Australian ETF industry has grown by 38%, or $75.39B.

The company said there were three new funds launched in May, including Betashares launching a range of fixed income ETFs that deliver predictable monthly income with a defined maturity date.

Betashares will join the move towards the private credit markets with the forthcoming launch of private credit products in the USA, now that the exchange traded fund specialist has hit $50 billion in assets, according to The Australian Financial Review.

Vanguard lead the industry in funds under management with $74.6 billion (27.3%), Betashares $51.4 billion (18.8%), iShares $45.8 billion (16.7%), and VanEck $25.7 billion (9.4%).