Global corporate credit metrics are likely to improve more for high-yield (HY) issuers than for investment-grade (IG) issuers over the next two years, says Fitch Ratings. Greater revenue growth and margin expansion, along with lower cash interest expense will be drivers, according to aggregate forecasts for a constant cohort of nearly 1,600 issuers with international Issuer Default Ratings included in our March 2024 Global Corporates Macro and Sector (GxO) Forecasts data file.

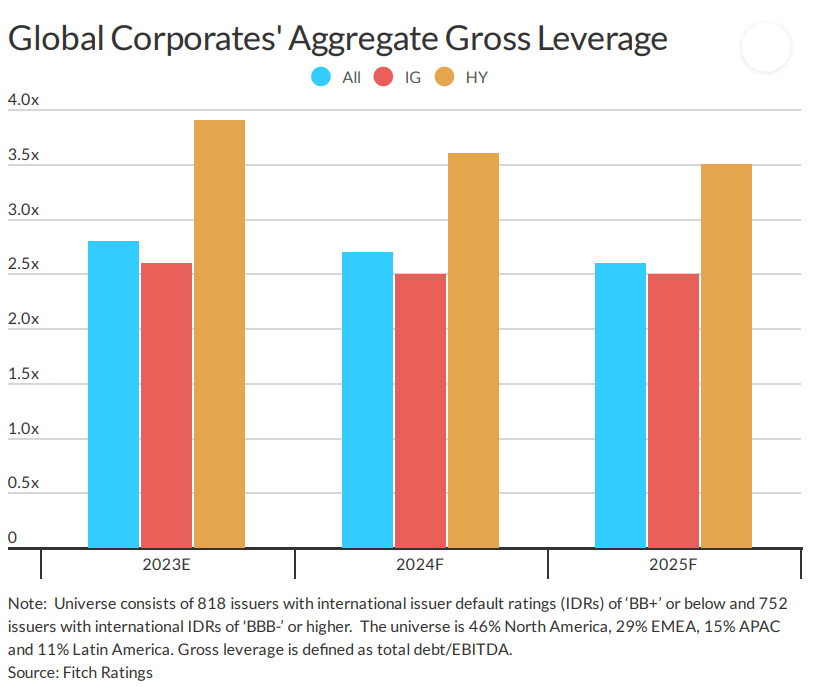

We project aggregate leverage will decline 0.4x to 3.5x by end-2025 for issuers rated ‘BB+’ or below globally and will be relatively flat at 2.5x-2.6x for those rated ‘BBB-’ or higher. We project aggregate interest coverage will increase 0.6x to 4.7x for HY issuers, compared with a 0.2x increase to 10.1x for IG issuers, with all regions improving, except EMEA due largely to higher aggregate debt in the region. We expect global total aggregate debt for our HY universe to be flat versus 2023 at USD2.3 trillion over the next two years and rise 5% to USD9.3 trillion for our IG universe.

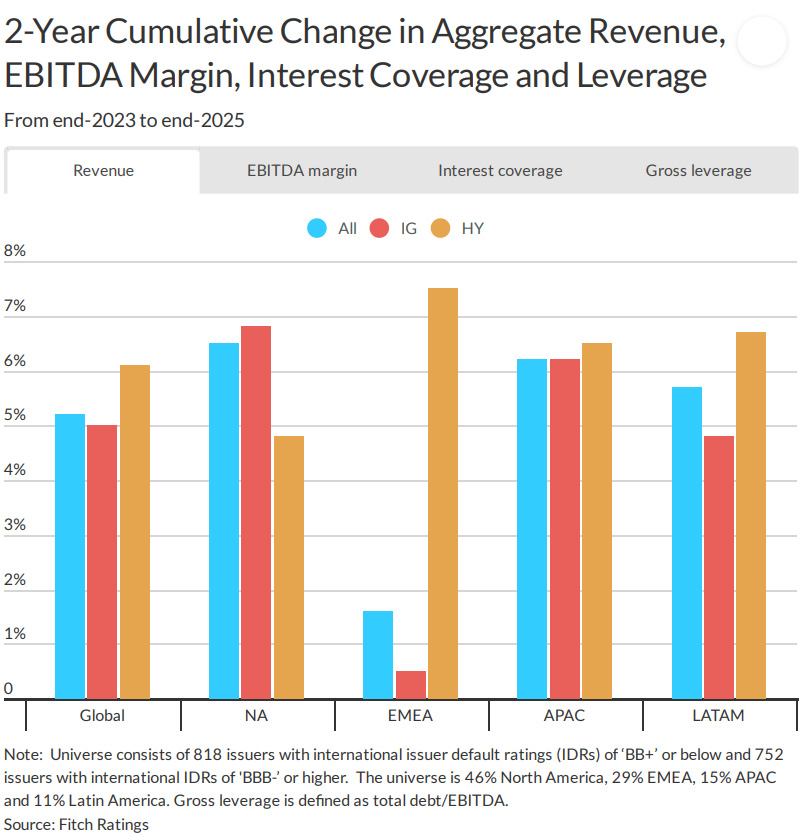

We project two-year cumulative aggregate global revenue growth of 6.1% for the HY issuers in our dataset, while the forecast for our cohort of IG issuers is 5.0%. Non-investment-grade companies in EMEA will lead with an assumed growth rate of 7.5%, compared with 6.7% for HY issuers in Latin America, 6.5% in APAC and 4.8% in North America.

Aggregate EBITDA margins for our global universe of HY and IG issuers were relatively close at 17.7% and 17.1%, respectively, in 2023, but we expect the margin gap to widen by 2025. Our forecasts indicate aggregate margins will expand 1.4 percentage points (pp) to 19.1% for HY issuers, compared with 0.7pp to 17.8% for IG issuers.

We expect North America to have the greatest improvement in profitability, with the aggregate margin expansion of 2.2pp to 19.1% for those rated speculative grade and 1.2pp to 18.4% for those rated IG. We expect APAC HY issuers’ aggregate profitability to increase 1.2pp to 15.1% and IG issuers’ 1.0pp to 14.6%. We forecast the aggregate EBITDA margin to increase 0.9pp to 28.3% for HY issuers and to decline 0.3pp to 20.6% for IG issuers in Latin America. We project aggregate EBITDA margins for our EMEA HY and IG cohorts to be down 0.1pp to 15.1% and flat at 21.3%, respectively.

Sector mix is contributing to regional differences in revenue and margin trends, as all issuers should benefit from lower inflation. For example, we project aerospace and defence, and transportation will generate above-average cumulative revenue growth in the mid-teens while telecom, gaming, and lodging and leisure have among the highest margins, reaching above 35% in some years. Collectively, more of these issuers are rated HY. Our revised assumptions for oil prices underpin our forecast of a more than 6% decline for the oil and gas sector’s revenue between 2023 and 2025, weighing down significantly on global aggregate revenue growth because of its relative size (the oil and gas sector represents more than 15% of our portfolio’s total revenue).

We expect the improvement in credit trends for HY issuers even as default rates rise in 2024. Fitch’s 2024 HY bond default forecast is 5.0%-5.5% for the US, and 4.0% for Europe, up from 2.94% and 1.7% in 2023, respectively. Our 2024 leveraged loan default rate forecasts are 3.5%-4.0% for the US, and 4.0% in Europe, up from 3.4% and 3.1% in 2023, respectively. Default activity will be concentrated among issuers rated on the lower end of the speculative grade spectrum, which are challenged by declining operational performance, high leverage and near-term debt maturities.