BetaShares Australian Investment Grade Corporate Bond ETF (ASX:CRED) is 100% invested in Australian dollar-denominated corporate bonds. The fund’s strategy is to invest in up to 50 bonds that provide superior expected excess returns over Australian government bonds.

BetaShares uses an index designed especially for this fund, called the Solactive Australian Investment Grade Corporate Bond Select TR Index.

Eligible bonds for inclusion must be:

- Senior corporate debt denominated in Australian dollars

- Fixed rate

- Investment grade

- Have amounts outstanding of at least $250m

- Have a term to maturity of between 5.25 and 10.25 years.

Each bond is assigned an equal weight at each rebalance date. No single issue will have an allocation of more than 7% at the rebalance date. Subordinated bonds, inflation-linked bonds, asset-backed securities and convertible bonds are not eligible for inclusion, nor are private placements.

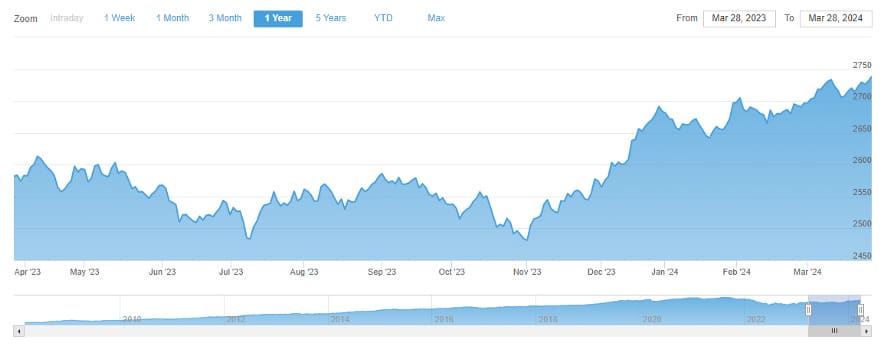

Over the last year, the index has performed well, returning 7.35% to 29 February 2024. CRED has done marginally better, returning 7.40%.

The last index rebalance was back in February and effective 1 March 2024. Four new securities were added and three deleted, all nearing the 5.25-year minimum term to maturity. Coles and Qantas were in both groups, see below.

Comparing the portfolio holdings to the index is interesting. I couldn’t find a complete list of the 50 investments the index uses to compare against CRED’s 58 holdings, more than the stated maximum, which goes against the whole purpose of an index, that it can be replicated. Further and unusually, CRED outperformed its index by 0.05% to 29 February 2024, but underperformed since inception on 31 May 2018 at 2.39% versus 2.70% for the index.

Also read:

BetaShares AAA ETF in the Spotlight

Challenger Sub Debt Review and New NAB Issue

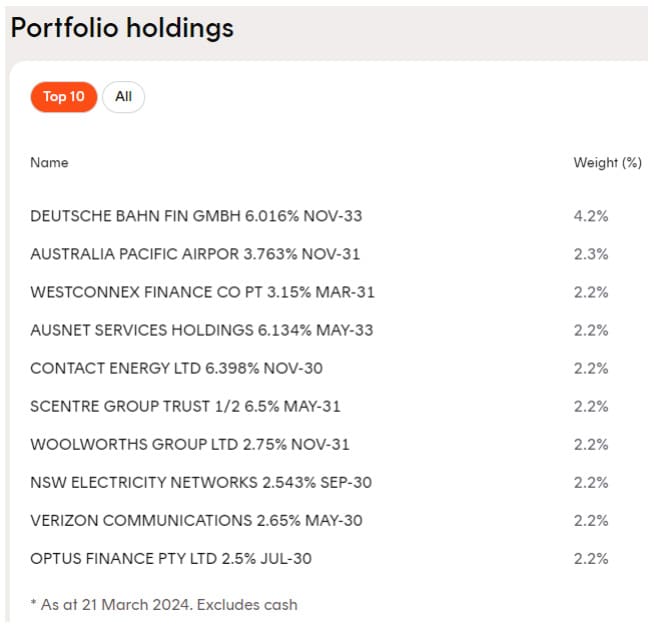

The top 10 securities held is shown below and Deutsche Bahn is the single largest holding at 4.2% of the portfolio. While Deutsche Bahn is domiciled overseas, it’s issued an Australian dollar-denominated bond which qualifies under the ETF framework.

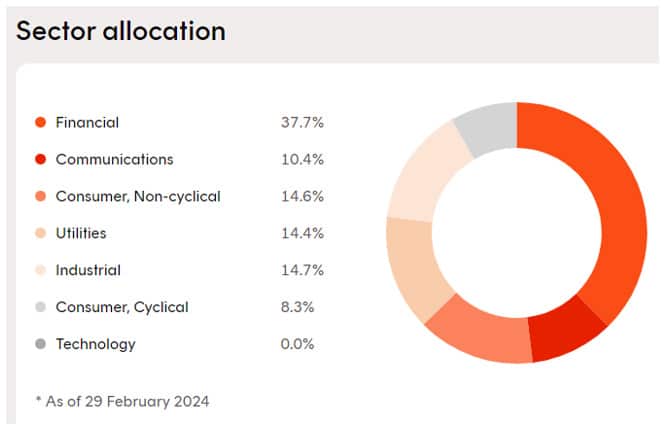

Much like the corporate bond market, the ETF holds a greater allocation to financials at 37.7%, then has four sectors that have over 10% allocations.

There are a couple of important points to understand about CRED:

- The ETF takes significant interest rate risk by holding longer dated fixed rate bonds.

CRED would have performed poorly when interest rates increased over the last few years. Its recent good results can likely be attributed to the market’s belief that interest rates have peaked and for there to be interest rate cuts this year, which isn’t necessarily the case.

Duration, a measure of interest rate risk is 5.79 years.

- Given significant interest rate risk, existing investors should consider switching out of the ETF if they think interest rates are going to rise.

- The portfolio ignores other protective parts of the fixed income market such as floating rate and inflation-linked bonds.

Thus, investors should consider adding other investments to cover rising interest rate scenarios and not invest in CRED alone for fixed income exposure.

- While CRED is protective in a rising interest rate scenario, very long-dated, fixed rate government bonds may outperform CRED in the same scenario. However, the fund does not hold any government bond allocation.

- CRED holds some very high quality bonds and is unlikely to experience any liquidity issues. But, during very stressed markets, even high quality corporate bonds may experience some illiquidity. Without an allocation to government bonds, there is a greater chance of illiquidity, forced selling and unit price falls in severely stressed markets compared to corporate bond funds that also have an allocation to government bonds.

CRED ETF Competitors

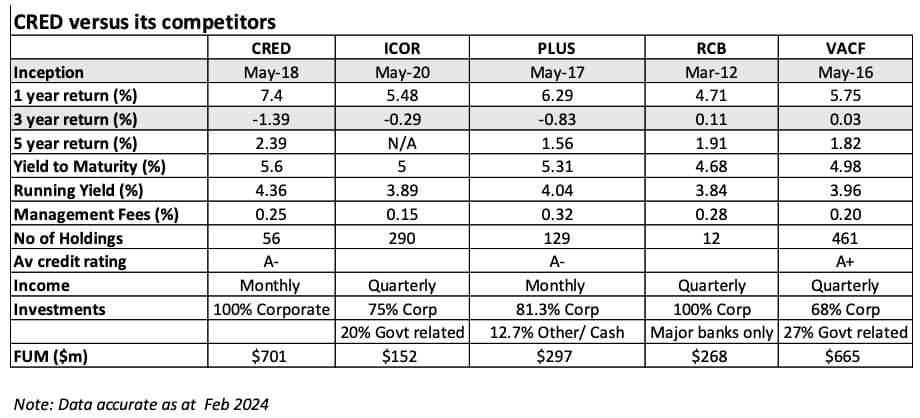

CRED has four investment grade corporate bond ETF competitors:

- iShares Core Corporate Bond ETF (ASX:ICOR)

- VanEck Australian Corporate Bond Plus ETF (ASX:PLUS)

- Russell Investments Australian Select Corporate Bond ETF (ASX:RCB)

- Vanguard Australian Corporate Fixed Interest Index ETF (ASX:VACF)

The closest, competitor to CRED is Russell Investments Australian Select Corporate Bond ETF (ASX:RCB). It has a 100% allocation to investment grade corporate bonds but all holdings are in major bank securities. While not stated in the table above, RCB’s credit rating would be three notches higher at AA-, making its portfolio lower risk but of course more concentrated and for this reason not necessarily a good fit for your portfolio, especially if you are already overweight financials.

Yield to maturity is close to 1% lower as at 29 February 2024. RCB has lower interest rate risk with duration at 2.46 years.

VanEck Australian Corporate Bond Plus ETF (ASX:PLUS) has the same portfolio credit rating as CRED but has two important differences. First it can invest in investment grade securities that have 2 to 10 years until maturity. If a bond drops below investment grade, down to BB-, and has at least 1.25 years unto maturity, it can remain in the index. Bonds with an investment grade credit rating must make up at least 80% of the index. My research doesn’t indicate any allowance for tolerances in CRED’s Solactive index. PLUS’s index is iBoxx AUD Corporates Yield Plus Mid Price Index provided by S&P Dow Jones.

At 29 February 2024, PLUS also had a 36.9% allocation to Banking services, the next highest allocation was to Other/ Cash for 12.7%, likely weighing down the last 12 month return and only two other sectors near 10%, Telecommunications and Electric Utilities. Modified duration was 4.05 years and fees were higher than for CRED at 0.32% versus 0.25%.

PLUS’s large Other/ Cash allocation needs further explanation. Does the fund consistently hold large sums to ensure liquidity or is it just a one off and down to trading activities?

The other two corporate bond ETFs, particularly Vanguard Australian Corporate Fixed Interest Index ETF (ASX:VACF), hold allocations to government bonds, making them lower risk and lower return. VACF is closest to CRED in terms of funds under management. While VACF and RCB have been able to maintain positive returns across the three periods listed in the table above. VACF is by far the most diverse of the ETFs shown, holding in excess of 450 securities. VACF tracks the common Australian corporate bond market index, the Bloomberg AusBond Credit 0+ Yr Index.

Note: Not all corporate bond ETFs are the same. Past performance does not guarantee future returns. None of the ETFs are recommendations, do your own research before you invest.