From Seema Shah, Chief Global Strategist, Principal Asset Management

For months, many leading indicators of economic activity have been signaling a future recession. The full effects of policy rate hikes are only now just starting to emerge, and should increasingly impact the real economy in coming quarters. While current economic resilience and a tech-led market rally continue to foster optimism, further weakness and a likely recession is still expected as 2024 approaches.

The continued resilience of consumers and labor markets suggest that a U.S. recession is not imminent. However, many risks still lie ahead. Several leading economic indicators have been contracting since 2022, and few are yet to demonstrate any convincing recovery:

- The Conference Board’s leading economic indicator has been contracting for 11 months, while a decline for six or more consecutive months has historically anticipated recession.

- Expectations of a broader slowdown are corroborated by the ISM Manufacturing survey, which has been in contraction since November 2022.

- The 3-month versus 10-year U.S. Treasury yield curve is deeply inverted, and began its inversion last November. History suggests this typically gives a 13-month lead time before recession.

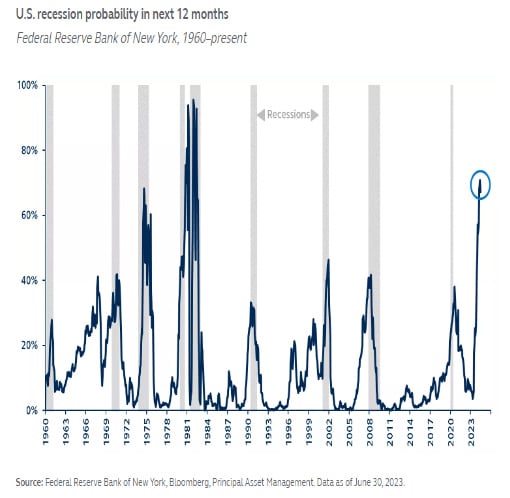

- The New York Federal Reserve’s own recession forecast (derived from the 3m10y curve) has been soaring above 65% since April—recession probability has never been this high without recession ultimately occurring.

Also read: Global Growth Outlook – Key Market Themes

Leading indicators almost uniformly signal weaker economic growth, with the full effects of significant and aggressive Fed tightening to-date yet to be fully recognized. The Fed’s hiking cycle isn’t done just yet either. Core inflation remains well above target, and the U.S. labor market continues to exhibit strength, requiring further Fed tightening and all but eliminating the likelihood of rate cuts this year. The foundations have been laid for a short and shallow recession beginning in 4Q 2023.