If you are thinking about investing direct, then there are a number of factors you’ll need to assess.

While many of the metrics will be similar to shares, they are some important differences. For example, growth is a crucial assessment when investing in shares. However, bondholders do not care if the company is growing or not as they will receive income and principal at maturity as long as the company continues to operate. When investing in bonds, ‘survivability’ is key. In fact, stable, reliable income earners are more attractive than aggressive, acquisitive, growth-oriented companies.

Because bond payments are legal obligations, whereas dividends on shares are not, companies will do all that they can to pay bondholders. So thinking about investing in bonds, it’s important to have an understanding of ways the company can access funds if needed. Are they regular bond issuers? Do they have attractive assets they could sell? Do they have relationships with multiple domestic and international banks? Do they have large, wealthy shareholders they can potentially ask for additional equity?

Here’s a list of my top tips:

- Who has issued the bond? Is it a government or corporate bond? Do you have an understanding of the company’s business and finances?

- Does the bond have a credit rating? While I wouldn’t rely on credit ratings, they are very useful in giving you an indication of the perceived risk of the bond. Be careful here, bonds can have different credit ratings to the issuer/company credit rating. Please see Interpreting Credit Ratings – What Do They Mean For Fixed Income?

- If it’s a corporate bond, where does it sit in the company’s capital structure? Also read Simplified Bank Capital Structure – Being on Top Gives You The Best View.

- What is the term of the bond? Is there a chance that the expected maturity date can be extended? If so, you need to make sure the yield on the bond compensates you for the longer term to maturity. The shorter the term to maturity, the less uncertainty and the lower the return compared to longer-dated bonds issued by the same company

- What is the yield to maturity, yield to worst and running yield* on the bond?

- Is the return enough compensation for the risk involved? A way to assess this is to ask the bond broker for a comparison with bonds with similar credit ratings and terms to maturity.

- Is the bond fixed rate, floating rate or inflation-linked? Does this fit in with your view of interest rates? Fixed-rate bonds typically pay half yearly interest while floating rate and inflation-linked bonds pay quarterly.

- Is the bond trading below or above its $100 face value? As a bond gets closer to its maturity date, its price will get closer to par. Bonds trading over face value are deemed to be trading at a ‘premium’ and those under trading at a ‘discount’. If you buy a bond trading at a premium, you get more income during the life of the bond, as it will lose capital value if you hold to maturity and vice versa for bonds trading at a discount.

- Check the size of the bond issue. The larger the issue the greater the chance of liquidity. If an issue is less than $100m, it is considered small.

- Are you buying the bond to trade before maturity or are you a hold-to-maturity investor?

Traders may be more opportunistic, perhaps buying when prices are low and perceived risk high, hoping for a quick turnaround to sell and make a profit. Hold to maturity investors will likely be more interested in yield to maturity and frequency of interest payments (known as coupons).

- Think about diversity in your portfolio, which should help cushion it from the worst downturns and maximise income over the longer term. For example, investigate the properties of sub-sectors such as Commonwealth government bonds, investment grade corporate bonds, sub-investment grade or ‘high yield’ bonds, emerging market bonds, ESG bonds, foreign currency bonds and structured finance securities, such as Residential Mortgage Backed Securities (RMBS).

Financial institutions are big bond issuers, you may already have too much exposure to that sector, so may want to target other corporate issuers.

Also read Eight reasons to invest in Fixed Income

Yield*

There are four main yields quoted for fixed income securities:

- Yield to maturity (YTM) includes the capital gain or loss on the bond price, as few bonds trade at the par value of $100 except at first issue, plus the interest until maturity.

- Yield to call (YTC) used for bonds with a call date.

- Yield to worst (YTW) is commonly used for bonds with a call date, or multiple call dates where the bond can be repaid prior to final maturity and is the worst yield an investor can expect over the life of a bond.

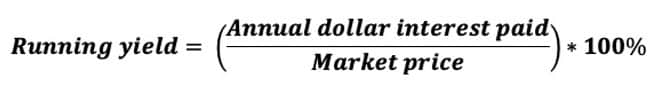

- Running yield is the expected income if you buy the bond and hold it for a year and is dependent on the price you pay for the bond in the market. Running yield is similar to dividend yield.