By Richard Quin, CIO and Principal, Bentham Asset Management

October 2022

Fund structure plays an important part in the performance of credit funds. A well-structured fund supports pricing transparency, liquidity and fairness for unitholders.

More than a decade ago, as the GFC was unfolding, we published a short paper on this topic, titled: “Credit Portfolios, Valuations and Liquidity in 2008”, outlining the structural features we would expect to see incorporated in an open-ended credit investment fund.

Significant moves in credit and rates in 2022, prompted us to update and expand the original paper.

Introduction

We have observed a number of structural differences between a range of credit funds available in Australia, leading to some interesting observations that investors need to be aware of.

In our view, a well-constructed open-ended credit fund which is reflective of the fundamental principles of credit portfolio management theory should:

- Have Mark to Market pricing to protect existing unit holders from inflow and outflows that could potentially otherwise arbitrage the fund.

- Have a high level of diversity by issuer and industry (and, where applicable, vintage) to minimise portfolio volatility.

- Limit non-rated debt that has less marketability or liquidity.

- Have low issuer concentration to lower the loss given default. Many investors are unaware of the liquidity risk of investing in funds that take large “cornerstone” positions in unrated debt. In Australia, it tends to follow that these funds are also relatively undiversified by issuer or industry.

- Have considerably more diversity than an equity portfolio.

- Invest in senior and secure investments that decrease the loss given default.

- Invest in large markets where the broad mix of investor participants aid liquidity, visibility and marketability.

- Pass all investment-related economic benefits to the fund’s investors (not the Manager), to avoid perverse incentives. This includes interest & principal payments, origination and other fees, and discounts.

- Have a fair buy / sell spread to reflect investment / redemption costs in the fund, to protect against arbitrage.

When credit portfolios are constructed contrary to the principles of credit portfolio management theory, we believe that investors are exposed to risks for which they are not generally compensated. There are many lessons to be learned from historical examples of funds that have failed investors through poor credit portfolio construction.

- Mark to Market versus Accrual Based valuations

The valuation policy (or “marking policy”) of credit funds can vary. Many funds Mark to Market (“MTM”) their portfolio holdings, but some use the Accrual Based (AB) method (or “Historical Cost Accounting”). It can be misleading to compare funds that use different methods.

Not surprisingly, in a weaker market where credit investments sell off, those managers that have Accrual Based valuation method appear to produce the strongest returns. If these Accrual Based funds were to be re-valued to the then-current market prices there could be a significant correction to their performance.

Hence performance comparisons can provide poor information for selecting a manager if investors unknowingly select the manager with “good” performance that is not marked to market.

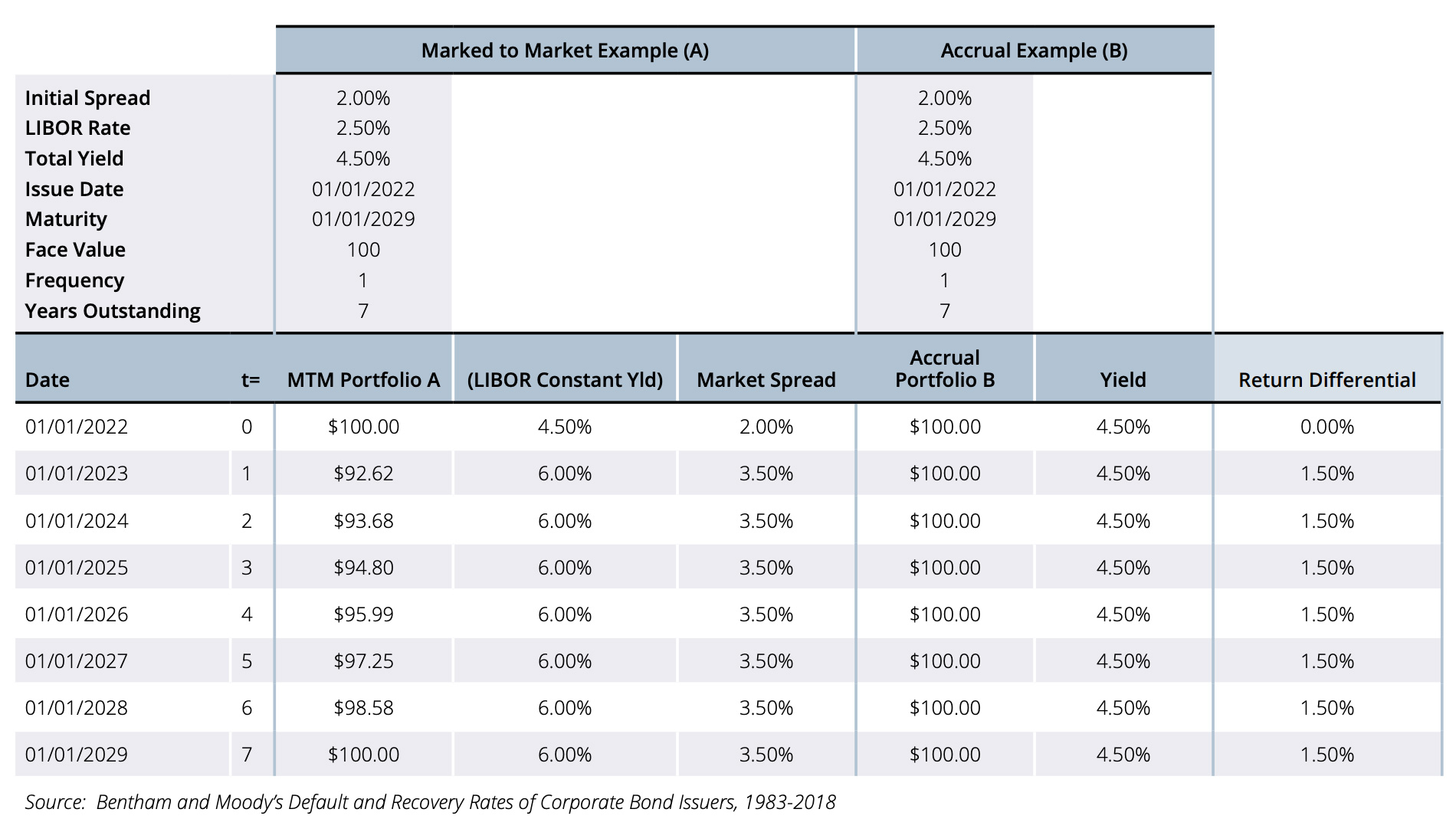

An example: Assume there are two funds that invest in the same bond, one is valued using Marked to Market and the other using Accrual Based valuation methodology. At t=0 both have the same value and yield. At t=1 (one year from issue) assume credit spreads widen by 150 basis points: the market value falls and the yield increases in the MTM fund, while the Accrual Based portfolio value and yield remains unchanged. From T=1, an investment into the MTM fund will outperform the Accrual Based fund by 1.50% a year (assuming no other changes) as the MTM fund has been revalued lower and now has a much higher prospective yield to maturity.

See Worked Example in Table 1 below.

Accrual accounting has its place, but we do not believe it is appropriate for open credit funds. For example, banks may use an Accrual Based valuation but simultaneously have provisions for credit losses. Private equity funds acknowledge the illiquidity of their underlying investments and do not offer the market open funds.

Accrual Based valuation may better suit closed end funds.

Key Takeaways:

- Marked to Market valuation is considered best practice for open-ended credit funds.

- Comparing returns of Accrual Based and Marked to Market funds makes it difficult for investors to compare like with like.

- Accrual Based valuation may be better suited to closed end funds.

Table 1. Worked Example – Mark to Market vs Accrual Based Valuation Method

2. MTM valuations support fair applications and redemptions

The frequency with which investors are able to make applications and redemptions from a fund (the fund’s “liquidity terms”) should reflect the frequency of the valuation of the fund’s underlying assets and the liquidity and saleability of those assets.

Significant issues of fairness arise if investors are permitted to enter or exit a fund based on stale unit prices.

In a falling market, the unit price of a fund that does not accurately value its portfolio will be held artificially high – this could significantly disadvantage a new investor (who would over-pay to invest), and advantages existing or redeeming holders. A canny investor could arbitrage such a situation – selling their investment in a staled priced or accrual valued investment (potentially valued at par or $100 plus accrued interest), and buying a Marked to Market investment (valued sub-par, at fair market value).

Conversely, in a rising market, the unit price of a fund that does not accurately value its portfolio will be held artificially low – meaning a new investor could take advantage of lagged pricing to the detriment of existing fund investors.

A similar risk of inequity can arise even if a portfolio of infrequently revalued assets is held in an appropriately structured, closed-end fund, if such a fund is then held within an open investment vehicle.

Key Takeaways:

- Fairness amongst investors in an open investment vehicle is best supported by frequent MTM pricing.

- An open-ended credit fund that uses Accrual Based or infrequent valuations is open to arbitrage exploitation.

FINA will publish the full paper in coming weeks.