From NewsworthyData utilising research from BestBrokers.com

Most common ChatGPT queries about ‘ETF’ by region:

- United States: ‘What are leveraged ETFs and are they safe for retail investors?’

- United Kingdom: ‘What is the difference between accumulating and distributing ETFs?’

- Europe: ‘Why do some ETFs have accumulating vs. distributing dividends, and which is better for me?’

- Asia (e.g., China, India): ‘Are ETFs available that track foreign indexes, and can I buy them locally?’

- Latin America: ‘Can I invest in the U.S.-listed ETFs, or only local ones?’

- Middle East: ‘Are there Shariah-compliant ETFs?’

- Australia: ‘How do ETFs fit into the superannuation (retirement) system?’

Even as high-level financial buzzwords like ‘carbon border adjustment’, ‘blue bonds’, and ‘net zero’ dominate headlines ahead of COP30, ordinary individuals still struggle to understand basic financial terms like ‘equity’, ‘APR’, and ‘GDP’. According to recent search data, Americans Google the term ‘equity’ over 188,000 times a month, while, in the UK, 6.5 million adults are estimated to have low financial literacy, according to a survey from the Financial Conduct Authority.

With so many people turning to Google instead of a financial advisor, the rise of AI tools like ChatGPT has made financial knowledge feel more accessible, at least on the surface. Curious to dig deeper, the team at BestBrokers asked: what are the most confusing financial terms people are searching for around the world? Using ChatGPT and country-level Google search volume data, we identified the financial buzzwords that generate the most confusion (and the questions people ask most frequently), then mapped the results globally.

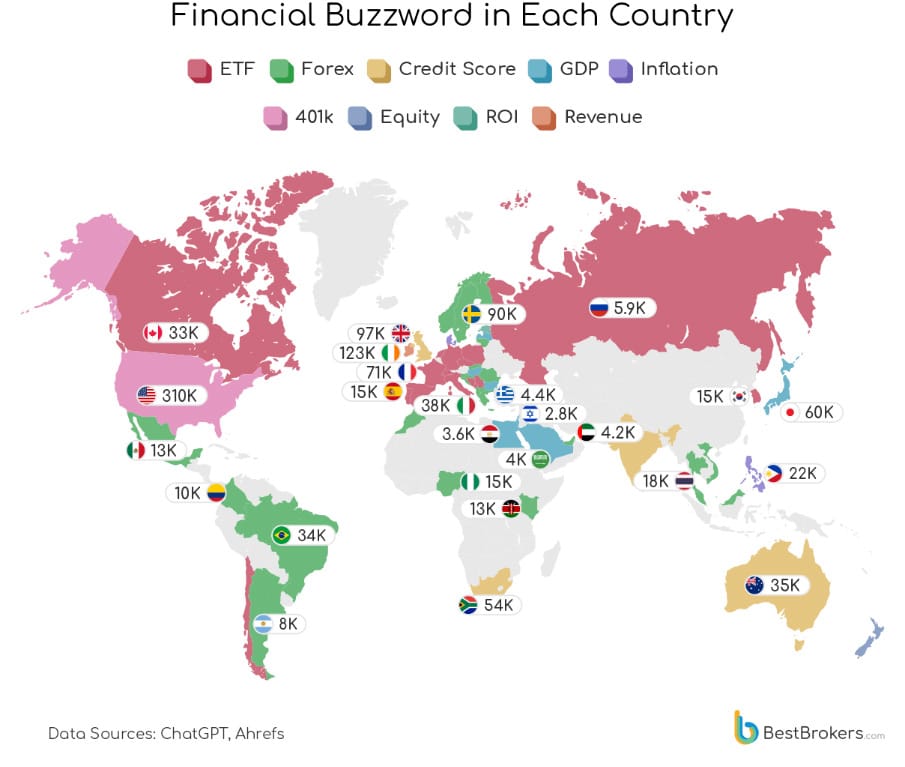

We discovered that the most confusing personal finance terms globally are ‘ETF’, ‘forex’, and ‘GDP’, with monthly search volumes ranging from 700,000 to 950,000. These terms generate the most queries in countries like the United States, Sweden, India, Germany, and Japan.

Also read: Fixed Income Flows Lead ETF Charge

Key takeaways:

- ‘ETF’ is the top searched term with 949K monthly queries, often confused with mutual funds and tax rules.

- In the US, ‘401(k)’ leads with 310K searches per month (on tax benefits and withdrawals); in the UK, ‘credit score’ gets 97K queries.

- Europeans focus on ETFs and Nordics on forex, while Japan’s top term is ‘GDP’.

- In Australia, what people wonder is how ETFs fit into the superannuation system. With specific rules for retirement savings, especially in self-managed super funds, Australians are turning to ETFs as low-cost, long-term investment options.

Out of the 30 most confusing financial terms ranked by ChatGPT, ETFs attract the most global interest with 949,000 global monthly searches, especially in the US, Germany, and India, where many confuse them with mutual funds or struggle with trading and tax rules. ‘Forex’ follows closely, with Sweden showing the highest interest due to the krona’s active role in global FX markets and high retail trading activity. ‘GDP’ ranks third, with 698,000 searches a month, often misinterpreted as a personal wealth measure, particularly in countries like Japan where economic stagnation has made growth indicators a topic of public concern.

Beyond the basic what-does-it-mean queries, there are more revealing questions such as ‘Does GDP growth mean I’m better off?’ or ‘Is equity better than salary?’. The first reflects a growing public skepticism about how national economic growth translates to everyday life, especially in countries like Japan or the United States, where ‘GDP’ can rise even as wages stagnate or inequality widens. The second shows a shift in workplace values, particularly among younger workers weighing short-term income against long-term potential in startups or stock-based compensation.

‘ETF’ tops confusion-driven searches in countries from Germany to South Korea, as many still struggle to distinguish it from a mutual fund or grasp how it is traded. Meanwhile, ‘forex’ sparks the most interest in emerging and smaller economies, especially across the Balkans and Africa, where currency volatility, remittances, and online trading platforms make it both relevant and misunderstood.

Around Europe, Ireland’s surprising top term is ‘revenue’ with 123K searches, likely reflecting its booming startup ecosystem and role as a major corporate tax hub. France, Italy, and Spain focus on ETFs, while Scandinavian countries like Sweden and Norway show strong interest in ‘forex’.

From the 57 countries on our list, Estonia uniquely has ‘ROI’ as its top financial search, while the Philippines and Denmark are the only two countries where ‘inflation’ leads, signaling persistent concerns about rising living costs.

Americans appear to struggle with understanding retirement plan rules, a crucial area for long-term financial stability, as reflected by the ‘401(k)’ topping searches with 310,000 queries. Additionally, ongoing anxiety about rising prices fuels confusion about how inflation affects savings and how to protect against it, which are among the most common questions on ChatGPT. Meanwhile, rising interest in ‘equity’ highlights a gap in understanding one’s ownership in mortgaged properties (what do I owe the bank versus what my equity is) as well as confusion about startup compensation and investment, a sign of growing enthusiasm for entrepreneurship and stock ownership, yet uncertainty about equity’s true value. Another standout is the confusion around ‘compound interest’, a key wealth-building concept that is often misunderstood or underestimated, despite its central role in everything from savings accounts to retirement growth. Similarly, the frequent mix-up between ‘gross and net income’ shows how even basic budgeting terms can trip people up, especially when navigating taxes or planning monthly expenses.

While Americans tend to be most confused by practical, everyday financial concepts like ‘401k’ plans, ‘inflation’, and ‘equity’, the British show a stronger focus on credit and investment-related terms such as ‘credit scores’, ‘capital gains tax’, and ‘net worth’.

With only 12,000 more monthly searches than ‘credit score’, ‘capital gains tax’ is the UK’s second most confusing financial term, which is notable given that many Britons may not realise investment profits can trigger sizable tax bills. The annual CGT allowance stands at just £3,000 for individuals in 2025/26, unchanged from 2024/25 but dramatically down from £6,000 in 2023/24 and £12,300 in 2022/23.

‘Capital gains’ are often confused with ‘dividends’, which may help explain the high search interest in both. Dividends are regular payments from a company’s profits to shareholders, while capital gains arise when an asset, such as stocks or property, is sold for more than it was bought for. Though both count as investment income, they are taxed differently and reported separately, leading to frequent misunderstandings among inexperienced investors.

Is ChatGPT a dependable source for financial advice?

We asked ChatGPT to identify the most confusing financial questions based on global search data and provided its straightforward, one-paragraph explanations below to evaluate how helpful it is for financial advice.

Are ETFs safe investments, and how do I choose the right one?

ChatGPT:

‘ETFs are generally considered a safer way to invest because they spread your money across many stocks or bonds, which lowers risk compared to buying individual stocks. However, they still go up and down with the market, so they’re not risk-free. To pick the right ETF, first decide what you want-like growth, income, or something safe-and choose the type of assets you want (stocks, bonds, etc.). Look for ETFs with low fees, a good track record, and enough people trading them so it’s easy to buy and sell. Also, check what index the ETF follows and how often it pays dividends. Understanding your own risk tolerance and reading the ETF’s details will help you find one that fits you best.’

How does forex trading work, and can beginners really make money?

ChatGPT: ‘Forex trading is buying and selling currencies to make a profit from changes in their exchange rates. Traders try to buy a currency when its value is low and sell it when it goes up (or sell first and buy back cheaper). It works 24/5 because currencies trade worldwide all day during the week. Beginners can make money, but it’s very risky and hard because the market moves fast and can be unpredictable. Success usually needs a lot of learning, practice, a good strategy, and strong risk management-without those, beginners often lose money. So while it’s possible to make money, most beginners should be careful and start small.’

How do I protect my savings and investments against inflation?

ChatGPT:

To protect your savings and investments against inflation, you want to put your money into assets that tend to grow faster than inflation over time. This usually means investing in things like stocks, real estate, or inflation-protected bonds (like TIPS in the U.S.), which can increase in value or income as prices rise. Keeping all your money in cash or regular savings accounts can lose buying power because inflation makes prices go up but your cash stays the same. Diversifying your investments and choosing options that have a history of beating inflation helps preserve your money’s value and even grow it.

Methodology

For this research, we used the AI tool ChatGPT to identify which personal finance terms users find most confusing and which of those generate the most questions on the platform. ChatGPT provided a list of 30 commonly misunderstood terms, including explanations of why they cause confusion and the top three questions it receives related to each. We then used the Keywords Explorer of Ahrefs, a leading SEO and keyword analysis platform, to analyse global search volumes for each term and identified the top 10 countries searching for them. Finally, we examined search data across 57 countries to determine which of the 30 terms was the most searched in each location, helping us uncover regional patterns in financial confusion.