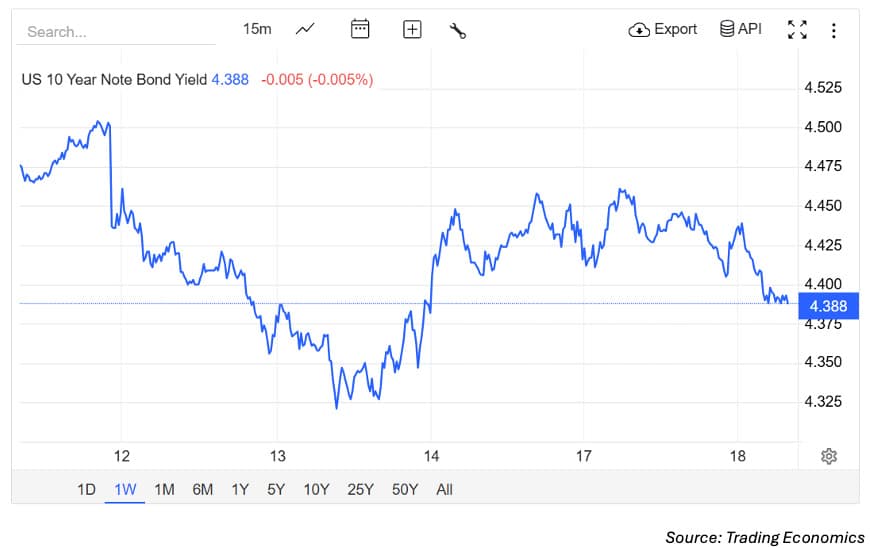

US Treasuries are not performing as the safe haven investment they once were. As war raged on between Israel and Iran, contributing to geopolitical uncertainty, yields barely rallied on the US 10-year. US Treasuries have traditionally been a flight-to-quality asset in uncertain times, but it seems international investors have their doubts. See the one-week chart below showing yields contracted around 20 basis points from circa 4.5% to a low of 4.325% but then recovered to finish 4.388% overnight. Not much to see here!

The US 10-year still remains a global benchmark for many other assets. Yet, spreads on other sub-sector fixed income securities remain tight, equity markets valuations are high. Are we ignoring warning signs of another correction?

Our lead article this week is a paper given by David Jacobs, Head of Domestic Markets, Reserve Bank of Australia to address the Australian Government Fixed Income Forum. Jacobs reviews market development, what the future might hold, and the implications for the RBA’s new framework for implementing monetary policy.

Chris Iggo from AXA IM investigates ‘The FAT trade (Forget About Trump)’ and thinks risk is expensive, acknowledging the equity market is most at risk, but also that credit spreads could rise again.

Popular commentator Benoit Anne from MFS Investment Management walks through how to hedge against rising geopolitical risks.

Fixed Income ETF inflows remain strong according to the latest Betashares ETF report, and Arif Husain from T. Rowe Price discusses the US dollar given his high conviction on US Treasuries.

Have a great week!