Janus Henderson portfolio managers Tim Winstone and Tom Ross recently published a paper about credit rating downgrades during 2020 and the opportunities for companies listed as sub-investment grade to make a comeback. Higher credit ratings and a return to investment grade will likely result in higher bond prices, creating an opportunity for investors.

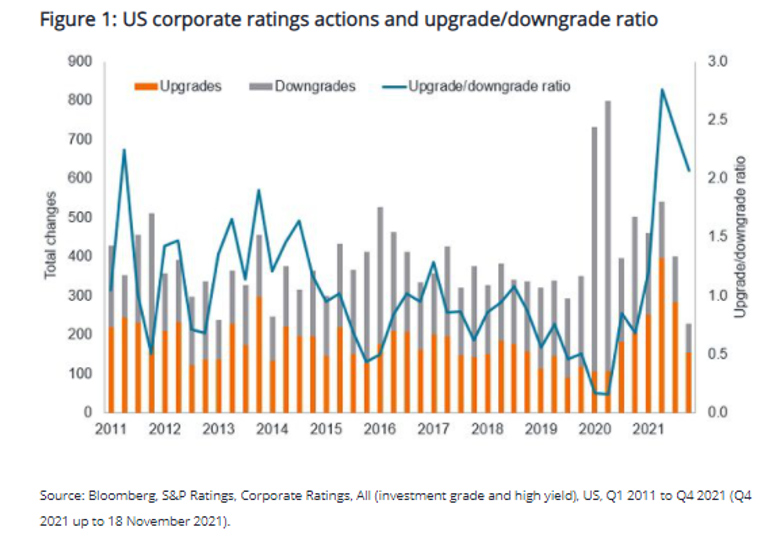

Last year, credit rating downgrades exceeded upgrades by a wide margin. Taking just the US as an example, the upgrade/downgrade ratio plunged to a low for the past decade.

2021 has seen a sharp recovery, with the ratio firmly above 1, signifying an excess of upgrades over downgrades. Helping to drive the advance has been a recovery in cash flow and earnings among companies. Balance sheets have improved as companies have used the low yield environment to refinance at attractive rates.

This positive momentum within credit upgrades has powerful repercussions for the outlook for rising stars. These are issuers who make the move from high yield to investment-grade status. Typically, this involves incremental gains as credit rating agencies gradually raise the credit rating of a bond a notch or two, say from BB- to BB+ and then to BBB- (using the S&P methodology as an example).

Also read: Five ETF Investment Themes To Diversify Your Portfolio

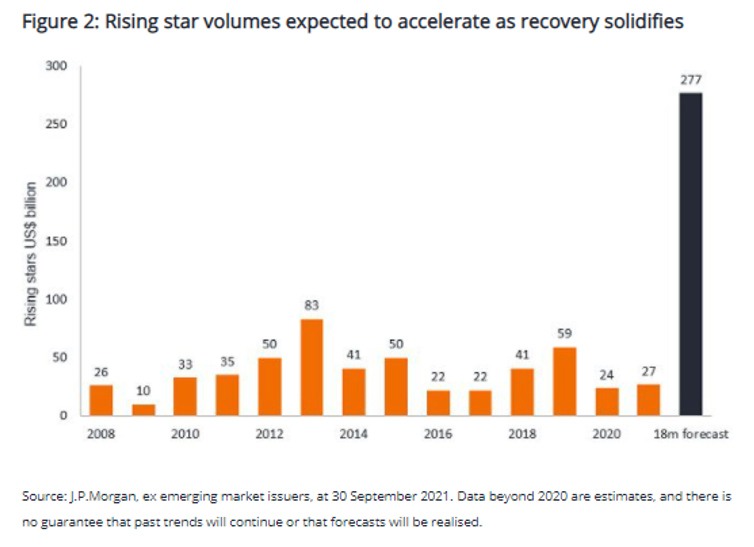

There was such a volume of downgrades in 2020 that this created a pool of companies that sit just below investment grade and are potentially ripe for elevation to investment-grade status. JPMorgan reckons there could be as much as US$277 billion of bonds globally that could make this migration by mid-2023 (absent another economic shock).

Why is this important? Well, there remains a significant cost difference between a high yield rating and an investment-grade rating for bond issuers. For example, the average credit spread on a high yield BB-rated bond is 218 basis points (bps) compared with 115 bps for an investment-grade BBB rated US bond, a spread differential (218 minus 115) of 103 bps. The spread differential is even more stark in Europe where BB-rated bonds trade on average with spreads of 256 bps compared with 114 bps for the BBB cohort#. In fact, the spread ratio (BB spread divided by BBB spread) is relatively high historically, which could be taken to indicate better value in BB-rated bonds compared with BBB-rated bonds.

These spread differentials of 100 basis points or more offer potential opportunities to benefit from spread narrowing as some bonds climb the credit rating ranking. This can offer a win-win situation for both investors (as existing bonds reprice higher from any decline in yield) and the issuing company (as the cost of borrowing declines).

The reasons for upgrades are varied. For example, Fiat Chrysler was upgraded in January 2021 as Fiat Chrysler merged with stronger-rated Peugeot to create Stellantis, as well as on expectations the auto industry would rebound from the COVID-19 downturn. JBS, the Brazilian meatpacker, was upgraded in November 2021 because of strong demand for protein from a recovering US economy and its positive free cash flow generation.

Creative Disruption

For some companies, the disruption caused by COVID-19 and the associated lockdowns was not all bad news. This is because it caused a realignment of consumer habits. One of the major beneficiaries was Netflix, the content streaming company, which saw a massive jump in subscriber numbers as households – deprived of external entertainment – flocked to its streaming service. As a result, S&P moved to upgrade Netflix to investment grade in October 2021, citing Netflix’s improving margins and positive cash flow expectations.

Identifying potential candidates for upgrade can therefore prove profitable for investors and it is one of the reasons why the crossover space between investment grade and high yield remains, in our view, one of the most compelling areas for seeking returns within fixed income.

Click here for the full version of the paper.

#Source: Bloomberg, ICE BofA BBB US Corporate Index, ICE BofA BB US High Yield Index, ICE BofA BBB Euro Corporate Index, ICE BofA BB Euro High Yield Index, Govt OAS, 18 November 2021. Basis point equals 1/100th of a percentage point. 1bps = 0.01%, 100 bps = 1%.