We publish the summary and fixed income section of a 3Q2025 Global Market Perspective report.

Report Summary

The global growth outlook has stabilized amid shifting trade dynamics.

Global economic resilience is emerging despite recent macro, policy, and geopolitical shocks, while investor focus has shifted away from U.S. dominance toward a more balanced global outlook.

- U.S. tariff threats have receded but will leave a bad taste on growth, labor market, and inflation

Recession odds have receded, but tariffs and policy uncertainty may soon manifest in slowing macro data. Yet, household and corporate balance sheets should provide a cushion, limiting layoffs and consumer weakness.

- The Federal Reserve needs an inflation or labor market nudge to cut rates this year. The Fed will keep policy rates on hold until late 2025 unless there is a sustained run of soft inflation or labor market prints. On the fiscal front, a gradual improvement in the budget deficit would come at the expense of growth.

- U.S. equity markets: positive gains to persist even amidst continued macro and policy volatility. The U.S. market’s full recovery implies a limited cushion against policy disappointment in the near term. Yet positive, albeit slower, economic growth implies continued earnings growth, with markets likely still trending higher.

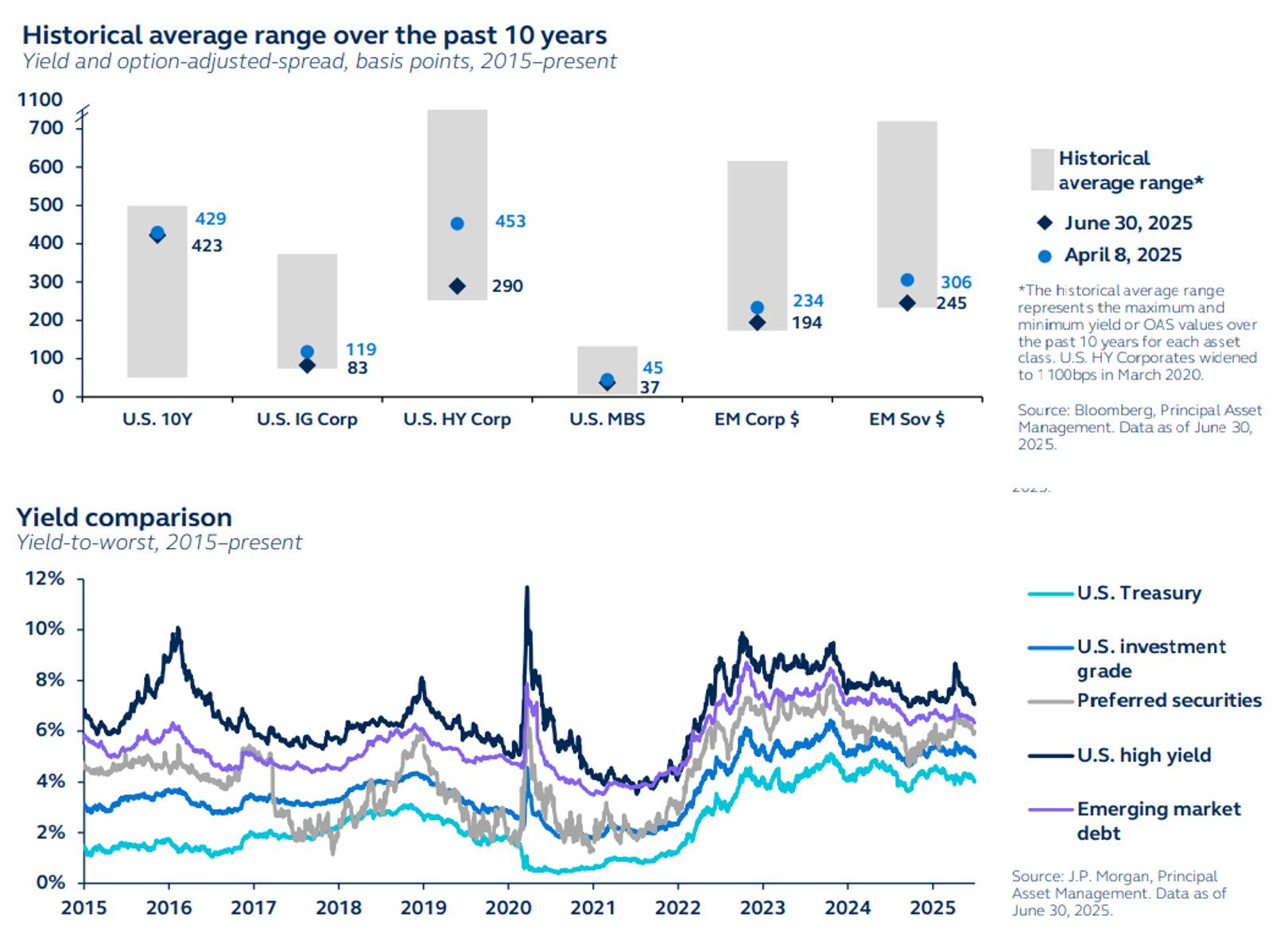

- Elevated fixed income yields should continue to attract investors. Credit spreads have re-tightened back close to historic lows. With the constructive global macro backdrop meaning that fundamentals remain solid, investors can once again consider higher-yielding fixed income solutions.

- Credit remains well positioned to perform strongly for the latter half of the year. Further spread tightening is unlikely, but credit offers investors an important source of income.

- Diversification has rarely looked so attractive. In an era of active global policymaking and higher for longer rates, diversification – both geographic and across a broader set of assets, will be critical. U.S. exceptionalism hasn’t disappeared; its key structural advantages remain intact. But as other global economies gain momentum, U.S. outperformance is likely to be more muted.

Fixed Income – U.S. bond market reflecting higher risk premiums

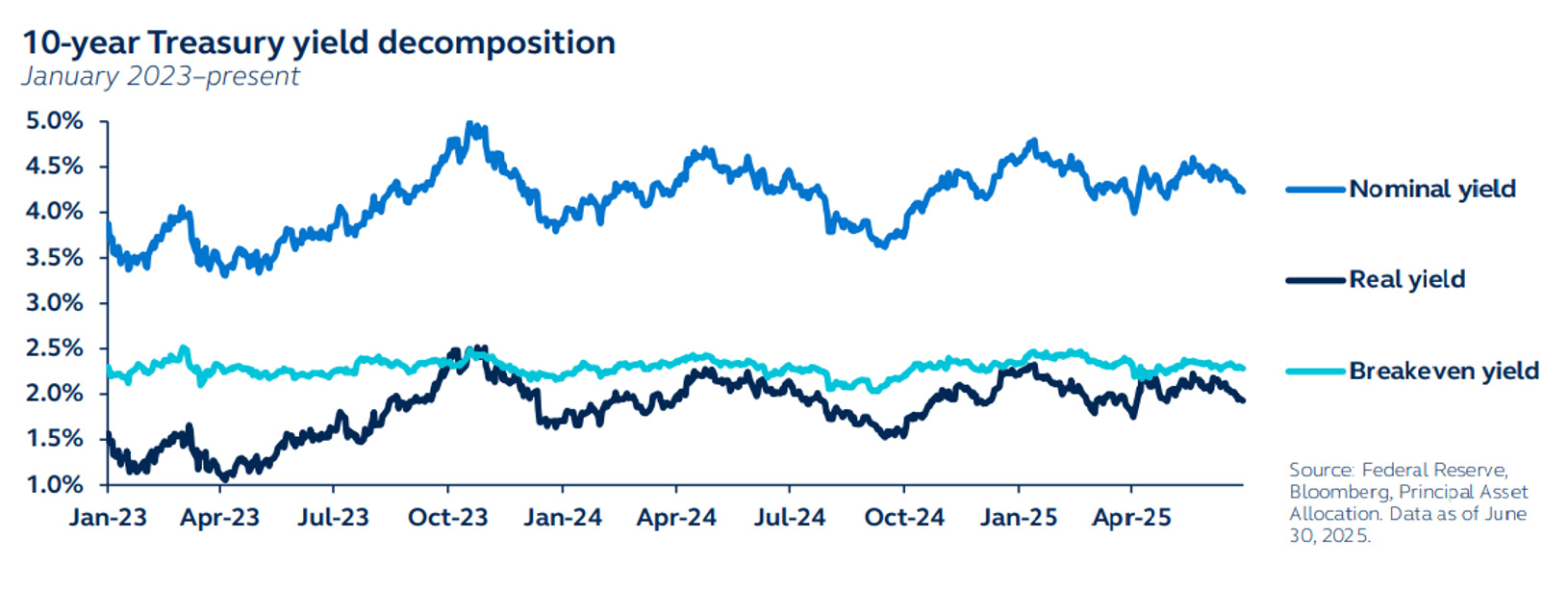

Bond market volatility surged in mid-Q2. Ten-year U.S. Treasury yields momentarily dropped below 4% at the start of the quarter before rising to 4.6% and then retreating to 4.25% at the end of Q2.

Nominal bond yields can be separated into two factors:

- Breakeven yields (a measure of inflation expectations) have remained fairly well-anchored.

- Real yields (a proxy for the growth outlook and risk premium), by contrast, have moved sizably and remain elevated, even despite Fed cuts. The elevated level of real yields likely reflects an increase in non-inflation risk premiums associated with increased Treasury supply, fiscal sustainability concerns, and potentially reduced demand for U.S. dollar-based assets.

The steepening of the longer end of the yield curve certainly suggests that these factors are at play, while both private and foreign investors have also increasingly shifted toward shorter-duration Treasurys, contributing to the move. This indicates that even if inflation were to remain under control, higher premiums, particularly at the long end of the curve, could keep borrowing costs elevated.

Corporate credit

Strong corporate fundamentals, along with solid balance sheets and elevated profit margins, are keeping the overall corporate credit environment constructive.

Increased pessimism about the economic backdrop and a rise in trade frictions led to wider credit spreads at the start of Q2, but this was quickly reversed as tariff concerns were swept to the side.

While Treasury yields ended the quarter just a few basis points lower, spreads across much of the credit landscape are once again close to historic tights. Yet, while additional spread compression may be limited, elevated yields mean that investors should remain attracted to the income that credit offers.

- Solid high-grade corporate balance sheets, strong fundamentals, and attractive yields create a favorable outlook for investment grade.

- As defaults are unlikely to meaningfully increase if earnings hold up, high yield offers compelling value – although credit selection will be crucial.

- Local currency EM debt should benefit from a weaker dollar, lower energy prices, and rate cuts