Thomas Poullaouec, Head of Multi-Asset Solutions APAC at T. Rowe Price, and his team have published their latest insights on global asset allocation and the investment environment for Australia. January 2026.

OUTLOOK

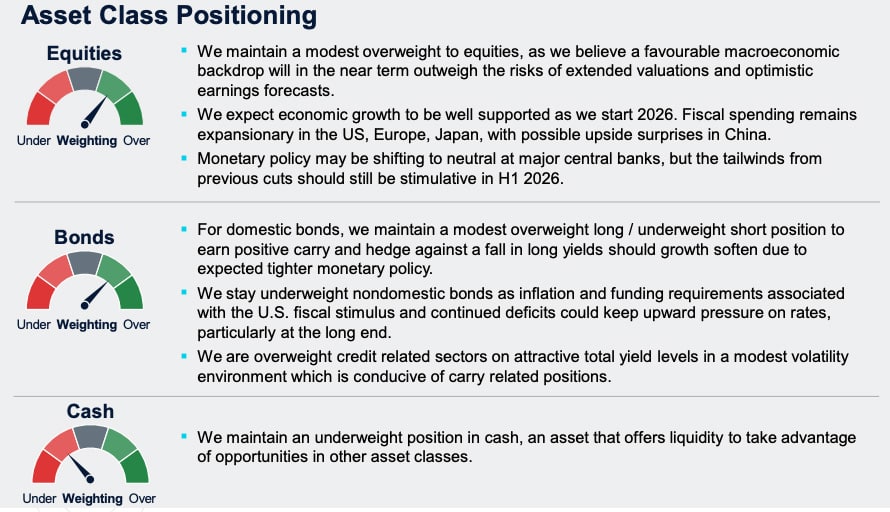

We maintain a relatively balanced view across global risk assets with a modest overweight in equities. Despite extended valuations, earnings trends and economic growth remain favorable, supported by fiscal and monetary policies in most regions.

U.S. economic growth remains resilient fueled by AI-driven capital spending and supportive economic policies, although softening labor market warrants monitoring.

In Australia, firm domestic data, including household spending, reinforces our view the RBA will stay on hold in H1.

Markets in Europe and Japan are supported by fiscal spending, lower inflation and moderating trade risks.

Key risks to global markets include narrowness of AI trends supporting earnings, economic growth and markets, sticky inflation, potential for quickening labor market declines, and ongoing geopolitical tensions.

THEMES DRIVING POSITIONING

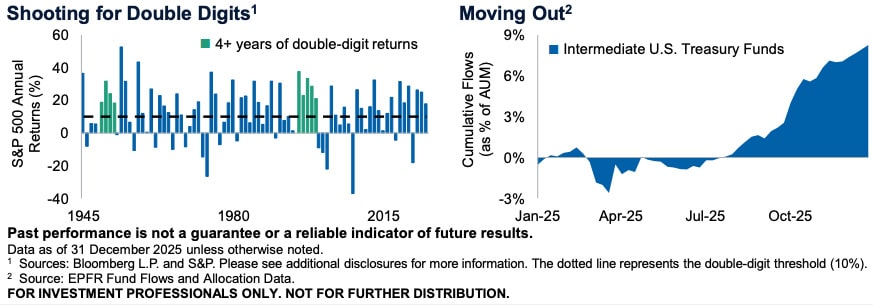

Four-Peat?

The U.S. equity bull market is now entering its fourth year, having put up double-digit returns in each of the past three, leaving investors wondering whether it can keep the streak alive. While multi-year stretches of positive equity market returns are common, delivering double-digit returns four years in row are few and far between. The naysayers point to elevated valuations, narrowness of the market, uncertainty around Fed policy amid leadership change, a softening labor market, and U.S. mid-term election risk. Yet history has shown bull markets don’t die of old age alone, and while valuations are elevated, they’re below prior cycle extremes. Bulls can also point to still robust earnings expectations, a broadening of AI beneficiaries, fiscal support, increased capex spending, deregulation, rising M&A activity, and easing trade tensions. With the risks reasonably balanced and momentum still intact, the path of least resistance for the equity market may continue to be higher for now—the question is can it reach double digits for the four-peat?

Also read: How To Manage Fixed Interest Investments If Interest Rates Rise

That Was Then, This is Now

The U.S. bond market delivered surprisingly strong performance last year, ending up more than 7%. U.S. investors with overseas bond exposure fared even better, gaining close to 9% thanks to a weaker U.S. dollar. While many investors had expected higher inflation, driven by tariffs and global fiscal spending plans to pressure bonds, yields ultimately ended the year lower. Fed easing in the latter part of the year in response to softer labor market data and easing inflation helped cement a winning year for bonds. Demand also contributed as investors finally moved from cash into short and intermediate parts of the yield curve. As we start this year, risks to the bond market appear tilted to the downside once again with upward pressure on rates from still above target inflation, strong growth supported by fiscal spending, and a flood of supply expected from sovereigns as well as corporations funding AI spending. The added uncertainty around monetary policy under a new Fed chair may also bring with it much higher volatility, leaving bond investors wishing they were back in 2025.

ASSET CLASS POSITIONING

Note: T. Rowe Price’s Australia Investment Committee comprises local and global investment professionals who apply views from the firm’s Global Asset Allocation Committee to make informed asset allocation views from an Australian investor perspective. The Committee is led by Thomas Poullaouec, Head of Multi-Asset Solutions APAC, based in Singapore.