The number of searches on our ETF fund finders gives us great insight into what you are interested in. Betashares Investment Grade Corporate Bond ETF and Coolabah Global Floating-Rate High Yield Complex ETF regularly feature as the most searched ETFs.

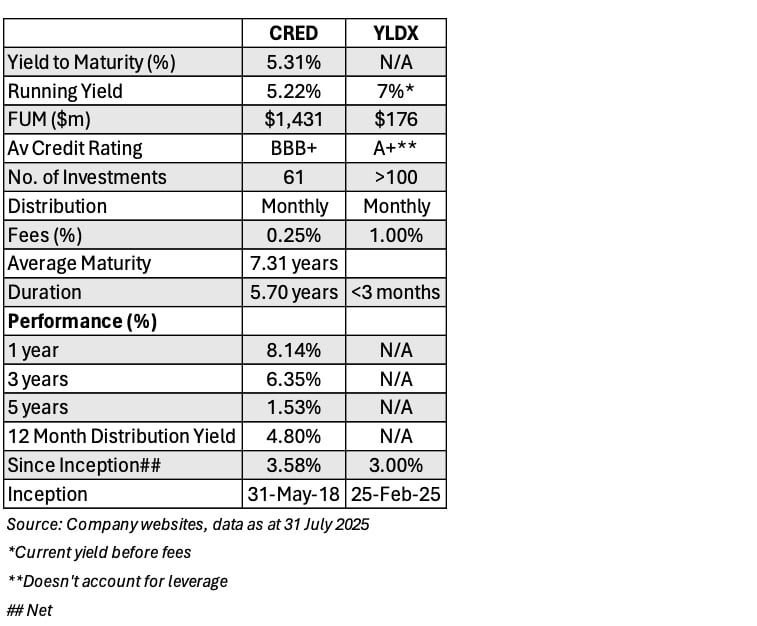

So, I thought it’d be great to compare the two. The table below shows key metrics. CRED has seven years track record while YLDX was first listed in February 2025. Note that the 7% current yield for YLDX is before fees.

1. Betashares Investment Grade Corporate Bond ETF (ASX:CRED)

CRED aims to track the performance of an index that provides exposure to a portfolio of investment-grade fixed-rate Australian corporate bonds. Eligible bonds must have amounts outstanding of at least $250m and a term to maturity of between 5.25 to 10.25 years. Up to 35 bonds are selected from an eligible universe, with each bond assigned an equal weight as at each rebalance date.

Income is paid monthly at a rate expected to be higher than term deposits, government and composite bond exposures.

View ETF: Betashares CRED ETF (ASX:CRED)

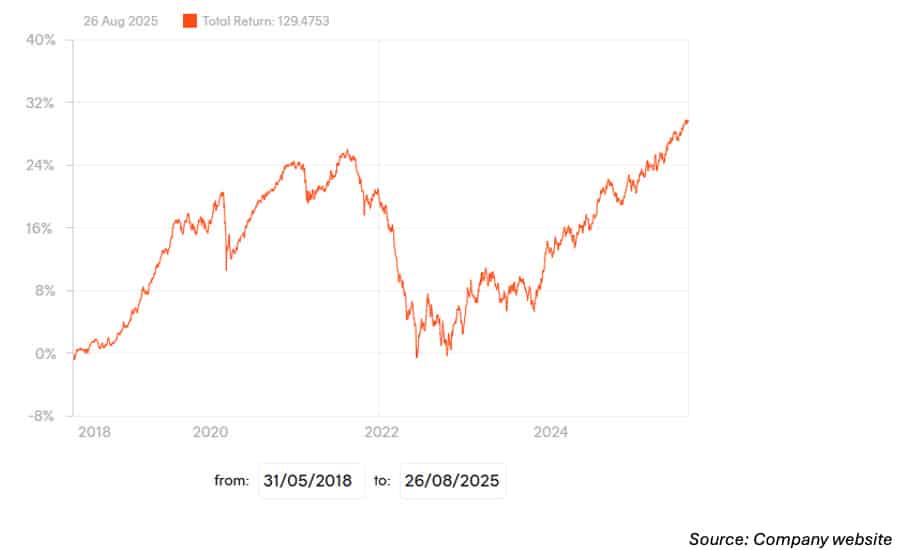

The fund has done very well over the last year to 31 July 2025, returning 8.14%. This is in part to its exposure to interest rate risk, known as duration. Over the last year, interest rates have contracted and fixed-rate bond prices have risen helping to deliver an excellent overall yield.

It’s unlikely that the next year will deliver similarly high yields unless interest rates fall by more than the market has already factored in. The running yield, at 5.22% is the best guide as to what investors can expect in the next 12 months. Longer term, the yield to maturity is 5.31%.

Also read: Record ETF Inflows Push Industry to New High

In term of interest rate risk, back in 2022 when interest rates were near zero, was not a time to be exposed to interest rate. You can see from the graph below, the steep decline in value of the portfolio and its steady rise since.

One of the main things to consider with this portfolio is whether you want interest rate exposure or a known fixed income.

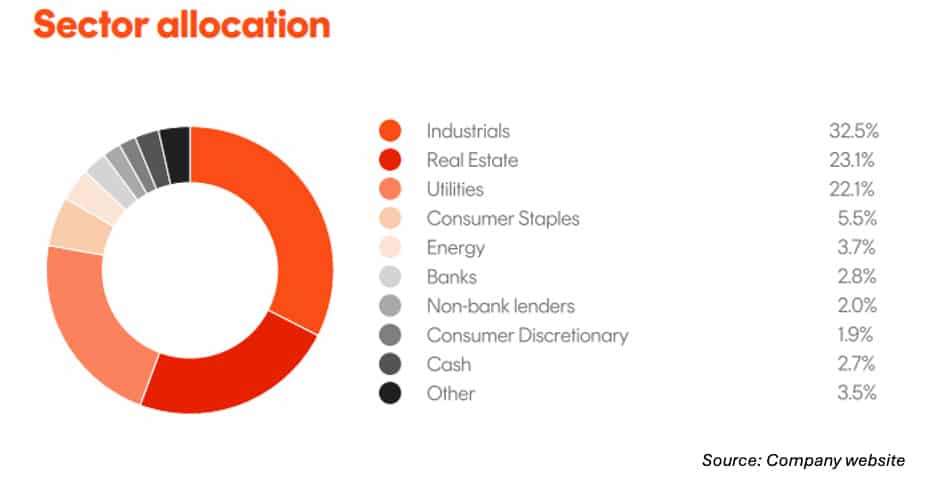

I like the asset mix with good exposure to industrials, real estate and utilities and no exposure is more than 3% of the portfolio as at 31 July 2025.

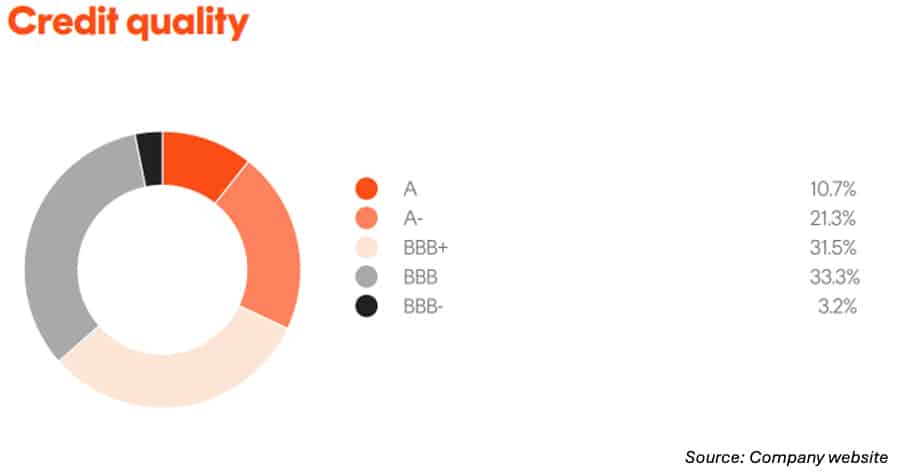

Credit quality is very good, with 32% of the portfolio rated in the single As, and only 3.2% in BBB- securities.

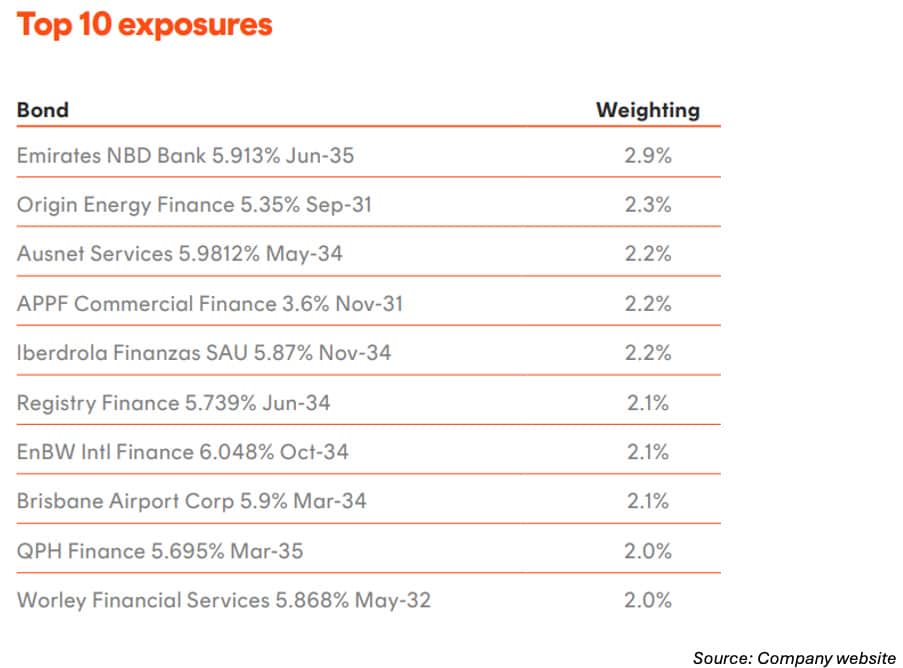

Below is the top 10 exposures as at 31 July 2025, and you can see some very well-known company names on the list.

At this point in the cycle, I would still be adding interest rate risk as I generally expect interest rates to fall further than the market expects in the medium to long term. CRED has a reasonable track record and has been making steady, monthly distributions, paying out 4.8% over the last year.

This isn’t necessarily a set-and-forget investment. There may be a point in the market when you want to take less interest rate risk, so should consider selling down the investment in preference for floating rate investments.

CRED Summary

- Senior, investment-grade bonds with an average BBB+ credit rating

- Exposed to interest rate risk

- Eligible bonds must have at least $250 million and term to maturity of between 5.25 to 10.25 years

- No single issuer has more than 7% of the portfolio at each rebalance date

Advantages

- Bonds chosen by expected returns rather than debt outstanding

- Good diversification by sector

- Monthly income payments

- Track record, operating for seven years and good recent history of consistent monthly interest payments

Things to be aware of

- Significant loss in 2022, but now offers a much higher yield to maturity

- The portfolio has taken on more risk than its recent past and its average credit rating has dropped from A- to BBB+

- The portfolio takes interest rate risk.

2. Coolabah Global Floating-Rate High Yield Complex ETF (CBOE: YLDX)

YLDX is completely different to CRED. It invests in G10 banks and insurers globally. When the fund was launched it was pitched as an alternative to listed hybrids. The fund brochure states it can invest in a $29 trillion investment universe with more than 60,000 securities.

View ETF: Coolabah YLDX ETF (CBOE:YLDX)

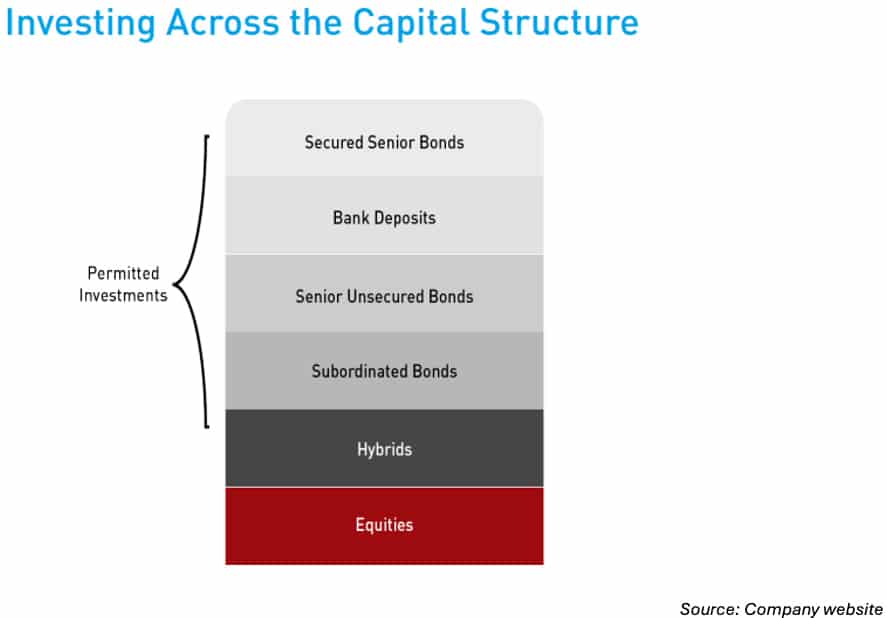

As at 30 June 2025, it predominantly invested in Australian major and regional banks across the capital structure, see below for the investible levels, and then uses the RBA repurchase scheme to borrow and leverage the portfolio, to achieve higher returns.

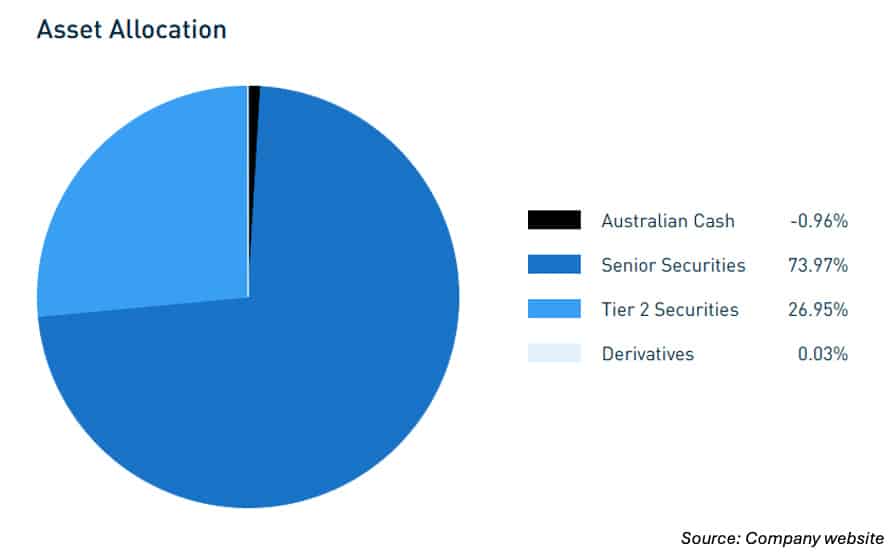

Approximately 74% of the portfolio is senior securities and the remainder subordinated bonds.

YLDX supplies CBOE, with quarterly investment statements and the June 2025 statement shows more than 100 underlying securities as well as interest rate and currency swaps.

YLDX takes very little interest rate risk investing in short-dated term deposits and floating rate securities. It can still invest in fixed-term investments but if they have more than 12 months to maturity, must be hedged to floating rate.

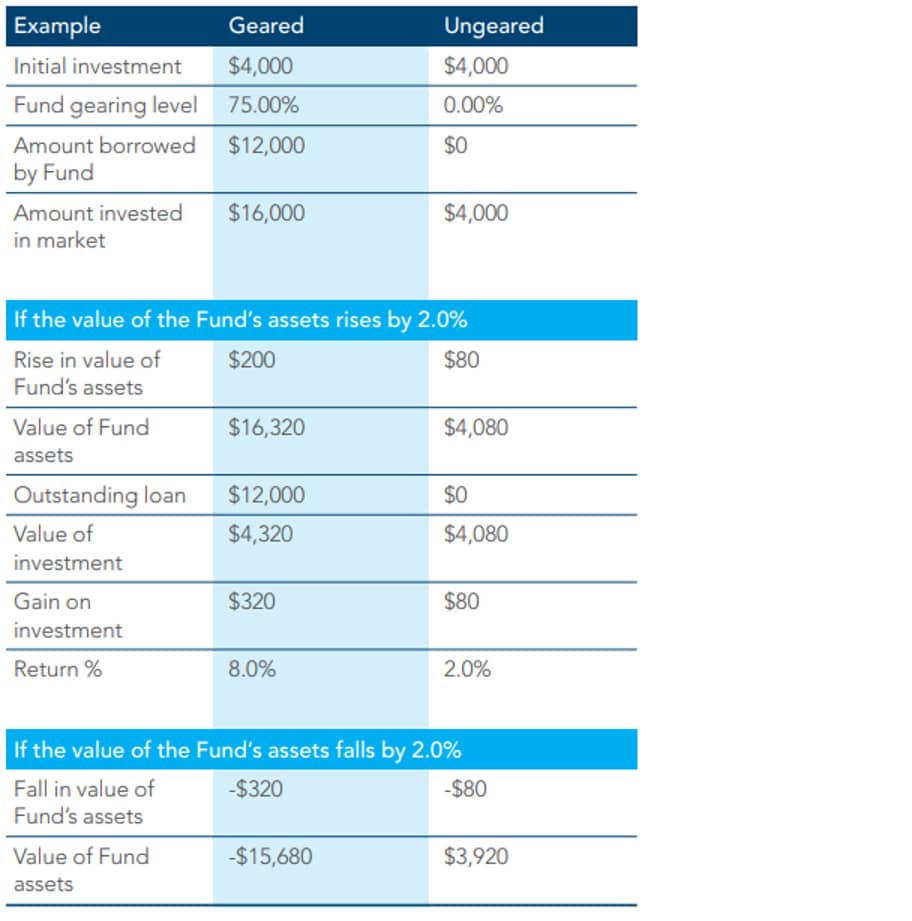

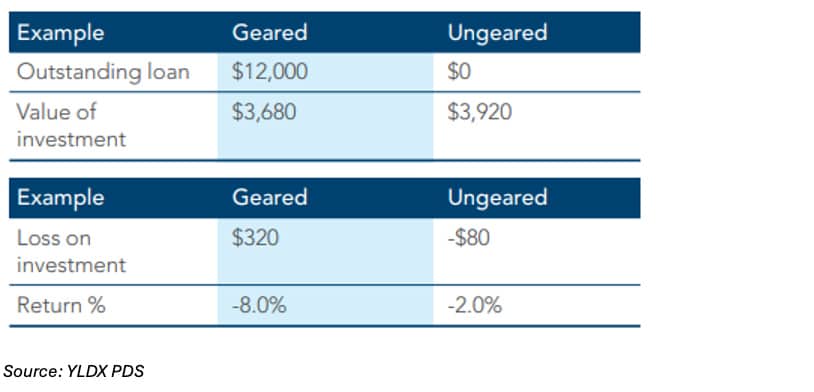

YLDX can take on substantial debt. The PDS states the fund will typically have gearing of 66.66% but can take the level to 75%. Note how gearing amplifies gains and losses.

The fund has an average A+ credit rating of investments, but there’s no way of showing the additional risk associated with borrowing.

I had a look at this fund for Intelligent Investor in Mid July 2025, and its funds under management (FUM) was $102m. In the six weeks since then, FUM is now $176m, so up more than 70%, this fund is growing fast.

YLDX Summary

- Floating rate

- Global

- Investment grade

- The fund can borrow and use derivatives

- Takes very little interest rate risk.

Advantages

- Detailed summary of the portfolio and its influences

- Low risk, high quality, investment-grade portfolio.

Things to be aware of

- Gearing has the potential to increase returns but also magnify losses

- High management fee

- New fund with no track record.

Summary

Both of these ETFs are possible replacements for ASX-listed bank hybrids but offer something different.

CRED, with its interest rate exposure, still has the potential to outperform. YLDX is higher risk than it first looks, but with its largely floating rate exposure is closer to the bank hybrids, but doesn’t have a call or maturity date.

Note: Not all corporate bond ETFs are the same. Past performance does not guarantee future returns. None of the ETFs are recommendations; do your own research before you invest.